This was a relatively quiet month with little investment activity. I was busy working on my teaching. We spent AUD 6k less than last month though we spent around AUD 9k in travel expenses for a future trip. Flying a family of four internationally costs a lot.

In August, the Australian Dollar rose from USD 0.6531 to USD 0.6772, so US Dollar returns are a lot higher than Australian Dollar returns this month. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 1.64%

S&P 500: 2.43%

HFRI Hedge Fund Index: 1.26% (forecast)

Australian Dollar Indices

ASX 200: 0.67%

Target Portfolio: -0.49% (forecast)

Australian 60/40 benchmark: 0.30%

We lost 0.87% in Australian Dollar terms or gained 2.79% in US Dollar terms. So we beat all the US Dollar indices and underperformed all the Australian Dollar indices!

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and so the total differs from the Australian Dollar returns on net assets mentioned above. Returns varied radically across asset classes. RoW stocks (mostly Defi Technologies) gained more than 13% and contributed the most to the overall return. Several asset classes lost money, with futures being the worst in terms of RoR and contribution to return.

Things that worked well this month:

- Defi Technologies (DEFI.NE) was the top performer, gaining AUD 54k. Australian Dollar futures contributed AUD 13k.

What really didn't work:

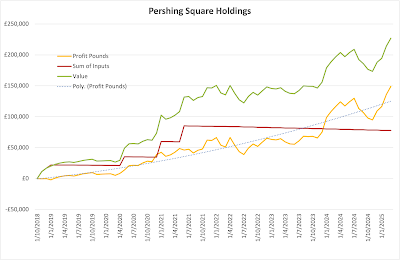

- Bitcoin lost AUD 39k. I discovered Defi Technologies due to my interest in bitcoin and Defi has so far more than offset my bitcoin losses. In total, I have lost AUD 47k on bitcoin and made AUD 143k on Defi Technologies. Pershing Square Holdings (PSH.L) was down again, losing AUD 11k. Chipotle was to blame this time, losing its CEO to Starbucks.

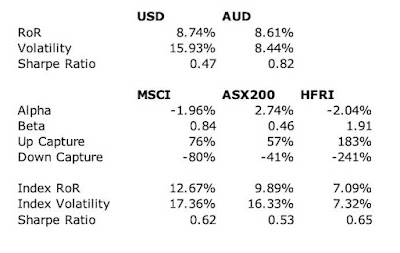

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Our performance fell back this month compared to the ASX200 but, as we have much lower volatility, we have a higher Sharpe ratio of 0.82 vs. 0.53. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 2.74% with a beta of only 0.46.

We moved away from our target allocation due to the gains in Defi Technology. We are most underweight cash and most overweight rest of the world stocks. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.The SMSF did have a winning month:

Unisuper did a little better and PSS(AP) a little worse.

We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I only made one additional move this month:

- I bought 5k shares of Regal Partners (RPL.AX) after what I thought was a great annual report. The market agreed for a few hours and then changed its mind...