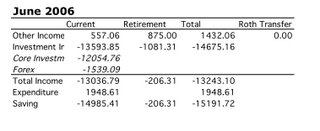

Non-investment income is low this month because of the strange schedule we get paid on. We receive June's pay at the end of May. The other income for June is some money from a research grant I got last year and wasn't paid this bit till this year and retirement contributions related to it and the combined May and June pay.

I report my numbers a bit differently to most other PF bloggers. Most people seem to list things according to accounts and note the change in the accounts each month. I think of investments as individual assets rather than accounts and I think of income in terms of whether I have direct access to that income - i.e. current income - or whether it is in a retirement account - retirement income. I am most concerned with raising my current assets and income rather than retirement income and assets. Mostly it is locked up till age 60. Though, as I've discussed in previous blogs, it is true that the US 403(b) portion (about $30k) can be withdrawn at marginal tax rates and penalties or perhaps without penalty as a 72t. The Roth contributions ($8k) can be withdrawn any time without tax or penalty, so perhaps I should list them as current assets. Roth profits can be withdrawn tax free for a first time home purchase... But the Australian superannuation account is the bulk of my retirement assets and is very hard to access before age 60. My goal is to reach a level where I can live off investments and trading way before that age. So essentially the money is useless to me.

Unlike most PF bloggers, I am not only concerned with the change in net worth but also in the rate of return on investment. Is net worth changing due to spending/saving behavior or due to investment gains or losses?

I also split out the effects due to changes in exchange rates on the current assets. A loss in terms of USD means there was some gain in terms of AUD. Therefore, this loss is not as critical as a loss in the actual base value of assets which I call core investment income.

*P.S. 13 July - adding in tax credits on mutual fund distributions in Australia the return for this month improved to -4.54%...

No comments:

Post a Comment