Overview

This was the first year that our net worth fell since 2008. Investment returns were negative but the value of our house increased a bit and we did save some money.* We were far short of the best case projection I made at the beginning of the year of a net worth of AUD 6.7 million. In my academic career, I spent a lot of time this year working on preparing and then teaching a new course, though I did get at least one newish research project completed. I was supposedly on long service leave for the first three months of the year but didn't really get to take any time off. This year, I plan on taking it a bit easier in the first half of the year before focusing on teaching in the second half of the year. Teaching was more in person this year and so a bit more enjoyable. I didn't leave the Canberra region all year since getting back from the coast right after New Year's Day.

All $ signs in this report indicate Australian Dollars. I'll do a separate report on individual investments. I do a

report breaking down of spending after the end of the financial year.

Investment Returns

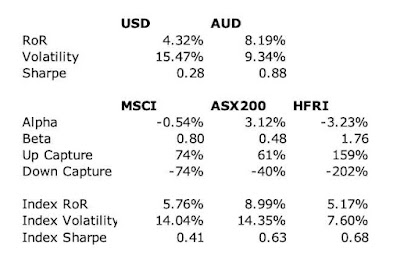

In Australian Dollar terms we lost 3.7% for the year but in USD terms we lost 9.6% because of the fall in the Australian Dollar over the year. The MSCI lost 18.0% in USD terms but the ASX 200 gained 0.9% in AUD terms. The HFRI hedge fund index lost 1.5% in USD terms. Our target portfolio lost 4.2% in AUD terms. So, we beat the MSCI and the target portfolio benchmarks this year but not the ASX 200 or HFRI Index.

This chart compares our portfolio to the benchmarks in Australian Dollar terms over the year:

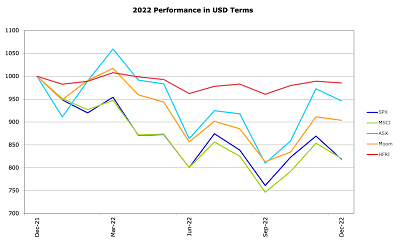

We tracked the target portfolio quite closely. It acted as a less volatile weighted average of Australian and international equity markets. Here are the same indices in US Dollar terms with the target portfolio replaced by the HFRI hedge fund index:

The HFRI had very low volatility and the strongest relative performance. In USD terms, our portfolio was much more volatile than in Ausrtalian Dollar terms as intended.

Here are annualized returns over various standard periods:

Benchmark returns have now mostly decreased over time. We have similar performance to the ASX 200 over ten years but much worse over twenty. We beat the HFRI over all the longer time horizons. We had particularly good relative performance over the three year horizon. Whether you think our performance is good or bad depends on what you think the default alternative investment is. If it is an ASX 200 index fund, then we are doing in the last ten years. If it is a global stock index fund then not so good over horizons longer than three years. If you think it is our target portfolio then we are doing well.

Here are the investment returns and contributions of each asset class in 2022:

The contributions to return from each asset class sum to the total portfolio return in gross asset and currency neutral terms. I then add on the contributions of leverage and the Australian Dollar to get the AUD net worth return. The portfolio shares are at the beginning of the year. Futures and gold did best and contributed most to the return. Private equity and real assets had small positive returns. Australian small cap stocks and foreign equities all did very badly.

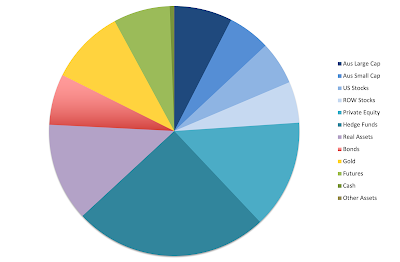

Investment Allocation

There weren't large changes in asset allocation over the year:

Mainly, real assets fluctuated with our exposure to URF.AX, which is a very levered (effectively) US residential real estate fund.

Accounts

Here are our annual accounts in Australian Dollars:

Percentage changes are for the total numbers. There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. There is an explanation at the end of this post.

We earned $153k after tax in salary etc. Total non-investment earnings including retirement contributions were $183k, down 9% on 2021. This was due to increased tax payments, fewer non-salary earnings, and fewer employee contributions to Moominmama's employer superannuation fund. We lost

(pre-tax including unrealized capital gains) $166k on non-retirement

account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We lost $15k on retirement accounts with $30k in employer retirement contributions. The value of our house is estimated to have risen by $133k. As a result, the investment loss totaled -$45k and total income $139k.

Total spending (doesn't include mortgage payments) of $152k was again up 12% for the year. Spending was almost exactly equal to after-tax non-investment income. We saved just $488 from

salaries etc.

$25k of the current

pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $120k into retirement accounts the SMSF from existing savings. This included $20k as a concessional contribution for Moominmama. Therefore, looking

at just saving from non-investment income, we dissaved $120k. The change in current net worth, was

therefore -$306k.

Taxes on superannuation returns are just estimated because apart from tax paid by the SMSF all we get to see are the after tax returns. I estimate this tax to make retirement and

non-retirement returns comparable. The total implicit tax on supernnuation was a negative $1k because we lost money. Net worth of retirement accounts increased by $136k after the transfer from current savings.

Finally, total net worth fell by $37k.

Projections

Last year my baseline projection for 2022 was for a

16% rate of return, no increase in the value of our home, flat other

income, and 6% growth in spending. This resulted in projected net worth increasing

by $800k to around $6.7 million. Obviously, we came nowhere near this projection.

This year the baseline projection (best case scenario) is for an 11.2% investment rate of return in AUD terms (assuming the Australian Dollar rises to 75 US cents), inflation of 7.6% and an 11% nominal increase in spending, and about a 3% increase in other income, leading to an $550k increase in net worth to around $6.5 million or a 9% increase. This would be very little gain in real terms after inflation. But, again, anything could happen.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then

the other two are fairly self-explanatory. However, property taxes etc. are included in the

current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.

Current other income is reported after

tax, while investment income is reported pre-tax. Net tax on investment

income then gets subtracted from current income as our annual tax refund

or extra payment gets included there. Retirement investment income gets

reported pre-tax too while retirement contributions are after tax. For

retirement accounts, "tax credits" is the imputed tax on investment

earnings which is used to compute pre-tax earnings from the actual

received amounts. For non-retirement accounts, "tax credits" are actual franking credits

received on Australian dividends and the tax withheld on foreign

investment income. Both of these are included in the pre-tax earning but

are not actually received month to month as cash....

For current accounts "core

expenditure" takes out business expenses that will be refunded by our

employers and some one-off expenditures. This year, there are

none of those one-off expenditures. "Saving" is the difference

between "other income" net of transfers to other columns and spending in

that column, while "change in net worth" also includes the investment

income.

* Venture capital returns haven't been reported yet for the December 2022 valuation, but I don't expect them to make a big difference.