Seems I've become very risk averse. That's why I set such a tight stop yesterday morning. But that resulted in me losing money on a day when I had predicted the market direction correctly and should have been making money. I thought about getting short around lunchtime. But was scared the market would run up again. It didn't. The market fell more in the afternoon. I'm still out of the market this morning and am watching the big employment reported. My guess was the market would move up in reaction. So far it has, but I didn't place a trade. Maybe there are times when you should just take a break from trading, like from all things. I'll think about getting into the market again next week (of course I am always 100% invested in a mix of stocks, bonds, funds etc., I am talking about short-term trading. Today is the last class of this semester. I've set my schedule for next semester to make it easier for me to trade. Teaching 4 days a week from 12-2. Plan on heavy market data days to get to campus fairly early and watch the pre-market, market, prepare class etc. Major action in terms of setting a direction in the market tends to be over by 11am I find... setting a stop after that is a lot safer than before 10am which is when my first class is at the moment.

The model trend should remain down over the weekend even if today is something of a rebound day. It is too early to tell if the initial uptrend will hold. Bonds are down and the dollar and stocks are up at this point. As often is the case, it is hard to see what in the report generated the spike in interest rates.

9:17am

Now stocks are down, the dollar is down, and bonds are off a little. Glad I didn't put a long trade on.

12:09pm

Got back from class and NDX is up 20+ points! Now the long trade is looking very good.... glad I'm just not trading :) Bonds are off quite a bit and the US Dollar is rallying strongly.

Saturday, December 09, 2006

Friday, December 08, 2006

Ouch - Stopped Out!

So far it looks like I predicted the direction of the market correctly yesterday. Had a meeting from 9-11 this morning and I set a stop. The stop was set at NQ (December) = 1808 which was the point where the stochastic would rise above 80 and negate the sell signal from the day before. The stop was hit and then the market dived. Lost $140 on the trade - guess it could be worse. But even when I'm right I am losing money which is discouraging. I'll wait for a bounce and re-evaluate whether to go short again.

Thursday, December 07, 2006

Model Switches to Sell

The model switched to sell at today's close. If the NDX had closed above 1802 the model would have remained on buy. This is a rather negative omen for bulls given that the high yesterday (c) did not exceed the previous high around Thanksgiving. As I mentioned, the move down from the top looked like an impulse wave in Elliott Wave terminology. The move up since then (a), (b) , (c) now looks like a corrective wave. So the coming wave down is a wave 3 or wave C.

Saturday, December 02, 2006

November Report

Investment Performance

Investment return in US Dollars was 2.67% vs. a 2.88% gain in the MSCI World Index, which I use as my overall benchmark and a 1.90% gain in the S&P 500. The trading accounts lost money again... The contributions of the different investments and trades is as follows:

The returns on all the individual investments are net of foreign exchange movements. The biggest single contribution to US Dollar returns was the foreign currency gains, which appears at the bottom of the table. Powertel made a nice gain this month.

Asset Allocation

At the end of the month the portfolio had a beta of 0.89 (a 1% rise in the market would result in a 0.89% increase in the portfolio). 58% of the portfolio was in stocks, 46% in bonds, 7% in cash, and loans totalled -22%. The remainder was in the hedge fund type and real estate investments, futures value etc.

Net Worth Performance

Net worth rose by $US12,188 to $US354,596 and in Australian Dollars gained $A6809 to $A449,083.

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions. Expenditure was $US1592 - almost exactly the same as last month - only 38% of take home pay ($4125).

Investment return in US Dollars was 2.67% vs. a 2.88% gain in the MSCI World Index, which I use as my overall benchmark and a 1.90% gain in the S&P 500. The trading accounts lost money again... The contributions of the different investments and trades is as follows:

The returns on all the individual investments are net of foreign exchange movements. The biggest single contribution to US Dollar returns was the foreign currency gains, which appears at the bottom of the table. Powertel made a nice gain this month.

Asset Allocation

At the end of the month the portfolio had a beta of 0.89 (a 1% rise in the market would result in a 0.89% increase in the portfolio). 58% of the portfolio was in stocks, 46% in bonds, 7% in cash, and loans totalled -22%. The remainder was in the hedge fund type and real estate investments, futures value etc.

Net Worth Performance

Net worth rose by $US12,188 to $US354,596 and in Australian Dollars gained $A6809 to $A449,083.

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions. Expenditure was $US1592 - almost exactly the same as last month - only 38% of take home pay ($4125).

Wednesday, November 29, 2006

Model Forecasts - Trading Diary

At this point the NDX futures are up 5. If this holds or even if the index were to fall 12 points or so today the model is calling for a change of trend from Thursday. If we fall more than 12 points today then Thursday would open with oversold conditions if the index was unchanged from today's close. So that's the roadmap. Cover short positions today unless there is a huge selloff. Everything will depend on the economic data and Fed Beige Book published today.

Update: 10:47am

I did some NQ daytrading and am now holding the short positions with stops in around the day's highs. One theory is that the high today is the top of the B-Wave (in Elliott Wave Theory) of the correction that started on Friday. The big decline on Monday looks impulsive rather than a complete correction and the wave since then looks like an ABC formation. On the other hand, unless things reverse sharply here and the market ends down (which at the moment looks unlikely unless they totally hate the Fed Beige Book at 2pm) the model is saying to get long at today's close. So wait and see for the moment.

Update: 11:49am

The stops were hit while I was commuting and now I am flat. Though the market is off from the level of the stops (always annoying) I will remain flat till nearer 2pm. Have a meeting coming shortly for the next 1 hour or so. NDX could be making an ending diagonal formation intraday and if so it isn't complete.

Update: 2:34pm

Tha market doesn't hate the beige book, but so far it doesn't seem to like it either. I got long - waiting to see if that is the right stance.

Update: 8:29pm

In retrospect I would have been much better off without the stops.... I always have mixed feelings about stops. Sometimes I wish I had them and other times wish I didn't. I sold out of both long positions (QQQQ and NQ) by the end of the day. Will re-establish in the morning.

Update: 10:47am

I did some NQ daytrading and am now holding the short positions with stops in around the day's highs. One theory is that the high today is the top of the B-Wave (in Elliott Wave Theory) of the correction that started on Friday. The big decline on Monday looks impulsive rather than a complete correction and the wave since then looks like an ABC formation. On the other hand, unless things reverse sharply here and the market ends down (which at the moment looks unlikely unless they totally hate the Fed Beige Book at 2pm) the model is saying to get long at today's close. So wait and see for the moment.

Update: 11:49am

The stops were hit while I was commuting and now I am flat. Though the market is off from the level of the stops (always annoying) I will remain flat till nearer 2pm. Have a meeting coming shortly for the next 1 hour or so. NDX could be making an ending diagonal formation intraday and if so it isn't complete.

Update: 2:34pm

Tha market doesn't hate the beige book, but so far it doesn't seem to like it either. I got long - waiting to see if that is the right stance.

Update: 8:29pm

In retrospect I would have been much better off without the stops.... I always have mixed feelings about stops. Sometimes I wish I had them and other times wish I didn't. I sold out of both long positions (QQQQ and NQ) by the end of the day. Will re-establish in the morning.

Tuesday Update

The market rebounded a little today. Friday remains the likely timing for a more substantial upswing. That is unless we get to oversold conditions (stochastic less than 20) before that. For that to happen we need to get another serious selloff in the next couple of days. The Aussie Dollar rallied against me. My futures position is partially hedging the underlying exposure to the AUD so actually my USD net worth rose still due to this rally in the AUD, but much less than it could have. The "autoregressive model" is now giving a more emphatic sell signal today for the Aussie. Bonds rose too, which is good for me. So all in all today was probably a wash. I did a couple of NDX daytrades the losing one lost a little less than the winning one made so I guess that is OK too :)

Tomorrow we get a bunch more macro news including preliminary GDP, new home sales and the Fed's Beige Book. Today existing home sales were up, but as expected there was a year on year price decline again.

Tomorrow we get a bunch more macro news including preliminary GDP, new home sales and the Fed's Beige Book. Today existing home sales were up, but as expected there was a year on year price decline again.

Tuesday, November 28, 2006

Trading Update

I've been short NDX for a while and losing money. In strongly overbought situations it is hard to use "the model". Each time it seems to show that the overbought situation is ending there has been a quick reversal back to overbought conditions. A nimble trader could have played these intraday "buy the dip" situations we have been having. Today's down move brings me to about breakeven on the month. The model is now clearly short. Expect more downside. Friday though could be the beginning of a new uptrend. It could get going on Thursday already. Overall though my portfolio is up about 2% so far this month and now beating the market. I fully expect to lose money in Australia in the next few days, though.

Monday, November 27, 2006

Forex Update

I've been successful so far trading the Aussie Dollar on the long side - making $US814 so far (this is just futures contracts not gains on my actual Australian investments due to the rise in the AUD) - and now I have switched to the short side. I was long one contract and am now short one contract. So I have gone from almost 100% in Australian Dollars portfolio wide to about 50/50 Aussies and Greenbacks. The reason is because my "autoregressive model" gave a sell signal on the Friday close. I don't know how far the down move will go. It seems reasonable that the sharp fall in the US Dollar last week will correct somewhat even if the USD is headed down further after that. And the Aussie does look relatively weak. I've also relabeled my posts about currency trading as "Forex" instead of "Trading" so that they will be easier to find.

P.S. Noon Monday

I sold another AUD contract, taking my AUD exposure down to 23% and USD up to 67% (the rest is in funds exposed to other currencies).

P.S. Noon Monday

I sold another AUD contract, taking my AUD exposure down to 23% and USD up to 67% (the rest is in funds exposed to other currencies).

Saturday, November 25, 2006

Thanksgiving Conversation

As many other bloggers mention, we often find ourselves having conversations about finances with people we don't usually talk to about finances at occasions like Thanksgiving. And it is always amazing what people don't know. We were talking about looking for other jobs and relocating and someone mentioned: "It's a pity that retirement accounts are set up in America so that it makes it difficult to move jobs". With a bit of prodding it sounds like the guy has a 403(b) defined contribution account with TIAA-CREF just like I do. I told him that it probably isn't a barrier to moving but he should check with his HR people if he is thinking of moving so he knows what to do. I said anyway he could roll it over into an IRA even if he couldn't keep the account or transfer it to his new employer and then he could just start a new account with his new employer. Our host (early 50s, actually with a PhD in economics) then said: "how do you know if you have a defined benefit or defined contribution?" I explained, looks like she has defined benefit with state government and that could be an impediment to moving. If you stay with the state more than 20 years they up the benefit level and she's only been 16 years. That's what she said anyway. Then everyone commented that they hate thinking about this stuff and dealing with money... I didn't investigate why.

The first guy though did know how much was in his 403(b), how much he contributed each month, and had shifted some of the money to more aggressive options in the previous year. The host had an FSA (something I don't do because I think it's too much hassle) and knew all these things came out pre-tax. We also discussed the percentages my employer and I put into my 403(b).

The first guy though did know how much was in his 403(b), how much he contributed each month, and had shifted some of the money to more aggressive options in the previous year. The host had an FSA (something I don't do because I think it's too much hassle) and knew all these things came out pre-tax. We also discussed the percentages my employer and I put into my 403(b).

Tuesday, November 21, 2006

Investment Decisions

I have made the three investment decisions I've been discussing recently:

1. I am investing $7000 in the Hussman Strategic Growth Fund in my Roth IRA.

2. After my discussion with one of the portfolio managers, and reading up on their funds and approach to investing, I have decided to make an initial investment of $5000 (the minimum) in the TFS Market Neutral Fund. Currently, this fund is the top performer in Morningstar's long-short category. The fund's track record is short but over this time it shows strong upward movement, but short-term movements tend to be against the market. This indicates the fund has a low beta and high alpha which are desirable for a market neutral fund. This chart shows the fund's performance relative to the S&P 500:

The fund was particularly strong during the mid-year market meltdown and has beaten the market for the last 12 months and year to date. Other factors that I like are that the managers invest in the fund and also manage hedge funds through the same firm and that they have a particularly interesting compensation structure on a new fund they have launched, which includes an incentive fee, but could result in them receiving no compensation for the year. This suggests they are very confident of beating the market of course. Finally, they focus on quantitative investment and trading strategies.

3. I will max out my 403(b) contributions to my TIAA-CREF account, starting on December 1st.

The reason behind these moves is I don't want to add money to my U.S. trading accounts until they breakeven. I also don't want to devote more money to short-term trading until I can prove I can make profits consistently.

The Hussman and TFS Funds essentially give you a hedge fund without high hedge fund fees, high minimum investments, high net worth requirements, or low liquidity. These and other such funds are well worth considering as an alternative to traditional long-only mutual funds. I already invest in two hedge fund vehicles in Australia - one a fund of funds, and one a closed end fund that is similar to these two funds.

The two new funds add to my existing core investments. These are intended to be investments that do not need adjustment over the stock or business cycle. Eventually, I'd like to have around 50% of net worth in investments of this type I think.

1. I am investing $7000 in the Hussman Strategic Growth Fund in my Roth IRA.

2. After my discussion with one of the portfolio managers, and reading up on their funds and approach to investing, I have decided to make an initial investment of $5000 (the minimum) in the TFS Market Neutral Fund. Currently, this fund is the top performer in Morningstar's long-short category. The fund's track record is short but over this time it shows strong upward movement, but short-term movements tend to be against the market. This indicates the fund has a low beta and high alpha which are desirable for a market neutral fund. This chart shows the fund's performance relative to the S&P 500:

The fund was particularly strong during the mid-year market meltdown and has beaten the market for the last 12 months and year to date. Other factors that I like are that the managers invest in the fund and also manage hedge funds through the same firm and that they have a particularly interesting compensation structure on a new fund they have launched, which includes an incentive fee, but could result in them receiving no compensation for the year. This suggests they are very confident of beating the market of course. Finally, they focus on quantitative investment and trading strategies.

3. I will max out my 403(b) contributions to my TIAA-CREF account, starting on December 1st.

The reason behind these moves is I don't want to add money to my U.S. trading accounts until they breakeven. I also don't want to devote more money to short-term trading until I can prove I can make profits consistently.

The Hussman and TFS Funds essentially give you a hedge fund without high hedge fund fees, high minimum investments, high net worth requirements, or low liquidity. These and other such funds are well worth considering as an alternative to traditional long-only mutual funds. I already invest in two hedge fund vehicles in Australia - one a fund of funds, and one a closed end fund that is similar to these two funds.

The two new funds add to my existing core investments. These are intended to be investments that do not need adjustment over the stock or business cycle. Eventually, I'd like to have around 50% of net worth in investments of this type I think.

Sunday, November 19, 2006

Benefits Fair

I went to my employer's annual benefits fair on Friday. The fair is on the first day of the open enrollment period that runs till December 1st. Like a trade convention/fair on two floors, with tables for all the vendors. Full of people talking with the vendors' representatives and eating the free snacks. The only one I was really interested in was the TIAA-CREF rep. I asked him about supplemental retirement accounts (we are required to contribute 1% of salary and receive an 8% employer contribution - to contribute more than 1% you need to apply for a supplementary account). He was out of forms and told me to go visit HR's office. Back at my own office I downloaded the form from HR's website. Turns out that you can start a supplemental account and change your contribution every month! No need to wait for "open enrollment". I still need to make a final decision on this, but now I know I can reverse this any time and stop making additional contributions it feels a bit easier. I figure that going from a 1% employee contribution to the maximum allowed contribution ($1250 per month) will reduce each half-monthly take home pay check by only $380. That's not too bad.

Tuesday, November 14, 2006

Letter from the Australian Tax Office

Today, I received a letter from the Australian Tax Office regarding my past holding of IYS. This investment sold by Deutsche Bank is in the process of being wound up, though I have already sold. The ATO has disallowed some deductions and other features of the scheme , which apparently it regarded as being too aggressive in reducing tax. So they want to know what I reported on my 2001-2 tax Australian tax return regarding this investment (I moved to the US in July 2002). Luckily, I have all my old tax returns here and the spreadsheets I used in preparing them, so it took hardly any time to dig out the information. Now I know why I save all this stuff :) After mid-2002 I reported all income, deductions, and capital gains and losses on this investment to the US IRS. I hope I don't owe too much tax if any in Australia for that year.

Sunday, November 12, 2006

Inheritance

Claire is blogging again about money from family. I'm the first commenter on this post.

After reading some of the other comments on Claire's post I think there are some things that I should or could add. Somebody mentioned telling their parents what to spend. I certainly don't do that, except as I said in the post to tell my mother she is rich and can and should spend more money. I only advise on choosing other financial advisers and then work with them to make decisions on investments. My father asked my advice too while he was alive but never gave me any clue about how much money there was in total.

In the posts there is a strong emphasis on the merits of being self-made and self-reliant. I agree that these are very desirable. If I have children (I'm 41 now, but my father was 48 when I was born :)) it is probably something I am going to have to think about regarding them too. I know of cases where people who inherited money young were demotivated. The good cases seem mostly to share the trait that the children worked in the family business alongside the parents and eventually took it over. In my case I had no idea there was as much money as there is till I was 37 years old when my father died. We grew up very much at the lower end of the middle class. My father came from a formerly wealthy family - the main thing we inherited though then was attitudes to investment, risk, debt etc. I sometimes say he was nouveau pauvre - the newly poor and the exact opposite of the nouveau riche - the newly rich. His mother died in 1970 and legal battles among family took up many years after that. What he inherited was art and antiques. His father's family were in the art/antique dealing business. What he received was mainly inventory from his father's business. His father died in 1922 when my father was just 5-6 years old.

Over time he sold most of it. The final sale in 1996 was the biggest. These art works realised far more than the valuation. He was shocked how much he received. At the time he just told me it was much more than the valuation.

The point of this story is that people don't want their parents to sacrifice to leave them money. I fully agree with this. Our case is different in that the core of the wealth was handed down from the previous generation (the little we have salvaged actually - maybe this makes us more upper class than middle class however ludicrous that notion is), though my father saved plenty during his life time too. I think my mother should spend the income on what she has inherited. But she's not.

After reading some of the other comments on Claire's post I think there are some things that I should or could add. Somebody mentioned telling their parents what to spend. I certainly don't do that, except as I said in the post to tell my mother she is rich and can and should spend more money. I only advise on choosing other financial advisers and then work with them to make decisions on investments. My father asked my advice too while he was alive but never gave me any clue about how much money there was in total.

In the posts there is a strong emphasis on the merits of being self-made and self-reliant. I agree that these are very desirable. If I have children (I'm 41 now, but my father was 48 when I was born :)) it is probably something I am going to have to think about regarding them too. I know of cases where people who inherited money young were demotivated. The good cases seem mostly to share the trait that the children worked in the family business alongside the parents and eventually took it over. In my case I had no idea there was as much money as there is till I was 37 years old when my father died. We grew up very much at the lower end of the middle class. My father came from a formerly wealthy family - the main thing we inherited though then was attitudes to investment, risk, debt etc. I sometimes say he was nouveau pauvre - the newly poor and the exact opposite of the nouveau riche - the newly rich. His mother died in 1970 and legal battles among family took up many years after that. What he inherited was art and antiques. His father's family were in the art/antique dealing business. What he received was mainly inventory from his father's business. His father died in 1922 when my father was just 5-6 years old.

Over time he sold most of it. The final sale in 1996 was the biggest. These art works realised far more than the valuation. He was shocked how much he received. At the time he just told me it was much more than the valuation.

The point of this story is that people don't want their parents to sacrifice to leave them money. I fully agree with this. Our case is different in that the core of the wealth was handed down from the previous generation (the little we have salvaged actually - maybe this makes us more upper class than middle class however ludicrous that notion is), though my father saved plenty during his life time too. I think my mother should spend the income on what she has inherited. But she's not.

A Pair Trade?

Pair trades are one of the strategies commonly used by hedge funds. The idea is to buy a stock that is expected to perform well and short another stock in the same industry which is expected to underperform. A similar idea is to buy a portfolio of stocks that the investor expects to perform well and short index futures or ETFs etc. to remove the general market risk from the portfolio. The latter is the Hussman Strategic Growth Fund's strategy in perceived poor market conditions. I have been thinking for a while of shorting an ETF that attempts to replicate the Dow Jones REITs index - IYR. Many REITs have very high P/E ratios and high price to book ratios. Even if there were no decline in the property market it seems possible that their share prices should correct towards more historical price earnings and price book ratios. The rapid rise of IYR's share price is rather scary though for shorts.

On Friday I was reading about the upcoming IPO of hedge fund manager Fortress Investment Group. I noticed that they manage one NYSE listed REIT - Newcastle. This REIT invests in mortgages rather than actual property - largely commercial mortages. Its dividend yield is very high, its P/E is low and management is buying shares. What I don't understand is how it is managing to significantly increase earnings and dividends when it pays out 90% plus of earnings. Of course it seems strange to buy shares in a REIT when I expect a downturn in the property market.... I also have shares in my 403(b) in the TIAA Real Estate Fund. It invests directly in property and the value of the fund is based directly on the appraised value of the properties it owns. The share price cannot deviate from the fund's book value.

A solution to my reluctance to short IYR and concern about how NCT could increase earnings is to buy NCT and short IYR. It seems to me that IYR is overvalued relative to NCT. I am thinking to buy just 100 shares of NCT initially (less than 1% of net worth), but to short 100 shares of IYR (a little more than 2% of net worth). The additional short exposure to IYR will be partially hedging my TIAA Real Estate and Hudson City Bank Corp investments. For a complete hedge I'd need to short around 200 shares of IYR.

I am gradually moving short-term trading from my Ameritrade account to my Interactive Brokers account due to the tax advantages of futures trading and cheaper commissions at IB. So I am gradually turning my Ameritrade account into an investment account. I want to keep $25k of equity in the account in order to allow me to daytrade if I want to. So I want to have around $50k in investments in this account eventually (50% margin ratio). So far I have a little less than $8k (BRK/B and HCBK).

On Friday I was reading about the upcoming IPO of hedge fund manager Fortress Investment Group. I noticed that they manage one NYSE listed REIT - Newcastle. This REIT invests in mortgages rather than actual property - largely commercial mortages. Its dividend yield is very high, its P/E is low and management is buying shares. What I don't understand is how it is managing to significantly increase earnings and dividends when it pays out 90% plus of earnings. Of course it seems strange to buy shares in a REIT when I expect a downturn in the property market.... I also have shares in my 403(b) in the TIAA Real Estate Fund. It invests directly in property and the value of the fund is based directly on the appraised value of the properties it owns. The share price cannot deviate from the fund's book value.

A solution to my reluctance to short IYR and concern about how NCT could increase earnings is to buy NCT and short IYR. It seems to me that IYR is overvalued relative to NCT. I am thinking to buy just 100 shares of NCT initially (less than 1% of net worth), but to short 100 shares of IYR (a little more than 2% of net worth). The additional short exposure to IYR will be partially hedging my TIAA Real Estate and Hudson City Bank Corp investments. For a complete hedge I'd need to short around 200 shares of IYR.

I am gradually moving short-term trading from my Ameritrade account to my Interactive Brokers account due to the tax advantages of futures trading and cheaper commissions at IB. So I am gradually turning my Ameritrade account into an investment account. I want to keep $25k of equity in the account in order to allow me to daytrade if I want to. So I want to have around $50k in investments in this account eventually (50% margin ratio). So far I have a little less than $8k (BRK/B and HCBK).

Saturday, November 11, 2006

Currency Hedging and Exposure: Part III

Finally, I get to actual practical hedging strategies. But, first, I'll explain something about forex futures contracts. These are the contract sizes of the smallest futures contracts available in a few different currencies:

Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

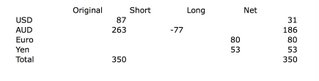

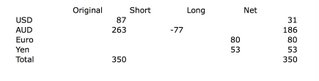

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.

Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.

Friday, November 10, 2006

Currency Exposure and Hedging: Part II

Diversifcation makes sense in currency trading in the same way it makes sense in stock trading and investing. For example, in the last couple of days I thought the US Dollar would fall. Turned out I was right but the Australian Dollar also turned out to be weak. So just buying Australian Dollars did not turn out to be the way to profit from the move in the USD. In retrospect the Euro would have been the best choice. One couldn't have known that upfront but being diversified away from the US Dollar - holding say AUD, Euro, and Yen would have been a better strategy than just buying the Aussie. Don't put all your eggs in one basket.

Currency Exposure and Hedging: Part I

Most investors don't think about currency exposure and leave their portfolio in the currency of their home country. When they invest in foreign assets they may consider their currency exposure and either try to take advantage of changes in the value of the foreign currency relative to their own currency or hedge it away. For small investors this usually means buying a fund that hedges the foreign currency exposure back into the domestic currency. But currency exposure is a choice even if it is a default choice. If you don't do anything about it you do not have a neutral exposure but probably a big exposure to your home currency. Now, if you are for example a US investor it may make sense to have a portfolio denominated in US Dollars as when you get to actually spend some of the money you will be spending in US Dollars if you are still living in the United States. Diversifying runs the risk that if the US Dollar gains value against foreign currencies over time your portfolio will lose value in US Dollar terms. But if the US Dollar loses relative value over time diversifying would result in gains.

For an international investor like myself with 75% of my net worth in Australian accounts and 25% in US accounts, who isn't sure what country he or she will be living in in the future, currency strategy becomes much more important. From a low in 2001 of less than 50 U.S. Cents the Aussie rose to around 80 cents in 2004-5 and is now trading around 77 U.S. Cents. As most of my assets were still in Australia when I moved to the US in 2002 I gained tremendously from the rise in the Australian currency. Since moving to the US I have sent considerable savings back to Australia when the AUD was at a level that I perceived as attractive.

I don't know if the Aussie Dollar will keep rising. It is no longer undervalued like it was at the beginning of the decade and 80 U.S. Cents has provided resistance during the last decade. On the other hand, I don't see any compelling reasons to cause it to fall. So now we are in more of a trading environment.

As my net worth has grown the absolute dollar value of changes in the exchange rate have of course increased. My Australian Dollar exposure is $A341k. Therefore, a 1 cent move up or down in the Aussie changes my net worth in USD terms by $US3410. That's very nice when the Aussie is rising but not good news when it is falling. The changes in my net worth measured in Australian Dollars are much less of course.

I'll discuss different hedging strategies in upcoming posts.

For an international investor like myself with 75% of my net worth in Australian accounts and 25% in US accounts, who isn't sure what country he or she will be living in in the future, currency strategy becomes much more important. From a low in 2001 of less than 50 U.S. Cents the Aussie rose to around 80 cents in 2004-5 and is now trading around 77 U.S. Cents. As most of my assets were still in Australia when I moved to the US in 2002 I gained tremendously from the rise in the Australian currency. Since moving to the US I have sent considerable savings back to Australia when the AUD was at a level that I perceived as attractive.

I don't know if the Aussie Dollar will keep rising. It is no longer undervalued like it was at the beginning of the decade and 80 U.S. Cents has provided resistance during the last decade. On the other hand, I don't see any compelling reasons to cause it to fall. So now we are in more of a trading environment.

As my net worth has grown the absolute dollar value of changes in the exchange rate have of course increased. My Australian Dollar exposure is $A341k. Therefore, a 1 cent move up or down in the Aussie changes my net worth in USD terms by $US3410. That's very nice when the Aussie is rising but not good news when it is falling. The changes in my net worth measured in Australian Dollars are much less of course.

I'll discuss different hedging strategies in upcoming posts.

Thursday, November 09, 2006

Hussman Strategic Growth Fund

I am considering investing in the Hussman Strategic Growth Fund. This is effectively a long-short equity hedge fund in mutual fund format and without the hedge fund fees. As the chart shows the fund performed excellently in the last bear market from 2000 to 2002. It hasn't performed so well recently due to using hedging due to the view that stocks are overvalued and the market shows little momentum. It's annual return since inception in 2000 is 12.71%. In the last 5 years my return has been 12.68% p.a. while the MSCI World Index has returned 10.30% and the S&P 500 5.71%. For the 5 years ending June 30 the HSGFX returned 11.55% vs. 2.49% for the S&P 500, while I returned 9.74% and the MSCI returned 6.92%.

The reason why I am now considering this fund, is that since opening a futures account I can separate the country I am investing in from the currency I am investing in. Up till now I have transferred most of my after tax savings to Australia, buying Australian Dollars in the process. Now I can in theory invest in the US and buy Australian Dollar futures if I want to be exposed to that currency.

Looks like the fund is available via Ameritrade though they don't list "Hussman" as a fund family. But they want a $49.99 fee to buy a mutual fund! This might just about make sense for my Roth IRA account if I am buying say a $7000 chunk, but otherwise it would make sense to apply to the fund directly and avoid the fee. Any thoughts?

Wednesday, November 08, 2006

Reinstating My Previous Goal for the Year

Seems I was too hasty in lowering my goal for the year to $350,000 from $370,000. I have passed a net worth of $US350k and $A450k. So I am reinstating the old goal and seeing how close I can get. Finally I am on the right side of the stock market and the Aussie Dollar has been performing very nicely too. If I was more confident I would have benefited even more from the latter. Made three quick trades so far on the Aussie, all profitable.

Tuesday, November 07, 2006

The 24 Hour Forex Market

The chart shows the last day's trading in Globex Australian Dollar Futures. I sold my position on Sunday evening when the market seemed like it might be beginning to trade down. It's good that I did because around 2am EST the price collapsed and my stop would have been hit. Just before 5am though the market began to rally. Note that these times are 7am and 10am in London, the world's biggest foreign exchange market. Currently the price is above my sale price...

This shows why this market is best for either hedging or a very small level of speculation for overnight trades, or for daytrading, though often the big moves are happening in the middle of the night for US traders. Globex futures allow 80:1 leverage in Australian Dollars and some spot currency brokers allow larger levels still. This is where naive traders can quickly lose large amounts of money by being tempted to leverage too large positions on a seemingly small margin deposit. I'm definitely going to continue to step very gingerly in this market.

Monday, November 06, 2006

Powertel

I bought into this Aussie telecom firm where the green arrow is on the chart. This was based on a tip from a Hong Kong based investor I know online and the research from investment banks he sent to me. My purchase price was $A1.20. It's been pretty volatile since I bought, but as I write it is now at $A1.35. Is it finally breaking out of the multiyear triangle I outlined on the chart? It recently declared its first ever profit (as predicted in the research) and then signed a wholesale access agreement on Friday with Telecom NZ's AAPT subsidiary. AAPT was my second individual shareholding, which I bought at the IPO in November 1997 (the first was Colonial - also an IPO buy). AAPT was acquired by Telecom NZ yielding me an eventual $A8600 in profit. I still hold Telecom NZ and it has yielded me an additional net $A100 in profit in the last six years! Sounds terrible, but on second thoughts that's about what the S&P 500 has made including dividends in the same time frame.

Closed My First Australian Dollar Futures Trade

Made $US64.30. Got in @ 0.7683 and out @ 0.7690. Each 0.0001 is worth $US10 on a single contract trade. Hopefully this won't follow the pattern of the NASDAQ 100 futures (NQ) where my first trade made money and the second trade was a losing trade. I entered this trade Friday after the steep rise in the US Dollar and fall in the Australian Dollar after the unemployment report came out on Friday morning. I did some technical analysis over the weekend, which showed that there was a significant chance that we were now in at least a short term downtrend. So I got out this evening with a small profit. I had a stop in anyway but if the chances seem stronger that the pullback will continue why take the risk of ending up losing money? But I don't feel certain enough about that to short the Aussie and right now have too little equity in my account to do both that and buy an NQ contract. I put some more money in my account but it is on hold till Wednesday :( I bought one NQ contract @ 1714 as the model is long. The model is predicting the Republicans will retain control of congress or if the Democrats gain control Bush will veto any moves they make to raise taxes on stocks. That has to be the implication of expecting the market to rise through the end of the coming week?

Friday, November 03, 2006

Want to Be a Millionaire? Pick Your Currency :)

I forgot to mention this, but October saw me exceed 1/3 million Dollars for the first time. US Dollars that is. I reached 1/3 million Australian Dollars in July 2005. In many currencies I am already a millionaire. All you need to do is pick your currency and you too can be a millionaire. The Pacific Exchange Rate Service Website has lots of nice resources about exchange rates that I often refer to. Most recently I became a Zloty (Polish) millionaire :) Everyone with positive net worth can be an Indonesian or Vietnamese millionaire...

Thursday, November 02, 2006

Closed my First Futures Trade and Opened Another

I closed my first futures trade (short NQ (NASDAQ 100 E-Mini)) and went long (and long QQQQ and QQQQ calls too). Made 10 points on that first trade ($200 - $4.80 in commissions) which is nice. Yes the model is forecasting tomorrow as an upday...

October Report

Investment Performance

Investment return in US Dollars was 2.70% vs. a 3.27% gain in the MSCI World Index, which I use as my overall benchmark and a 4.74% gain in the NDX which I use as a trading benchmark. The trading accounts lost 14.3% - a disastrous performance. Total returns in terms of Australian Dollars was a loss of 0.31%. The best performer of the month was the CFS Conservative Fund, my biggest single investment and the worst performer was QQQQ trading.

Asset Allocation

At the end of the month the portfolio had a beta of -0.14 (a 1% rise in the market would result in a 0.14% decline in the portfolio). Assets were allocated as follows:

Asset Class:

Stocks Long 41.58%

Stocks Short -18.67% (QQQQ)

Futures 0.00% (NQ)

Put Options 0.29% (QQQQ)

Bonds 46.02%

Real Estate 4.92%

Hedge Funds 2.62%

Cash 31.49%

Loans -8.44%

Asset Loans 0.18%

Much of the cash is used as margin for the short position. Bonds are held via the CREF Bond Market Fund and the CFS Conservative Fund. 65% of net assets are deemed to be AUD related and 24% USD related with the remainder in global funds.

Net Worth Performance

Net worth rose by $US12,003 to $US342,135 but in Australian Dollars lost $A614 to $A441920. This is the reverse of last month's pattern as the Australian Dollar rose strongly this month.

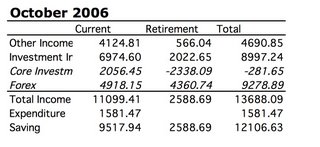

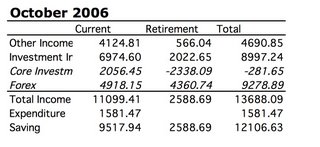

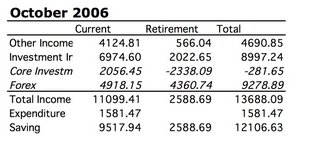

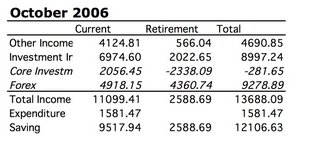

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions.

As you can see total investment income was -$US282 before taking into account foreign currency fluctuations which resulted in a net investment gain of $US8997. But retirement accounts suffered a loss of $US2338 before taking into account the change in the exchange rate. This is due to the disastrous loss I suffered in QQQQ trading in my Roth IRA. Expenditure was $US1581 - this is about my base level of spending if I don't travel anywhere or make large purchases.

Investment return in US Dollars was 2.70% vs. a 3.27% gain in the MSCI World Index, which I use as my overall benchmark and a 4.74% gain in the NDX which I use as a trading benchmark. The trading accounts lost 14.3% - a disastrous performance. Total returns in terms of Australian Dollars was a loss of 0.31%. The best performer of the month was the CFS Conservative Fund, my biggest single investment and the worst performer was QQQQ trading.

Asset Allocation

At the end of the month the portfolio had a beta of -0.14 (a 1% rise in the market would result in a 0.14% decline in the portfolio). Assets were allocated as follows:

Asset Class:

Stocks Long 41.58%

Stocks Short -18.67% (QQQQ)

Futures 0.00% (NQ)

Put Options 0.29% (QQQQ)

Bonds 46.02%

Real Estate 4.92%

Hedge Funds 2.62%

Cash 31.49%

Loans -8.44%

Asset Loans 0.18%

Much of the cash is used as margin for the short position. Bonds are held via the CREF Bond Market Fund and the CFS Conservative Fund. 65% of net assets are deemed to be AUD related and 24% USD related with the remainder in global funds.

Net Worth Performance

Net worth rose by $US12,003 to $US342,135 but in Australian Dollars lost $A614 to $A441920. This is the reverse of last month's pattern as the Australian Dollar rose strongly this month.

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions.

As you can see total investment income was -$US282 before taking into account foreign currency fluctuations which resulted in a net investment gain of $US8997. But retirement accounts suffered a loss of $US2338 before taking into account the change in the exchange rate. This is due to the disastrous loss I suffered in QQQQ trading in my Roth IRA. Expenditure was $US1581 - this is about my base level of spending if I don't travel anywhere or make large purchases.

Tuesday, October 31, 2006

First Futures Trade

By this afternoon I felt comfortable enough with the IB software and with the market to do my first real futures trade - selling a NASDAQ 100 E-Mini contract (@1743). This is equivalent to shorting 800 QQQQ shares. At the market close (NYSE - the Globex futures market trades almost 24 hours a day) I was up $112 on the trade. So that is nice that my first futures trade at least starts off profitably. Commission is just $2.40. Still puzzled by some quirks of the IB interface - like why I am not seeing the current profit and loss on my account window. I am also short 1500 QQQQ in my Ameritrade trading account and have 3 QQQQ puts in my Roth IRA account.

First Impressions of IB and Futures Trading

I spent some time last night getting used to the IB system and making paper trades in NASDAQ 100, 10 year bond, and Australian Dollar futures. Someone posted recently in response to one of my blogposts that trading all three would be like having three full time jobs, if trading QQQQ was like a full time job. I don't think so but it is hard to execute a paper trading strategy and a real trading strategy at the same time if they are not identical and you also have another real full time job... This morning I was feeling rather nervous, not because I would lose "money" on the paper trading but that it was taking my attention away from the real trading and some time today I need to get a lot of other work done. Being a professor gives me a lot of flexibility about when I do a large portion of my work, but it still has to get done... So I closed out the paper trades and either later today or tomorrow I will take a look at the daily statement generated to get familiar with that. IB also update your account value on the fly and I found some quirks in that, some of which may just be bugs in the paper trading simulation. One is that the standalone Trader Workstation (TWS) gives you the current profit and loss and realized and unrealized portions on each position. But when I opened a chart (which is initially disabled on new accounts) all that disappeared! The browser based version of TWS didn't seem to give me that at all. I will have to check my real account. Also I didn't really understand how they compute various of the figures regarding margin - there doesn't seem to be much rationale. I asked an experienced futures trader and he said he didn't understand it either. I would have expected that the initial required margin would be moved into my "commodities account" and then that value would fluctuate with the profit and loss. But the amount is somewhere between the initial and maintenance margin. I should probably do some deliberately "money" losing trades and see what happens when the maintenance margin is hit. The charts are pretty flexible though as slightly less user friendly (not surprising) than those in Ameritrade. They don't look as dynamic as Ameritrade's charts - but if you look closely they show exactly the same information.

Monday, October 30, 2006

My First Paper Trade

Bought 13 Australian Dollar contracts @ 0.7675. IB gives you $1M in imaginary play money and the underlying value of an Australian Dollar futures contract is $A100,000. So hedging $US1M into AUD requires 13 contracts. Now I am looking through all the reports generated to try to understand what happened. A bonus of IB is all the contextual help menus are very useful.

Paying Money Overseas

Paying money overseas gets easier and easier as credit card payments get more widespread internationally. But sometimes you need to pay in foreign currency. It isn't hard to do this if you know how. You go to your bank and either buy an international money order and mail it or wire the money to an account directly. But you need to know. I was just talking to my mother today. We are still trying to get money from the German government in compensation for property that was seized by the Nazi regime. As an aside, this is one reason I'm not a big fan of real estate as an investment. It is a long story - the property is in Eastern Germany and until 1989 there was no way to get anything from the Communist government of the Deutsche Demokratische Republik. Some time after 1989 (1995) we were contacted by a lawyer that we could make a claim and since then we have been in process. We have received some money. My mother decided to split our share of the value between my brother and I. So far I've received about $7000. This was my share of one of our properties. Now we are trying to get the money for the second property and several months ago the German government required us to pay a small number of Euros as a fee to get to the next stage. Finally, today I understood that the reason this is still held up is instead of paying in Euros my mother sent a personal check in Sterling drawn on her bank in London. Obviously the check hasn't been cashed. It would probably cost the government agency there about as much to cash a personal check in foreign currency as the fee is worth... Her reason why she didn't send payment in Euros is that the bank where she lives gave her a hard time about paying in Euro. I can't really get a straight answer why. I think they just told her it would cost a lot and discouraged her so she took the "easy" way out and sent a personal check in the wrong currency. I told her to phone the lawyer and tell him what she did and what can she or he do next.... Hopefully soon this story will finally be over

Saturday, October 28, 2006

And Today Wasn't

a good trading day. I closed out the MSFT trade for a profit which was the only good thing that happened. HCBK was downgraded by Merrill Lynch. The model predicted a turning point at last night's close, but if the stochastic rose above 80 that turning point would be negated. So the stochastic was above 80 until around midday when the market suddenly fell. I was still convinced the uptrend was continuing though so I tried to go long part way into the fall after getting stopped out. Bad move.... Oh well, I didn't lose as much as I made yesterday. It now does seem that we are back in a downtrend.

Friday, October 27, 2006

Market Update

In my existing accounts I bought some Microsoft shares this morning in anticipation of this evening's earnings release. I remain long QQQQ. The model is long but tomorrow could be a turning point unless the stochastic rises above 80. If today's close is strong that is possible. At the moment the market is down a bit due to the fall in new home prices announced at 10am of 9.7% since September 2005. This was the biggest fall year on year since that index started keeping records. Sales of new homes though increased and the housing sector ETF, XHB is up.

4:49pm Update

Turned out to be a very good trading day. Berkshire Hathaway B (BRK/B) shares rose $98! Unfortunately I only own one share :( I did some day-trading of Redhat (RHAT) which fell more than 25% and then rebounded a little. I also bought Microsoft (MSFT) shares in anticipation of this evening's earnings. Though Microsoft beat analysts' expectations by more than 10%, some traders initially thought they were guiding to a much lower earnings number for next quarter. Turns out they expect to earn roughly in line with analysts' estimates but are deferring a third of the income to the following quarter due to Vista related issues. Also bought shares in Hudson City Bank Corp (HCBK) - a New Jersey based thrift. Not sure if this is a position trade or an investment. Will have to see what happens. There is a chance that it will be added to the S&P 500 soon. Also it has a large amount of excess cash for a bank and is buying back shares. However, the P/E is very high for a bank and so these expectations may already be built into the price. On the other hand with all that cash it should do fine if the housing market really implodes and maybe be in a position to acquire other banks down the road?

4:49pm Update

Turned out to be a very good trading day. Berkshire Hathaway B (BRK/B) shares rose $98! Unfortunately I only own one share :( I did some day-trading of Redhat (RHAT) which fell more than 25% and then rebounded a little. I also bought Microsoft (MSFT) shares in anticipation of this evening's earnings. Though Microsoft beat analysts' expectations by more than 10%, some traders initially thought they were guiding to a much lower earnings number for next quarter. Turns out they expect to earn roughly in line with analysts' estimates but are deferring a third of the income to the following quarter due to Vista related issues. Also bought shares in Hudson City Bank Corp (HCBK) - a New Jersey based thrift. Not sure if this is a position trade or an investment. Will have to see what happens. There is a chance that it will be added to the S&P 500 soon. Also it has a large amount of excess cash for a bank and is buying back shares. However, the P/E is very high for a bank and so these expectations may already be built into the price. On the other hand with all that cash it should do fine if the housing market really implodes and maybe be in a position to acquire other banks down the road?

Thursday, October 26, 2006

Interactive Brokers Account Operational

After faxing a copy of my driver's license to IB yesterday my IB account is finally operational. All I've done so far is log in, look at some quotes, and put in a request for a paper trading account. Expect more reports as I figure out how to use the different tools and make some paper trades.

Nationwide Retirement Score

I just did the online retirement preparedness quiz. Like most such questionaires it didn't ask the big question about inheritance. Do people think that that is inappropriate, or too uncertain, or make people feel put off by feelings of envy for those with large inheritances, or the providers just want to minimize people's assets so that they save more with the provider in question?

I don't think it asked about assets such as businesses either. Very much designed for the middle-class employee...

I scored 125. What is your score?

I don't think it asked about assets such as businesses either. Very much designed for the middle-class employee...

I scored 125. What is your score?

Wednesday, October 25, 2006

New NetWorthIQ Release

NetWorthIQ have a new release. The new version splits out non-owner occupied real estate. I think that is a great improvement. They also have some notes attached to each net worth category on the net worth updating page explaining what should go in each entry. Good start on both. Splitting out the value of businesses is another thing I would like to see. Mentioning where more exotic investments and loans like margin loans and short positions should go would also be useful. I lump the latter into "other debt". I could just put the net worth of my brokerage account under "stocks" but that would be a bit misleading. Once I break out the cash and include that in cash the short positions would result in a negative stock value. At the moment I include options under "other assets". Therefore those have to go in other debt. Don't know yet how I will treat futures positions. Actually, as they now list REITs and other real estate funds under "other real estate" I am going to have to go back and recompute all my entries!

Reality Check

At this point there doesn't look like any way I am going to meet my original goal of getting to $370,000 by the end of this year. So I am lowering the goal to $350,000. That would still be a 30% gain in net worth and more than my minimal goal of a $50,000 gain. The same growth rate implies goals of $450k for 2007, $575k for 2008, $775k for 2009, and $1M for the end of 2010. These are still very steep goals. But they are something to aim for that is not totally unrealistic.

Monday, October 23, 2006

Risk and Return in a World Where Only Relative Wealth Matters

Eric Falkenstein, a hedge fund manager in Minneapolis with a PhD in economics, has written a fascinating paper (warning: grad-level economics stuff :)) about risk and return on investments in a world where investors only care about their wealth relative to others and their returns on investment relative to others returns on investment. The rationale for investigating this idea is that:

1. The traditional CAPM (Capital Asset Pricing Model) doesn't have much empirical support - the average rate of return on high beta stocks isn't higher than on low beta stocks.

2. Much research on happiness in economics has shown that beyond a basic subsistence level relative wealth matters more than absolute levels of wealth.

3. The prevalence of index investing and relative return investing. This may have been accompanied by a trend to lower risk premia for stocks, corporate bonds, and other traditionally risky assets over time.

He argues that if all you care about is relative wealth then holding the average market portfolio has zero risk. Deviating from the market portfolio is risky. If this is true then the rate of return on all assets in the market portfolio is equal. There is no extra reward for investing in assets with higher variances of returns compared to the market portfolio whether those risks are correlated with the market portfolio (high beta) or not (idiosyncratic risk). I have yet to work through the implications (except that there is no extra reward for buying and holding stocks in such a world over buying 90 day T-Bills) but if the guy is right he could be on the path to a Nobel Prize in Economics... I understand the paper, but I as I am not a specialist in financial economics I don't know if there are any flaws in his argument which aren't immediately obvious.

1. The traditional CAPM (Capital Asset Pricing Model) doesn't have much empirical support - the average rate of return on high beta stocks isn't higher than on low beta stocks.

2. Much research on happiness in economics has shown that beyond a basic subsistence level relative wealth matters more than absolute levels of wealth.

3. The prevalence of index investing and relative return investing. This may have been accompanied by a trend to lower risk premia for stocks, corporate bonds, and other traditionally risky assets over time.

He argues that if all you care about is relative wealth then holding the average market portfolio has zero risk. Deviating from the market portfolio is risky. If this is true then the rate of return on all assets in the market portfolio is equal. There is no extra reward for investing in assets with higher variances of returns compared to the market portfolio whether those risks are correlated with the market portfolio (high beta) or not (idiosyncratic risk). I have yet to work through the implications (except that there is no extra reward for buying and holding stocks in such a world over buying 90 day T-Bills) but if the guy is right he could be on the path to a Nobel Prize in Economics... I understand the paper, but I as I am not a specialist in financial economics I don't know if there are any flaws in his argument which aren't immediately obvious.

Friday, October 20, 2006

Rentometer

A Zillow for renters: Rentometer. Very cool. Oh and both my apartment and my girlfriend's are very good deals, not surprisingly :)

Sunday, October 15, 2006

Marriage, non-Marriage, and Economics

An interesting article in the NY Times today discusses the implications that now a minority of US households consist of married couples with or without children. A quote: “we have an anachronistic view as to what extent you can use marriage to organize the distribution and redistribution of benefits” expresses how I feel about the way taxation, benefit, and other systems are set up in the US. In my opinion the state should only play a role in helping (or not) raising children who are not able to fend for themselves and are society's future members. I don't see why the state should be at all involved per se in partnerships with or without children involved. The reason they are involved is because historically women had very limited economic opportunities so it was natural to provide benefits to women who were married and not working through their husbands (for example by inheriting social security payments). Rather than extend such an anachronistic system to further people through gay marriage (though the numbers are small as this article points out and so practically don't make a big difference) I would favor making the system more gender neutral and individual based and allow people to develop partnerships as they see fit without worrying about the financial implications. Many countries have systems that are much closer to my ideal. Australia, one of the two countries I am a citizen of (and the other one is not the United States) is closer to this ideal in many ways. Changing a small country, populationwise, is probably easier than changing institutions in a country as large as the US.

Friday, October 13, 2006

Stopped Out Again

Again the model was stopped out today. I lost a lot of money. The majority of my profits from this experimental trading period have been lost. In fact I am back to the return the market has given over this period. From that perspective I guess it hasn't been too much of a disaster? :) If one stuck exactly to the model a day like today wouldn't be disastrous. But if you don't trade the system properly days like today are very bad news. Over this period I have improved the model and decision rules a lot. It is a much better system than at the beginning of the period. So it hasn't been a waste. I am not giving up. I still have some profits left and a tool that in theory can produce tremendous profits. I'm not sure what the problem has been. Too much leverage does make me nervous and do dumb things. I plan to use less leverage going forward and try to stick more closely to the model signals. Doing what are really two full time jobs at the same time is hard. I end up doing neither very well. On the other hand trading more than one thing simultaneously in smaller amounts in each instrument would be psychologically easier. Soon I will be able to start paper trading at IB (I initiated the transfer of $5000 today). I am thinking to experiment with trading two or three instruments simultaneously. As it won't be real money I won't be worried about losing money. Probably trading NDX, bonds, and Australian Dollars would be a good combination as the three assets have little correlation with each other. I won't have time to model bonds and dollars so I will trade these purely on the basis of charts. Right now I'd be long the AUD and short bonds probably.

Wednesday, October 11, 2006

The Old Model Won

The old model won today as NDX ended up a couple of points and even the new "averaged stochastic" rose. But really the market didn't go anywhere much. Tomorrow these various stochastics almost absolutely have to fall due to the way they are computed. Will it be a down day finally? One potential trigger is the beginning of earnings season. Alcoa reported after the close and did not meet expectations.

I won't be updating the old model unless the new doesn't prove to be better in actual trading. In simulated trading since January 1st and June 30th this year it strongly outperforms the old model, even if today, the first day of using it was not one of those outperforming days.

I remember Teresa Lo from years back when she posted on Silicon Investor. Now she also has a blog and my impression is she has a similar attitude to me somewhere between academic finance and technical analysis and trying to work out objectively what works and what doesn't. She also emphasizes the very important role of psychology in trading success.

I won't be updating the old model unless the new doesn't prove to be better in actual trading. In simulated trading since January 1st and June 30th this year it strongly outperforms the old model, even if today, the first day of using it was not one of those outperforming days.

I remember Teresa Lo from years back when she posted on Silicon Investor. Now she also has a blog and my impression is she has a similar attitude to me somewhere between academic finance and technical analysis and trying to work out objectively what works and what doesn't. She also emphasizes the very important role of psychology in trading success.

Tuesday, October 10, 2006

Major Model Improvement?

I noticed today that the standard slow(5,3) stochastic began to decline today while my preferred full(5,5,3) stochastic increased steeply. The existing model forecast predicts a decline in the market starting on Wednesday. But with the slow stoch already declining I would feel uncomfortable about being long. I did some trading simulations on a spreadsheet and found that the slow(5,3) stoch is often too early in determining changes in trend while the full(5,5,3) stoch is too late. Is this why I find it hard to stick to trading the model? Averaging the two stochastics outperforms either of the two stochastics. So now I have applied the forecasting models to this averaged stochastic. All three indicators estimated using the new model say the averaged stoch will fall on Tuesday. To do that the NDX must fall at least 10 points. Therefore, the model's decision is to get short at today's close.

Monday, October 09, 2006

Getting Started with Technical Analysis

Million Dollar Countdown asked for some advice on introductory books on technical analysis. There are only two technical analysis books I have ever read. One is the classic guide to interpreting charts by Edwards and Magee. This book provides the fundamental rationale for technical analysis. Once you read this, hopefully, you will be convinced that movement in the financial markets is not totally random. They explain the basics of price and volume action in the markets. This kind of understanding is even more important in intraday trading than in interpreting large scale chart patterns. This edition has been much updated from the 1960s edition I borrowed from our university library in Australia. The other book is Frost and Prechter's "The Elliott Wave Principle". Elliott wave theory systematizes a lot of the formations and ideas found in traditional technical analysis as presented by Edward and Magee. Everything else I know I picked up on the web or developed myself. Stockcharts.com has an excellent "chart school" for example.

I am very skeptical about a lot of the other technical analysis out there. Some of it makes no sense to me coming from a background in time series analysis and much of the rest is not very predictive. Those latter methods may be good for working out which waves the market has gone through and maybe E-Wave could then help in predicting what might come next but the indicator itself doesn't predict anything. One such indicator IMO is the much used MACD. However, I have found that stochastic oscillators are much more useful and can be used to predict the market to some degree. Then there are methods, which are hard to comprehend but seem to produce excellent results.

As a beginner a reasonable goal is to understand technical analysis well enough to avoid making stupid and expensive mistakes.

I am very skeptical about a lot of the other technical analysis out there. Some of it makes no sense to me coming from a background in time series analysis and much of the rest is not very predictive. Those latter methods may be good for working out which waves the market has gone through and maybe E-Wave could then help in predicting what might come next but the indicator itself doesn't predict anything. One such indicator IMO is the much used MACD. However, I have found that stochastic oscillators are much more useful and can be used to predict the market to some degree. Then there are methods, which are hard to comprehend but seem to produce excellent results.

As a beginner a reasonable goal is to understand technical analysis well enough to avoid making stupid and expensive mistakes.

Interactive Brokers Application

I finally got around to submitting an application for an account with Interactive Brokers. Security checks are now running before I can actually fund the account. My plan is to initially deposit $5000 from my HSBC Online Savings account which I have been saving up. That's the minimum amount required to open an account. At this stage I signed up for all US stock, options, and futures markets. You can also trade a number of foreign markets, but I don't have any need for that at the moment and one can always add additional permissions as required. IB has a paper trading facility and I plan to use it initially to get used to futures trades which is what I plan to use the account for initially. Once I get used to trading I will initially trade one E-Mini NASDAQ contract which is equivalent to 800 QQQQ shares. I also will look at trading Australian Dollar contracts to hedge my Australian Dollar and US Dollar exposures. The reason I want to trade stock futures is because under the 60/40 rule they are taxed at lower rates than short-term stock trades. Being able to modify my currency exposure without wiring money between the US and Australia is also attractive. The Australian Dollar ETF (FXA) is not a viable alternative. To sell short $A100,000 requires margin of about $US37,500. Using futures the required margin is only about $US1,500 for the same transaction (and the taxes on gains are lower). My new short-term goal is to reach a total of $65,000 in my three U.S. trading accounts.

Sunday, October 08, 2006

Zillow?

Has anyone else noticed that Zillow hasn't updated any house prices for the last three weeks (since 9/15/06)? What's up over there? Frustrating for financial markets junkies like me! Zillow is a great easy to use service though it has its quirks like not updating past estimates when new information becomes available which can lead the trends in prices to be very unreliable. Hope this lack of updating doesn't signal some trouble with this enterprise.

Thursday, October 05, 2006

Labels!