At the beginning of the 2020-21 financial year the Macquarie Winton Global Alpha Fund (managed futures) had AUD 1.27 billion in assets. It only returned AUD 1 million that year and had been performing weakly for a while. In the 2020-21 financial year there were net redemptions of AUD 829 million. Then in 2021-22 it made AUD 80 million. There were still net redemptions of AUD 194 million this year and the fund is down to AUD 324 million in assets.

Friday, September 30, 2022

More Saving

This blog hasn't really been about saving money in terms of spending less. But facing a year with negative returns and maybe even a fall in net worth in the end, I have focused on cutting expenditure and costs. By switching our car insurance from a comprehensive policy to a third party property damage policy I saved about AUD 400 a year. A reduction from about AUD 675 to AUD 175. The insurance company only values our car at AUD 2,300 and the excess is AUD 695. So, it just didn't make sense to me to insure the car itself. On the new policy we can still get a payout if our car is damaged in an accident by an uninsured driver.

Recently we also called a plumber to look at all the faulty taps in the house. They can't repair taps with ceramic disks and so I decided to just replace all the 7 sets of taps in the house. The plumber told me that I can save money by going buying the taps myself and then getting them to install them. Saving is about $500. So, today we went to a bathroom/plumbing store and selected and ordered taps.

I wonder what Ramit would think about all this?

Wednesday, September 21, 2022

Not Renewing Wholesale Investor Status

I got a message from Interactive Brokers that I needed to renew my wholesale investor status as two years had passed since I submitted an accountant's certificate. They currently only allow retail investors to borrow a maximum of AUD 50k in margin loans. The accountant agreed to do it again and I sent her all the relevant material to prove my net worth was more than AUD 2.5 million that took me 2-3 hours to put together. I came up with a number of AUD 3.7 million – the test is done on an individual not family basis – and so thought it would be easy. But now she has come back and said she can't include any superannuation in the number! So she estimates my net worth for the purpose of the test is AUD 2.4 million. She suggested I get a professional valuation of my house to prove the higher number I suggested for it (AUD 1.25 million).

It doesn't make any sense to me that an SMSF would be excluded but home equity included.

Anyway, I looked carefully at my Interactive Brokers account. Currently, I could borrow a maximum of AUD 96k. The saving in interest per year for the amount above 50k compared to CommSec is about AUD 5k. But I am unlikely to borrow that much, as I don't want to get a margin call if things go pear-shaped. So, I've decided not to do the property valuation, because it might come in lower and I still wouldn't qualify. I will wait till when I actually want to borrow more or make a new venture capital investment in Australia and I am closer to qualifying.

Of course, it is much easier to qualify as an accredited investor under US rules. Moominmama qualified in order to participate in AngelList even though her net worth including super is definitely under AUD 2.5 million.

Tuesday, September 13, 2022

Childcare and Education Spending

Spending on childcare and education is by far our largest spending category now and has gone up steeply. We are now at AUD 47k for the last 12 months, which is 30% of spending. So, I was wondering where all that money was going:

Turns out that we are spending twice as much on daycare for the 3 year old as on private school for the 6 year old. We get little childcare subsidy. We also spent $4k on deposits for the two children to start at a new private school in 2024. We shouldn't have that expenditure again and the government wants to increase childcare subsidies. So, perhaps this is peak expenditure on this category in real terms until they are both in high school? School fees first fall and then increase again with age.

Tuesday, September 06, 2022

Lowered my Mortgage Rate

I read in the Australian Financial Review that having an offset facility usually means that the mortgage interest rate that you are paying is higher and that this gap is biggest at the Commonwealth Bank, where we have our mortgage and offset account. The article said that the gap could be as big as 1.91%! I don't remember this being explained to me when we got our mortgage and offset account though I did discuss with the salesperson whether we should get an offset account.

I have wondered why our mortgage rate was so high and tried to move our mortgage to HSBC to get a lower rate. They just continually ran me around and nothing ever happened. So, I gave up on that.

So, I phoned the bank and he told me that I should phone regularly to "review my discounts", which I have never done. Basically, there is a seniority discount - the longer you are with the bank the more the discount. So the standard rate for the offset account is actually 6.3%. I was paying 5.4%. He increased the discount from 0.9% to 2.29%, lowering my mortgage rate to 4.01%. If I switched to the no frills product cited in the AFR he could only give me a 0.2% discount off the 5.53% standard rate.

I estimate the gain in net worth at the end of the mortgage, assuming we don't pay off the mortgage any faster, is AUD 271k at 6% inflation and AUD 188k at 3% future inflation. The saved interest is in the ballpark of AUD 90k. It feels weird to earn that much for about an hour's work.

Sunday, September 04, 2022

August 2022 Report

August was a mixed month. The MSCI World Index (USD gross) lost by 3.64% and the S&P 500 lost 4.08% in USD terms, but the ASX 200 gained 1.43% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6968 to USD 0.6855 but it rose against the Pound from one Pound buying AUD 1.7430 to AUD 1.6958. We gained 0.25% in Australian Dollar terms but lost 1.38% in US Dollar terms. The target portfolio lost 0.71% in Australian Dollar terms and the HFRI hedge fund index rose 0.50% in US Dollar terms. So, we out-performed three benchmarks and under-performed two.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have added in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance followed by futures, which had the strongest return. US stocks were the worst performer followed by gold and rest of the world stocks.

Things that worked well this month:

- Pershing Square Holdings was the best performer (AUD 11k) followed by Aspect Diversified Futures (10k) and Winton Global Alpha (8k).

What really didn't work:

- Australian Dollar Futures lost AUD 7k.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index nor the MSCI. Compared to the ASX200, our rate of return has only been 0.6% lower, but our volatility has been 5% lower. We are performing 2% per annum worse than the average hedge fund levered 1.7 times.

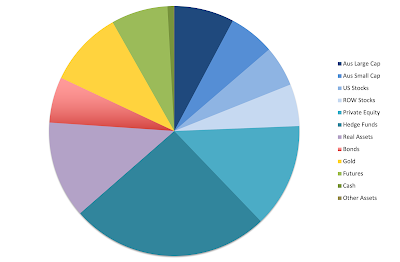

We moved a bit away from our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I bought AUD 75k of units in the Aspect Diversified Futures Fund (Class A). This cash came from the redemption of Pershing Square Tontine Holdings.

- I sold AUD 25k of the First Choice Wholesale version of this fund and bought units of First Sentier Developing Companies instead.

- I switched about USD 17k from the TIAA Real Estate Fund to the TIAA Social Choice Fund (a balanced fund).

- I traded 10k shares of Regal Funds (RF1.AX) a couple of times.

- I invested USD 2.5k in a start-up offered by the Unpopular Ventures syndicate.

- I sold 12.5k shares of WAM Leaders (WLE.AX) to fund venture capital investments.

- I sold 3k shares of Ruffer Investment Company (RICA.L) for the same purpose.

- We received the payout from the sale of Lured.

Monday, August 29, 2022

Transfer to HSBC Australia Didn't Work

I transferred USD 1,000 from Interactive Brokers to the HSBC Everyday Global Account. I was surprised to find that they converted it to Australian Dollars. I am confused about whether I did something wrong or not. I posted a question about it in the mobile chat and the app said it was still learning and didn't understand and a consultant would get back to me.

P.S. 30Aug22

So, the consultant explained that first you have to add the US Dollar "product" to your account before you can transfer US Dollars to your account. I now applied and was approved.

Even if I get this working properly this is a slow method of converting currency. First I need to transfer money to IB, then wait before I am allowed to withdraw it again, then wait while the transfer to HSBC happens, then do another transfer. Of course, we could simply have lots of US Dollars lying around at HSBC just in case, but there is an interest cost to doing that... So all this might be too much hassle.

For September's investment in Unpopular Ventures, I'm planning to sell some shares at IB and then transfer US Dollars to HSBC and see how it goes.

P.P.S. 30Aug22

So now I know when you get the 2% cashback on debit card purchases. You need to deposit at least $2,000 a month into the account. That is a tremendous rate of return compared to passing that spending money through our offset account - about 5 times the rate of return. So, I am going to get Moominmama's salary deposited to this account in future. I'm not sure about opening one myself as I have a lot lower rate of spending on a debit/credit card.

Sunday, August 28, 2022

History of Franking Credits

This year's tax returns include large amounts of franking credits connected to Australian dividends. I almost managed to wipe out Moominmama's tax bill with them. The franking credits are added to income and then deducted from the tax bill. As the corporate tax rate for large companies is 30%, if you are in the 34.5% marginal tax bracket (including the Medicare Levy) like she is, it would seem that franked dividends will slightly increase your tax bill. Say you got a $1,000 dividend including the franking credit. Your tax on the dividend as a whole is $345 and you deduct the $300 franking credit from that, paying $45 in tax on the dividend. The magic of franking credits is that if you have investment deductions like margin interest, you will end up with surplus credits. Let's say you have $500 in margin interest in this example. Then your tax on the net $500 in income is $172.50. After deducting the franking credit from this, you have $127.50 in tax credits, which you can apply against the tax on your salary etc.

Foreign source income tax offsets work in a similar way. These are tax paid to foreign governments on dividends etc. Finally, there are also Early Stage Venture Capital Limited Partnership tax offsets. If you invest in an ESVCLP you can get a credit worth up to 10% of your investment. This totally offsets tax on other income even without any deductions!

Over time, the amount of franking credits and foreign source income tax offsets we have received has increased, as you would expect, though this year's credits are off the scale:

This doesn't include any tax credits received by our SMSF or any other superannuation fund for that matter.

Saturday, August 27, 2022

Moominmama's 2021-22 Taxes

I also did Moominmama's taxes for this financial year. The post about last year's taxes is here. Here is a summary of her tax return for this year:

Her salary was up steeply this year, as last year large superannuation contributions were deducted from it. This year, we redirected those to our new SMSF. Australian dividends were up dramatically as I tried to get more investments in her name. Gross income fell by 15% though because of reduced capital gains.

Total deductions rose by 66%, mainly because of the $20k in contributions to the SMSF. As a result, net income fell 32% mainly I think because of the reduced capital gains this year.

Gross tax applies the tax bracket rates to taxable income. Most of this nominal tax was eliminated by the 208% increase in franking credits. As a result, she should be assessed for only $1.4k in tax. As this is much less than the tax withheld from her salary, I expect she will get a refund of around $4k.

Moominpapa's 2021-22 Taxes

This year, I've prepared our tax returns earlier than usual as I have already received all the required information. Here is a summary of my taxes. Last year's taxes are here. To make things clearer, I reclassify a few items compared to the actual tax form. Of course, everything is in Australian Dollars.

On the income side, Australian dividends and franked distributions from managed funds are again up strongly. My salary still dominates my income sources but only increased by 3%.

A big chunk of foreign source income is from the distribution from Aspect Diversified Futures Fund. As a result, I am moving that holding into the SMSF. Net capital gain is zero due mainly to some strategic sales ton generate losses. I am carrying forward $99k in capital losses, which is double what was brought forward from last year.

In total, gross income grew 8%.

Deductions fell 47% because last year they included the loss on Virgin Australia bonds. Most deductions are interest including the $14k in other deductions.

Net income rose as a result by 26%.

Gross tax is computed by applying the rates in the tax table to the net income. In Australia, you don't enter the tax due in your tax return, but I like to compute it so that I know how big or small my refund will be.

Franking credits (from Australian dividends), foreign tax paid, and the

Early Stage Venture Capital (ESVCLP) offset (none this year as there were no capital calls from Aura) are all deducted from gross

tax to arrive at the tax assessment.

Estimated assessed tax rose 47%.

I estimate that I will pay 28% of net income in tax. Tax was withheld on my salary at an average rate of 31%. I already paid $6,546 in tax installments and so estimate that I need to pay an additional $2,829 in tax.

Wednesday, August 17, 2022

Reduced Our Health Insurance Premium

Inspired by Jessica Irvine's article on health insurance in the Sydney Morning Herald (I get her weekly newsletter), I phoned BUPA a couple of times and reduced our monthly health insurance premium from AUD 596 to about AUD 530. I switched the hospital coverage from gold (which we wanted when Moominmama was pregnant) to silver advanced (which is probably still too much coverage) and the extras from Budget Extras to Freedom 50. I think we should probably just drop the extras but Moominmama seems to think we'll use it. I'll monitor after a year or two and see if we are getting our money's worth. I estimate that the extra tax we would have to pay if we didn't have private health insurance is about AUD 370 a month. Moominmama likes private health insurance (and private schools etc.) whereas I don't get the point, really.

Saturday, August 13, 2022

HSBC Everyday Global Account

Back at the beginning of 2021 I opened an HSBC account for Moominmama because Plus 500 refused to send money to an account in our joint names. Moominmama has just been using it for shopping getting 2% cashback some months. I just realised that it can hold foreign currencies. So, instead of using OFX to convert and transfer money to the US to invest in Unpopular Ventures and Masterworks I could convert the money at Interactive Brokers at the best exchange rate, transfer it to HSBC and then transfer it to the recipient from there for an AUD 30 fee. OFX have about a 1.4% exchange rate cost plus an AUD 15 fee for small orders. And one day when there are distributions from Unpopular Ventures we could transfer the money back to HSBC without converting it.

Superannuation Performance Update

I just calculated the return on my TIAA-CREF 403b in Australian Dollar terms to compare to our Australian superannuation funds. While the SMSF has done a lot better than Unisuper and PSS(AP) since inception, TIAA has really shone. This is mainly due to our investment in the TIAA Real Estate Fund and partly due to the fall in the Australian Dollar. Now, I am wondering whether to switch out of that fund.

Pre-tax returns for the 2021-22 financial year were: SMSF 2.6%, Unisuper -5.0%, PSS(AP) -2.9%, TIAA-CREF 28.5%. I am very generous in estimating the tax paid by Unisuper and PSS(AP). This boosts estimated pre-tax returns on the way up a little but detracts a bit on the way down.

Saturday, August 06, 2022

June 2022 Report

With the final private asset valuations complete, I am ready to present the June accounts. I needn't have waited, as the share price of Aura VF1 only rose by one cent and Aura VF2's share price was constant.

World markets fell sharply with the MSCI World Index (USD gross) falling by 8.39% and the S&P 500 by 8.25%. The ASX 200 fell 7.72%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7177 to USD 0.6900 increasing Australian Dollar returns and reducing USD returns. We lost 5.82% in Australian Dollar terms or 9.46% in US Dollar terms. The target portfolio lost 2.42% in Australian Dollar terms and the HFRI hedge fund index lost 3.08% in US Dollar terms. So, we under-performed all benchmarks apart from the ASX.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Hedge funds were the worst drag on performance followed by leverage. Only gold and the Australian Dollar contributed positive returns. The total benefit of the fall in the Australian Dollar was greater as many foreign assets are denominated in Australian Dollars. This includes gold which we invest in through an Australian ETF PMGOLD.AX.Things that worked well this month:

- Gold was the top performer (AUD 13k) followed by the China Fund (CHN) (9k), Winton Global Alpha (5k), and Aspect Diversified Futures (4k).

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost an incredible AUD 86k :(. Regal Funds followed with -36k and PSSAP rounded out the bottom three with -18k.

We moved a bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I bought 5,000 shares of Regal Partners (RPL.AX). So far, this looks like a mistake.

- I bought 20,000 shares of Pengana Private Equity (PE1.AX).

- I bought 2,000 shares of Regal Funds (RF1.AX).

- I sold 2,000 shares of PMGOLD.AX, a gold ETF. I'm beginning to feel over-stretched. This move reduced our leverage a bit and reduced our most expensive debt (CommSec margin loan). It also pushed our gold allocation back to 10% of gross assets.

- I sold a net 988 shares of WAR. I moved the rest of the position from one account to another to avoid a margin call.

Wednesday, August 03, 2022

July 2022 Report

July was a reversal of June. The S&P500 gained more than it lost in the previous month and gold fell more than it rose in the previous month. Investors seem to think that the Federal Reserve will raise interest rates by less than originally expected. The MSCI World Index (USD gross) rose by 7.02%, the S&P 500 by 9.22%, and the ASX 200 by 5.77%. All these are total returns including dividends. The Australian Dollar rose from USD 0.6900 to USD 0.6968 increasing Australian Dollar returns and reducing USD returns. We gained 4.11% in Australian Dollar terms or 5.13% in US Dollar terms. The target portfolio gained 3.75% in Australian Dollar terms and the HFRI hedge fund index was up only 1.65% in US Dollar terms. So, we out-performed the latter two benchmarks but under-performed the stock indices. The AUD return for the month is more than what would be expected historically given the ASX 200 performance for the month.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have for the first time added in the contributions of leverage and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance while Australian small cap had the best return. Gold was the worst performer and a significant detractor. Rest of the World stocks had a relatively poor performance because of our weighting to the China Fund.

Things that worked well this month:

- Regal Funds was the best performer (AUD 25k) followed by Pershing Square Holdings (18k), Tribeca Global Resources (18k), and another seven investments that gained more than AUD 10k.

What really didn't work:

- Gold was the worst performer (-24k) followed by the China Fund (-9k) and Winton Global Alpha (-5k). Only six investments lost money while 29 gained.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. This month, I have added another three rows to report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index and not really against the MSCI. Compared to the ASX200 our rate of return has only been 0.6% lower but our volatility has been 5% lower.

We are performing 2% per annum worse than the average hedge fund levered 1.7 times. I'm not sure why this alpha has deteriorated sharply recently. July 2017, which was dropped from the estimation this month, was a good month for hedge funds but both June and July 2017 were particularly good months for us in USD terms as the Australian Dollar rose sharply.

We moved a bit away from our target allocation. This was mainly because of the redemption of Pershing Square Tontine Holdings that reduced our private equity allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I sold 4,000 shares of WAM Leaders to get some cash.

- I made an AUD 20k concessional superannuation contribution for Moominmama.

- We combined these to start an account at Colonial First State for the SMSF investing in Aspect Diversified Futures with an initial AUD 25k (the minimum investment for Class A shares).

- As mentioned above, PSTH returned the cash to shareholders. There is a placeholder position still in our account which might turn into SPAR warrants at some point.

- I bought a net AUD 75k, mainly with the US Dollars from PSTH.

- I invested around AUD 10k in 64 Devonshire Road, Rossmore, NSW.

- I bought 1,250 PMGOLD shares (12.5 ounces of gold).

- I bought 3,000 more shares in Pendal (PDL.AX), when it was announced that merger talks were back on.

Friday, July 29, 2022

How I Made AUD 2,900 Instantly

A couple of days ago, I went on the Domacom platform just to see if anything was new. I found an offer to sell about 10,000 units in a semi-rural property near Sydney for AUD 1.0156 placed on 30th May. But the property was revalued on 18th July by around 30%!. Almost instantly I bought the units. One downside is that I already own about AUD 10k of units in the neighboring property. Of course, I can't realize this profit, so it is just on paper. The market is very illiquid, which is why I managed to get this bargain in the first place. Both properties have a vote next March on whether to sell the properties and wind up the funds or whether to continue to hold. Recently, my first investment at Domacom held a vote and sold for a big profit.

To get the funds, I had to cancel my pledge to a campaign to buy rural property. My money has been tied up in the campaign for a year while they have made almost no progress on raising money. I think that in future I won't make pledges to campaigns and only engage in the secondary market. The additional advantage of that is that I avoid paying big fees for the purchase of the property and the often huge upfront cut (c. 10%) taken by the promoters of the campaign. It would be much better if they were paid by performance fees instead...

.jpg)