Regal Investment Fund (RF1.AX) is doing a share placement and a share purchase plan (SPP). Under the SPP you can buy up to AUD 30k of shares at the recent NAV of AUD 3.41. They have made an official 20% average rate of return since inception. My internal rate of return is higher than this. So, I think I should take up all of this, but don't have anything I want to sell in the SMSF's brokerage accounts. I could either make an additional AUD 30k non-concessional superannuation contribution to my account or withdraw something from one of the SMSF futures investments. It's probably the last chance to make non-concessional contributions to my account, as I could hit the balance transfer cap of AUD 1.9 million by 30 June 2025. Also, the futures investments have been weak recently, so I think they might see a return to the mean in terms of performance and selling now might not be a good move.

Wednesday, November 20, 2024

Regal Funds Share Purchase Plan

Tuesday, November 19, 2024

Australian Government Spending

When you get your notice of assessment from the Australian Taxation Office when they have processed your tax return, they send you statement of how the government spends your taxes, which they quaintly call a receipt:

I was a bit surprised by how little interest they are paying. Only a 2.3% average rate of interest and 3.8% of the budget.

Note that this tax total doesn't include the Medicare Levy, which was another $4,411 tax that I paid.

Saturday, November 16, 2024

Gold vs. Bitcoin

Our bitcoin position is now more valuable than our gold position. 11.5% of net worth is in bitcoin and 10.2% in gold both via ETFs. We also have 4.5% of net worth in crypto company Defi Technologies. Defi is up 215% since we first invested, bitcoin 78%, and gold 94% (since January 2019). I bought shares in gold ETFs earlier but this was when our current series of investments started. Our return should be lower in all of these as we added to the investments gradually.

Tuesday, November 12, 2024

It's Feeling Crazy Again

Things are starting to feel a bit crazy again. Yesterday, I was thinking: "Maybe this account could reach AUD 500k today!" It has a 69% return in the last year. All the P&L and changes numbers are for one day.

Sunday, November 03, 2024

October 2024 Report

In October, the Australian Dollar fell from USD 0.6913 to USD 0.6564, so US Dollar returns are lower than Australian Dollar returns this month. This was an average month in terms of investing activity. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): -2.21%

S&P 500: -0.91%

HFRI Hedge Fund Index: -0.15% (forecast)

Australian Dollar Indices

ASX 200: -1.29%

Target Portfolio: 2.71% (forecast)

Australian 60/40 benchmark: -0.27%

We gained 2.09% in Australian Dollar terms or lost 3.10% in US Dollar terms. So we underperformed US Dollar indices and the target portfolio but outperformed ASX and Vanguard benchmarks.

The SMSF returned -0.75% compared to Unisuper at 1.47% and PSS(AP) at 0.79%.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and so the total differs from the Australian Dollar returns on net assets mentioned above. RoW stocks (mostly Defi Technologies) lost a lot of money and private equity a little. Gold had the highest rate of return and made the greatest contribution to overall return.

Things that worked well this month:

- Gold and bitcoin gained AUD 62k and 41k respectively. The gain in gold is a new record amount for a gain in a single investment in one month. Regal Investment Fund (RF1.AX) gained 12k.

What really didn't work:

- Defi Technologies lost AUD 44k more than offsetting the gain in bitcoin. Australian Dollar futures lost AUD 21k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Our performance fell back this month compared to the ASX200 but, as we have much lower volatility, we have a higher Sharpe ratio of 0.88 vs. 0.55. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 3.33% with a beta of only 0.46.

We moved towards our target allocation this month. We are most underweight cash and most overweight rest of the world stocks. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. This month we had returns of capital from my investment in Integrated Portfolio Solutions (AUD 41k) and Aura VF1 (6k) and lots of dividends. We were also issued shares in Dash - the company acquiring IPS. I made the following additional moves this month:

- I sold 50k shares of Cadence Capital (CDM.AX) and bought 25k shares of Cadence Opportunities (CDO.AX). These were in different accounts. Until last month these two funds returns became more and more correlated until suddenly there has been a change in behaviour and an outsize gain in Cadence Opportunities. CDO is supposed to have a shorter term horizon and be more opportunistic.

- I bought 500 shares of the Fidelity bitcoin ETF (FBTC).

- I sold 1000 shares of the Perth Mint gold ETF (PMGOLD.AX). So I swapped this amount of gold for bitcoin.

Wednesday, October 23, 2024

Transition to Retirement

I am thinking of setting up a transition to retirement pension (TTR pension). This allows you to receive regular payouts from your superannuation once you reach the age of 60 even though you are still working. I will be 60 years old in about 6 weeks time! There are lots of strategies this can be used. In my case, I am thinking to continue working full time at least for the next year and to recontribute all the payout to superannuation as non-concessional contributions (post-tax contributions). This has two advantages:

- It will convert money that was contributed as concessional contributions (at the 15% or 30% contributions tax rate) and earned as investment returns into non-concessional contributions. If my children inherit some of my superannuation when they are past the age of 18 they then won't need to pay tax on this part of the payout. The "death tax" is only on concessional contributions and fund earnings.

- Once I hit the transfer balance cap, of currently $1.9 million, I can contribute the money to my wife's superannuation instead. I am currently at $1.7 million and she is at $800k. So, there is still a lot of unused capacity there.

When you retire or reach age 65 you can transfer money up to the transfer balance cap into a zero taxed pension account. Money over the limit stays in an accumulation account where earnings are taxed at 15% (10% for long term CGT). The TTR pension does not affect the calculation of the transfer balance cap unless you are still holding it at age 65 when it becomes a regular tax free pension account.

My Unisuper account is close to 100% concessional contributions and earnings. So, I would start with that and transfer $600k to a pension account and pay out 10% of it each year, which is the maximum withdrawal rate. You have to leave some money in the accumulation account to receive new contributions... But actually 60% of my SuperGuardian account is also concessional contributions and earnings, and so it would make sense to transfer $400k from that into a TTR pension account too. So I would be withdrawing $100k per year and recontributing. The reason I wouldn't withdraw the maximum annual non-concessional contribution level of $110k is because my employer contributes more than the allowed cap on concessional contributions each year and the excess becomes non-concessional contributions.*

The downside to recontributing to my wife's superannuation is that I could make those contributions from non-superannuation money resulting in getting even more money into super. After all, even if you have more than $1.9 million in super, the amount above the limit is concessionally taxed compared to non-super investments.** But right now I am not making those contributions. Instead, I have been building up a pile of cash offsetting our mortgage. This is partly to reduce our interest bill but also part of a plan to buy a more expensive house in the future. So, as long as I was planning on saving to buy a house, I wouldn't make non-concessional contributions to her account.

Anyway, I sent an email to Unisuper yesterday expressing my interest in TTR pensions and asking what the next step is.

Originally, I planned on switching to half time work when I reached 60 years old, but I seem to have fallen victim to the one more year syndrome. Seems silly to sacrifice $120k in pre-tax salary and superannuation just to have a bit easier time in the teaching half of my year. Also, my university is enacting a major cost-cutting exercise that likely will see more than 500 jobs cut in total. Academic jobs will not be cut till next year. They are not putting in a voluntary redundancy scheme. But I figure that if I am made redundant then I will get a bigger payout if I am still working full time. I could be wrong about that.

* That's why my Unisuper account isn't 100% concessional contributions and earnings.

** The government plans to tax superannuation in excess of a $3 million threshold at higher rates that include unrealised capital gains. But I think the senate will not pass that legislation and we are still a long way from the $3 million level.

Saturday, October 05, 2024

Scammed Again?

About a year ago, I got scammed for more than $2,000. I managed to get the money back from the merchant and only had foreign exchange conversion losses. At the time, Commonwealth Bank said they couldn't do anything because I had approved the transaction. This month, I found a round $50 transaction on our credit card from Seenenergy/Post Melbourne Australia. Neither I nor Moominmama recognized this transaction so I raised a dispute online. Almost instantly Commonwealth Bank refunded the $50! I wonder what is the difference between these two cases. I suppose that I did not actually click anything to authorize this transaction? Maybe it is because this is a credit card rather than debit? Or both? Our credit cards have been cancelled and we need to wait for new cards.

Friday, October 04, 2024

September 2024 Report

This was an average month in terms of investing activity. Spending fell steeply again to AUD 7.4k but it is going to be up strongly in October.

In September, the Australian Dollar rose from USD 0.6772 to USD 0.6913, so US Dollar returns are higher than Australian Dollar returns this month. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 2.36%

S&P 500: 2.14%

HFRI Hedge Fund Index: 1.19% (forecast)

Australian Dollar Indices

ASX 200: 3.30%

Target Portfolio: 1.07% (forecast)

Australian 60/40 benchmark: 1.28%

We gained 1.65% in Australian Dollar terms or 3.76% in US Dollar terms. So we only underperformed the ASX200.

The SMSF returned 1.11% compared to Unisuper at 1.12% and also PSS(AP) at 1.12%. The fund went over AUD 1.4 million for the first time.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and so the total differs from the Australian Dollar returns on net assets mentioned above. RoW stocks (mostly Defi Technologies) lost money, why all other asset classes gained. Australian small cap had the highest rate of return, while futures including bitcoin made the greatest contribution to overall return.

Things that worked well this month:

- Bitcoin gained AUD 28k and was followed by gold (24k), Tribeca Global Resources (TGF.AX, 17k), WAM Alternatives (WMA.AX, 15k), and Regal Investments (RF1.AX, 12k).

What really didn't work:

- Pershing Square Holdings (PSH.L) lost AUD 16k and Defi Technologies (DEFTF) lost AUD 14k.

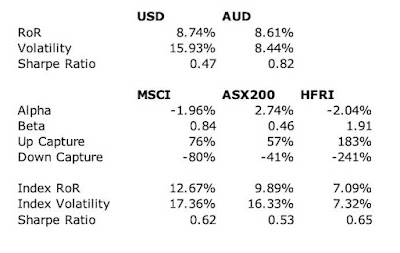

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Our performance fell back this month compared to the ASX200 but, as we have much lower volatility, we have a higher Sharpe ratio of 0.83 vs. 0.57. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 2.74% with a beta of only 0.46.

We moved towards our target allocation this month. We are most underweight cash and most overweight rest of the world stocks. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I made the following additional moves this month:

- In addition to the quarterly contribution to the Unpopular Ventures Rolling Fund, I made an additional investment of USD 5k in Kyte and a new investment of USD 3.75k in another start-up.

- I sold 2,000 shares of PMGOLD, the Perth Mint gold ETF, and added to the cash pile in our offset account.

- I sold our remaining holding in the Longwave Small Australian Companies Fund.

- I did a trade in Clime Investment Management (CIW.AX) after Geoffrey Wilson recommended it.

Saturday, September 14, 2024

Moominmama's Taxes 2023-24

I also did Moominmama's taxes for this financial year. It only took me about 2 hours to do both as I am very organized :) You can find previous years' reports here. Here is a summary of her tax return for this year:

Her salary was up 4% this year. Gross income was down 9% mainly because we lost money on futures instead of winning, I think.

Total deductions rose by 19%, mainly because of increased interest costs and futures losses, which are included as other deductions. As a result, net income fell 38%.

Gross tax applies the tax bracket rates to taxable income. This was more than offset by franking credits. So, she gets the franking credits refunded as cash and has a negative tax rate. She also had to pay tax installments. As a result, she should get a large refund, estimated near $12k.

If we get refunds as big as predicted here they will almost be enough to pay private school fees for both children for 3/4 of the year! One term's fees is one of the monetary units I now think in :)

Moominpapa's Taxes 2023-24

I did our taxes earlier this year as Aura sent me a tax statement earlier than in previous years. Here is a summary of my taxes. You can find previous year's taxes here. To make things clearer, I reclassify a few items compared to the actual tax form (such as foreign source income deductions). Of course, everything is in Australian Dollars.

Overall, gross income fell 6%, while deductions rose 5%, resulting in a fall in net income of 8%.

On the income side, Australian dividends, franked distributions from managed funds, and foreign source income were all down strongly. Tribeca Global Resources paid a much smaller dividend this year, some of my other share holdings were reduced slightly to make new investments, and I didn't get dividends from Fortescue (sold) or Pendal (acquired). I also reduced my holding of 3i (III.L) and so got reduced foreign source income.

My salary still dominates my income sources but again only increased by 3%. Net capital gain is zero due to carryover losses from last year. I am carrying forward $41k in capital losses to next year. Rising interest rates increased deductions, while charitable giving was up 33% after falling last year.

Gross tax is computed by applying the rates in the tax table to the net income. In Australia, you don't enter the tax due in your tax return, but I like to compute it so that I know how big or small my refund will likely be. Franking credits (from Australian dividends), foreign tax paid, and the Early Stage Venture Capital (ESVCLP) offset are all deducted from gross tax to arrive at the tax assessment. ESVCLP was up due to more capital calls from Aura.

Estimated assessed tax fell because of the reduced net income and larger offsets this year.

I estimate that I will pay 24% of net income in tax. Tax was withheld on my salary at an average rate of 32%. I already paid $7,996 in tax installments and so estimate that I should get a refund of $16,942! Let's see.

Monday, September 02, 2024

August 2024 Report

This was a relatively quiet month with little investment activity. I was busy working on my teaching. We spent AUD 6k less than last month though we spent around AUD 9k in travel expenses for a future trip. Flying a family of four internationally costs a lot.

In August, the Australian Dollar rose from USD 0.6531 to USD 0.6772, so US Dollar returns are a lot higher than Australian Dollar returns this month. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 1.64%

S&P 500: 2.43%

HFRI Hedge Fund Index: 1.26% (forecast)

Australian Dollar Indices

ASX 200: 0.67%

Target Portfolio: -0.49% (forecast)

Australian 60/40 benchmark: 0.30%

We lost 0.87% in Australian Dollar terms or gained 2.79% in US Dollar terms. So we beat all the US Dollar indices and underperformed all the Australian Dollar indices!

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and so the total differs from the Australian Dollar returns on net assets mentioned above. Returns varied radically across asset classes. RoW stocks (mostly Defi Technologies) gained more than 13% and contributed the most to the overall return. Several asset classes lost money, with futures being the worst in terms of RoR and contribution to return.

Things that worked well this month:

- Defi Technologies (DEFI.NE) was the top performer, gaining AUD 54k. Australian Dollar futures contributed AUD 13k.

What really didn't work:

- Bitcoin lost AUD 39k. I discovered Defi Technologies due to my interest in bitcoin and Defi has so far more than offset my bitcoin losses. In total, I have lost AUD 47k on bitcoin and made AUD 143k on Defi Technologies. Pershing Square Holdings (PSH.L) was down again, losing AUD 11k. Chipotle was to blame this time, losing its CEO to Starbucks.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Our performance fell back this month compared to the ASX200 but, as we have much lower volatility, we have a higher Sharpe ratio of 0.82 vs. 0.53. But as we optimize for Australian Dollar performance, our USD statistics are much worse. We do beat the HFRI hedge fund index in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 2.74% with a beta of only 0.46.

We moved away from our target allocation due to the gains in Defi Technology. We are most underweight cash and most overweight rest of the world stocks. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.The SMSF did have a winning month:

Unisuper did a little better and PSS(AP) a little worse.

We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. I only made one additional move this month:

- I bought 5k shares of Regal Partners (RPL.AX) after what I thought was a great annual report. The market agreed for a few hours and then changed its mind...

Monday, August 26, 2024

Should You Keep Your Superannuation in Accumulation Mode?

The accepted wisdom is that as soon as you retire in Australia and are over 60 years old, or as soon as you hit 65 years old even if you are still working you should shift your superannuation from accumulation to pension mode. You can transfer up to $1.9 million per fund member into pension mode currently. Investments in pension mode have zero tax. This is in comparison to 15% tax in accumulation mode with a 1/3 reduction for long-term capital gains.

But what if you have a lot of investments outside of superannuation? These are highly taxed and so doesn't it make sense to run these investments down first to reduce your overall tax? In pension mode there are required minimum withdrawals each year. If you don't spend that money it is simply added to your highly taxed non-super investments. So, despite not having to pay tax on your money in super, you are transferring more and more money out of super into your taxable accounts. Does it make sense to wait till you have spent your non-super investments?

I ran a simulation in my long-term projection spreadsheet. This isn't a Monte Carlo simulation. I just assume my historical average rate of return over the last 20 years applies into the future. I assume that I retire at age 65 and convert my super to a pension and Moominmama converts her super to a pension at age 60. She stops working when I do. I also assume that the tax rate on investments outside super is 20% of returns (without any attempt to define realised and unrealised gains) and in super in accumulation mode is 12.5%. Both are probably at the high end of what might actually happen. But the contrast with zero tax in pension mode, makes pension mode more attractive relative to accumulation mode. The simulation runs to 2050.

I also run a simulation where all our super stays in accumulation mode. This no pension scenario has 8% more assets in 2050 than the pension scenario.

This modelling is still not that realistic. I assume that all our superannuation can be moved to pension mode, even if we exceed the $1.9 million threshold. Also, we are likely to make more non-concessional contributions to Moominmama's account before 2029 and I assume we don't. I'm think that these tweaks won't change the fundamental result. We would have to have a lot less non-super investments to change the conclusions.

Sunday, August 18, 2024

New Spending Sub-Category

As the Sydney Morning Herald personal finance newsletter, Real Money, is featuring car expenses this week, I was curious about how much of our spending on car went to actual driving vs. maintenance. So, I split the existing "Petrol, maintenance etc." category into "Petrol, parking, tolls" and "Car repair, NRMA etc.". In the last twelve months we spent $2,143 on the former and $1,978 on the latter. So, it is about even. The total transport category was at $9,383, with a total spent on the car of $5,707 (61%) and $3,676 (39%) on taxis, Uber, buses, and scooters. Flying falls in the "Travel" category. Car expenditure also includes registration, insurance, and depreciation.

Saturday, August 03, 2024

July 2024 Report

In July, the Australian Dollar fell from USD 0.6671 to USD 0.6531 so US Dollar returns are lower than Australian Dollar returns this month. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 1.64%

S&P 500: 1.22%

HFRI Hedge Fund Index: 1.27%

Australian Dollar Indices

ASX 200: 4.20%

Target Portfolio: 1.79%.

Australian 60/40 benchmark: 3.06%.

We gained 3.55% in Australian Dollar terms or 1.37% in US Dollar terms

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral terms as the rate of return on gross assets and so the total differs from the Australian Dollar returns on net assets mentioned above. Returns varied radically across asset classes. RoW stocks (mostly Defi Technologies) gained more than 20% and contributed the most to the overall return. Gold had the second highest return and contribution. Only hedge funds lost money due to the fall in Pershing Square Holdings.

Things that worked well this month:

- Defi Technologies (DEFI.NE) was the top performer, gaining AUD 61k. This is a new record for the most any one investment has gained in a month. Also gaining AUD 10k or more were: Gold, 38k, Bitcoin, 30k, 3i (III.L), 10k, and Regal Partners (RPL.AX), 10k.

What really didn't work:

- Pershing Square Holdings (PSH.L) lost AUD 32k. It fell steeply after Universal Music Group – one of its main holdings – fell sharply following its earnings report. Nothing else lost AUD 10k or more.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Compared to the ASX200 we have a slightly lower average return but also lower volatility, resulting in a higher Sharpe ratio of 0.89 vs. 0.53. But as we optimize for Australian Dollar performance, our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. We do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 3.59% with a beta of only 0.45.

We moved towards our target allocation. I raised the desired level of cash and reduced all the other asset classes accordingly. We are most underweight cash and overweight rest of the world stocks. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

It's time for a check-in with the SMSF. This was a good month with a return of 6.15% after a few months of underperformance:

Performance since inception has been 9.8% per year compared to 6.7% and 7.2% for the Unisuper and PSS(AP) benchmarks. Volatility has been greater than either of these, but that includes volatility to the upside. Compared to Unisuper, we have captured 81% of its upside but only 29% of its downside. Put another way we have a beta of 0.43 to Unisuper but 6.8% of alpha annually.

We receive employer superannuation contributions every two weeks. We contribute USD 10k each quarter to the Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. We made the following additional moves this month:

- We made our annual concessional superannuation contribution to the SMSF for Moominmama. AUD 22.5k this time.

- I sold all our 96k shares of Platinum Capital (PMC.AX) following the announcement of their restructuring plan. I bought 17.5k shares of Pengana Private Equity (PE1.AX) and 6k of Regal Funds (RF1.AX) in place of our SMSF holding. I am transferring most of the proceeds of the sale in my own brokerage account to our offset account.

- I bought another 250 shares of the Fidelity bitcoin ETF (FBTC) in the SMSF.

- I bought 400 shares of the Putnam BDC ETF in the SMSF.

- I redeemed all units of the Longwave Australian Small Companies Fund in my name – 118k units worth about the same number of dollars. I reinvested half in the First Sentier Imputation Fund and sent the rest to our offset account. I also redeemed AUD 25k of Moominmama's holding. This funded her superannuation contribution above.

- By the end of the month we had around AUD 125k in our offset account, which is a big change.

Saturday, July 27, 2024

June 2024 Report

In June, the Australian Dollar rose from USD 0.6650 to USD 0.6671 so US Dollar returns are slightly better than Australian Dollar returns this month. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 2.26%

S&P 500: 3.59%

HFRI Hedge Fund Index: -0.20%

Australian Dollar Indices

ASX 200: 1.08%

Target Portfolio: 1.59%

Australian 60/40 benchmark: 1.04%.

We lost -0.51% in Australian Dollar terms or -0.19% in US Dollar terms. So, we underperformed all benchmarks.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets and so the total differs from the Australian Dollar returns on net assets mentioned above. Returns varied radically across asset classes. Futures (including bitcoin) lost the most and detracted the most from total return. RoW Stocks gained the most (mostly due to Defi Technologies) and contributed the most to total return.Things that worked well this month:

- Defi Technologies (DEFI.NE) was the top performer, gaining AUD 29k. The next three best were 3i (III.L, 11k), Pershing Square Holdings (PSH.L, 11k), and Unisuper (10k).

What really didn't work:

- Bitcoin lost AUD 45k and is one of the main reasons we underperformed this month. Tribeca Global Resources (TGF.AX) lost 13k.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Compared to the ASX200 we have a slightly lower average return but also lower volatility, resulting in a higher Sharpe ratio of 0.87 vs. 0.61. But as we optimize for Australian Dollar performance, our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. We do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 3.45% with a beta of only 0.45.

We moved away a bit from our target allocation. We are most underweight private equity and futures and large cap stocks and overweight RoW stocks and hedge funds. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. It was another busy month. We made the following additional moves this month:

- I sold 500 shares of 3i (III.L), which brought our invested capital close to zero.

- I sold 50k shares of Cadence Capital (CDM.AX). Another example of a boring fund, though in this case it is boring in practice, not theory. I added 18k shares of Cadence Opportunities (CDO.AX) instead, though recently it hasn't performed much differently to CDM.

- I sold 25k shares of Tribeca Global Resources (TGF.AX) and bought the same amount in a different account realising a capital loss. This has been a very underperforming fund since inception, with one good year, but I haven't given up yet.

- I sold 50k shares of the US Residential Property Fund, URF.AX.

- I sold 2k shares of WCMQ.AX.

- I sold 5k shares of Hearts and Minds (HM1.AX).

- I sold 7k shares of Platinum Capital (PMC.AX).

- I sold AUD 7.5k of the Longwave Developing Companies Fund. This was once CFS and then FS. The manager has changed now to Longwave. I plan to run down the holding in my wife's account to fund capital calls for venture capital funds and her retirement contribution for next year.

- I bought 1,000 shares of the gold ETF PMGOLD.AX.

- I bought 15k shares of Defi Technologies (DEFI.NE).

- I bought 7k shares of Regal Partners (RPL.AX). This hasn't turned out to be a good move so far.

- There were also some largely unsuccessful futures trades.

Wednesday, July 24, 2024

Sold All My Shares in Platinum Capital

The company announced the result of its strategic review: They will merge the listed investment company PMC.AX and their ETF PIXX.AX. The price jumped on the news to the $1.45-1.46 range. This leaves about a 5% potential gain to the current NAV of PMC.AX. But we have to wait probably till the end of the year for the plan to come fruition, and if PMC.AX continues to underperform as it has recently, the NAV can fall. So, I sold all my shares today.

It was one of my oldest investments. I first invested in 2001 but sold during the dot.com crash. I then reinvested in 2005 and have held varying amounts of shares since then. The internal rate of return has been 12.02%, which was enhanced by trading the shares. Total profit AUD 100,530.

Wednesday, July 17, 2024

Integrated Portfolio Solutions Acquired

Back in 2021, I co-invested alongside Aura AUD 100k in Integrated Portfolio Solutions, a private company. At the time, I thought there wasn't a lot of downside risk as an acquirer would be willing to pay to obtain the client accounts they were advising. The company didn't manage to execute on the expansion plans that they touted at the time. In the wealth management/advisory/platform business there are economies of scale needed to achieve profitability. Today it was announced that the company is being acquired for roughly the value at the point when we invested. Various closing costs are going to result in about an 8% loss. Part of the consideration for the acquisition is going to be in terms of equity of the acquirer, DASH Technology Group, but now my position will be a much more reasonable amount for an investment in a non-profitable private company. I feel lucky I didn't lose more!

Tuesday, July 16, 2024

Longwave Small Australian Companies

Recently, what used to be the First Sentier Developing Companies Fund became the Longwave Small Australian Companies Fund. In other words, First Sentier dropped managing the fund and transferred it to Longwave. I checked Longwave's track record and it wasn't that great. So, I decided to close our holdings of this fund. I withdrew part of Moominmama's holding to fund her concessional superannuation contribution for this financial year. Then I wanted to withdraw half of my holding and switch the rest to the FS Imputation Fund that does manage to beat its benchmark.

As my holding of this fund is under my CommSec margin loan, I had to send the Colonial First State forms requesting the transaction to CommSec. Then CommSec sent me back their own withdrawal form, which was super unclear. Turns out that they have switched 50% of my Longwave holding to FS Imputation. But then instead of withdrawing the rest, they have withdrawn 50% of the rest! I can't be bothered to fill out another set of forms to submit right now as I don't need to withdraw the money...

Tuesday, July 09, 2024

Superannuation Returns for the 2023-24 Financial Year

The Australian reports on the performance of superannuation funds for the just completed financial year. This year, retail funds tended to perform better than industry funds because of their higher allocation to public stock markets rather than private assets. How did our SMSF do by comparison? I don't actually compute comparable after-tax performance figures, which are how superannuation returns are reported.* Public offer funds make an allowance for future tax payable, which includes capital gains tax if the assets are sold. This means that members who withdraw funds don't push tax liabilities onto those that stay. This is unlike a regular unlisted managed fund where tax is at the investor level and attached to distributions...

So, instead I estimate what the performance of our employer funds might be pre-tax. This probably over-estimates the performance of the employer funds, but reconciling tax expected with tax actually paid on our SMSF would be hard work. On that basis, the SMSF returned 9.54%. Unisuper returned 10.89% and PSS(AP) 10.55%. Both the latter are balanced funds. Even though we underperformed for the year, we are still ahead overall since inception:

PSS(AP) has, however, inched ahead in risk-adjusted performance. It now has an information ratio (Sharpe ratio with zero risk free rate) of 1.02, versus 0.96 for the SMSF. Unisuper is on 0.83.

Since inception, the SMSF has returned an annualized 7.9% pre-tax versus 6.44% for Unisuper and 6.63% for PSS(AP).

* Reported performance does deduct administration, audit, ASIC fees etc. As an example, for the year to 31 December 2023, Unisuper report a return of 10.3%, while I estimate a pretax return of 11.15% for the fund.

Saturday, July 06, 2024

Spending 2023-24

For the last seven years I've been putting together reports on our spending over the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many spending reports you'll see online, though all our numbers are in Australian Dollars. At the top level, we can break down total income (as reported in our tax returns plus employer superannuation contributions) into the following expenditure categories:

The gross income for this year (bottom line), and so also "Other Saving", is just an estimate. It is based on the gross income we expect to report in our tax returns (before investment expenses etc.) plus employer superannuation contributions. Tax includes local property tax as well as income tax and tax on superannuation contributions. Investing costs include margin interest. Mortgage interest is included in spending here (though usually I consider them to be an investment cost), while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Other saving is then what is left over. This is much bigger than our saving out of salaries because gross income includes investment returns reported in our tax returns. Spending increased by 4% this year in line with inflation. Gross income, especially in real terms, has been slowly declining since the peak in 2020-21. This is partly because I moved high-tax investments into superannuation. Expected other saving is the lowest it has been. The latter includes the AUD 20k concessional contribution we made for Moominmama to our SMSF in each of the last three years. Graphically, it looks like this:

We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories:

Our biggest spending category, if we don't count tax, continues to be childcare and education, which declined slightly this year as the youngest moved out of daycare and the older one changed schools. Both are now in the same private school since the beginning of this calendar year. As mentioned above, the income, tax, and other savings numbers for this year are all estimates. Commentary on each category follows:

Employer superannuation contributions: These include employer contributions (we don't do any salary sacrifice contributions) but not the concessional contributions we paid into the SMSF.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This includes tax on our concessional contributions to the SMSF. It does not include taxes on SMSF earnings as the superannuation earnings are not included in income here.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income in order to get the numbers to add up.* Foreign tax paid is the same story.

Income tax paid is one category that has fallen since 2017-18! Franking credits rose fourfold.

Life and disability insurance: I have been trying to bring this under control and the amount paid has also fallen since 2017-18 as a result.

Health: Includes health insurance and direct spending. Spending peaked with the birth of our second child.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). Rising interest rates have pushed up spending this year again as has replacement of our central air-conditioner, which will cost more than AUD 11k.

Transport: About half is spending on our car and half is my spending on Uber, e-scooters, buses etc. I tried to spend less on Uber this year. I reduced my transport spending by 22% as a result. Also, the value of our car rose, contributing AUD 1,700.

Utilities: This includes water, gas, electricity, telephone, internet, and online storage etc.

Subscriptions: This is spending on all online services that aren't basic infrastructure. After rising strongly during the pandemic we brought it back under control this year with an 8% reduction.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. Spending has been stable in nominal terms for the last three years.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants. It was low in 2020-22 because of the pandemic. It then jumped as life got more back to normal and rose 11% as prices are climbing I feel particularly in this area. I just paid more than AUD 7 for a large coffee this morning in Queensland, which is a record for me.

Cash spending: This has collapsed to almost zero. I try not to use cash so that I can track spending. Moominmama also gets some cash out at supermarkets that is included in that category.

Department stores: All other stores selling goods that aren't supermarkets. Has been falling since 2019-20.

Mail order: This continued to decline since the pandemic peak in 2020-21. Down another 15% this year.

Childcare and education: We are now paying for private school for both children plus music classes, swimming classes...

Travel: This includes flights, hotels, car rental etc. It was very high in 2017-18 when we went to Europe and Japan. In 2020-21 it was down to zero due to the pandemic and having a small child. This year it almost reached the nominal level of 2017-18. We paid to rent a house in Bondi Beach in Sydney because my brother and his wife were supposed to visit. That was very expensive. In the end, they couldn't visit because of the war in the Middle East. And now we took a second vacation in Winter in Queensland.

Charity: Continues to fluctuate around my goal of AUD 1k. When I think I am really financially independent and my children are grown up I'd plan to increase it.

Other: This is mostly other services. It includes everything from haircuts to fees for tourist attractions. I don't include the latter in travel because we might also pay to go to a museum or paid play place when we are home.

This year's increased spending was mainly driven by increased housing and travel costs, while most other categories declined despite inflation. Both housing and travel included one-off costs. I paid the second half of the air-conditioner bill a few days ago in the new financial year, so I expect housing costs will remain similar in 2024-25. Travel is hard to predict, but I expect that spending will remain high as we begin to spend more on airfares again. We were still paying for daycare in the first half of the financial year, so I expect education costs to fall a little in 2024-25.

* Moominmama has negative income tax and gets some of her franking credits paid out as cash. This is accounted for here as a reduction in the net income tax category.

Sunday, June 23, 2024

Revisiting Inflation vs. Investment Returns

In January, I posted about how much of investment returns were being taken up to cover the effects of inflation. I fitted a quadratic curve to monthly investment income to smooth it out and compared that to the current inflation rate multiplied by our net worth. It didn't look good. How are things looking now that inflation has come down a bit?

On this graph, I have also added fitted saving and an alternative calculation of expected investment returns. To calculate this one, I fitted a linear trend to the monthly percentage rate of return and multiplied that by net worth. It doesn't include any gain in the value of our house, and turns out to be relatively more conservative. On the other hand, the "boiling point" where investment returns exceeded saving was still around 2012.

The picture has improved in the last few months as inflation has declined. Using the more conservative measure of projected investment income we have a surplus above inflation of around AUD 15k per month, which is in the ballpark of our current spending not counting taxes. If inflation stayed low, retirement should be feasible. But there is still huge uncertainty around future inflation, investment returns, and spending, which continues to make me cautious.

Thursday, June 20, 2024

Coinsnacks Issues Negative Report on Defi Technologies

Coinsnacks issues a negative article on Defi Technologies. The stock fell 25-30% in Tuesday trading as a result. The article is very selective. The company has issued statements suggesting that their financial position has improved radically since the end of Q1 in March. We will have to wait till the end of the current quarter to fully understand that. The current rise in stock price is as much about that as the promotional efforts that the company has made to raise its stock price. The company issued a statement claiming that the report may be connected to short sellers, which is pointedly not denied by Coinsnack's report which says they do not own shares in the company... If I understand the Defi's statement, they were approached to sell new shares to an investment bank, which they suspect would be used to cover a short position. But that was back on 10 June, when stock price was lower. So, I am confused. Anyway, in today's trade in Europe and Canada (US market was closed) the price stabilized for now.

Monday, June 17, 2024

Getting a Bit Crazy

Crazy to see an investment up by more in a day than any of my investments have been up in a month before in terms of dollars.... So far it is up about four times this month what any individual investment has done before. Of course, no guarantee that this will hold, so thought I'd post while it lasts. If you are puzzled, then you haven't read my recent posts. Let's see where we're at a the end of the month.

No, it's not bitcoin, which has been doing nothing. Still I saw this really nice chart of bitcoin's price path to date:

The x-axis is log days since the inception of Bitcoin, while the y-axis is the log price. With this transformation, bitcoin has followed a linear path. Yes, the growth rate has slowed over time, but now we see that it hasn't been an arbitrary rate of slowing. This is called the Bitcoin Power Law Theory. Of course, this is based on econophysics and might not continue to hold in the future.

P.S.

After being up 25% in European trade we closed up "only" 6% in North American trade.

Monday, June 10, 2024

L1 Long-Short Fund

The L1 Long-Short Fund (LSF.AX) is a closed end hedge fund listed on the ASX. It has had a very strong performance, beating the ASX 200 by threefold since its inception in 2014. But is it worth investing in now? The fund trades at a premium of about 9% to net asset value, as we might expect from a fund that has historically outperformed the market. So, that is a negative but not too large a premium. I plotted the fund's total return index (NAV not market price) against the ASX 200. The pattern looked familiar. It was a lot like that of Regal Funds' RF1.AX listed fund:

I set all three total return indices to 1000 in May 2019 when Regal Investments debuted on the ASX. What are the performance statistics of the two funds relative to the ASX? Since mid-2019, LSF had a beta of 1.066 and RF1, 0.80. The monthly alpha of the two funds have been 1.05% and 1.07%. RF1's alpha is a little more precisely estimated. The betas of the two funds using market price instead of NAV are much higher. RF1 has been around 1.3.

At this stage, I am not that inclined to invest in LSF given I am invested in RF1, but I might add it in the future.

Sunday, June 09, 2024

Regal Partners Thesis

Regal Partners (RPL.AX) – the listed management company of Regal Funds – has increased rapidly in price recently:

I have doubled the size of my holding from 10k to 20k shares. I think both the Merricks acquisition and the private placement by the Pershing Square management company at a high valuation have been positives that have helped push the price higher. I am now back in profit on this investment. The IRR has hit 7.7%, which is pretty decent all things considered. The chart looks bullish for now, especially given the large volume associated with the green candles.

In other news, Defi Technologies (DEFI.NE) briefly hit double my initial entry point on Friday at CAD 1.88 before pulling back to close at 1.76. My average price is higher than CAD 0.94 due to subsequent additional purchases, including another 5,000 shares on Friday. I now have 70k shares.

Relative Wealth

Take all the bitcoin in the world and divide by the number of people - how much is an equal share? About 0.0025. Similarly, an equal share of the world's mined gold is about 0.8 ounces. Our family of four people has about 400 times its equal share of bitcoin and 50 times its equal share of gold currently. The dollar value of our gold holding is about 1.5 times our bitcoin holding.

Saturday, June 08, 2024

Cambria Funds Launches a New Managed Futures ETF: How Will it Perform?

Cambria Funds have launched a new managed futures ETF – MFUT – managed by Chesapeake - Jerry Parker's (one of the turtle traders) firm. I compared the historic performance of the Chesapeake Diversified Plus managed futures program to the Winton Global Alpha Fund since 1996:

Clearly, Winton has outperformed Chesapeake and with substantially less volatility. The average return of Chesapeake has been 11.6% p.a., while Winton achieved 15.0%. Chesapeake's information ratio (Sharpe ratio with a zero percent hurdle) was only 0.44, while Winton's was 0.96.

It seems that Chesapeake's volatility decreased after about 2012. So let's focus on the period since then. Since the beginning of 2012 Chesapeake has outperformed Winton with an average annual return of 8.8% vs. 7.3%. However, Winton was still less volatile with an information ratio of 0.77 vs. Chesapeake's 0.52.

The full period, the correlation between the monthly returns of the two funds was only 0.44. Since 2012 it was 0.54. So, there it would seem there is a potential diversification case for investing in both funds. However the information ratio of an equal weight combination of the two funds is lower than that of Winton alone. This is true for both the full period and the post 2011 period. So, based on this, I won't be investing in MFUT.

Friday, June 07, 2024

Defi Technologies Announces a Stock Buyback

The news is pushing the price up strongly again today, though they won't start buying till next week.

Thursday, June 06, 2024

May 2024 Report

In May, the Australian Dollar rose from USD 0.6494 to USD 0.6650 so US Dollar returns are much stronger than Australian Dollar returns this month. Stock indices and other benchmarks performed as follows (total returns including dividends):

US Dollar Indices

MSCI World Index (gross): 4.12%

S&P 500: 4.96%

HFRI Hedge Fund Index: 1.87% (forecast)

Australian Dollar Indices

ASX 200: 0.75%

Target Portfolio: 0.56% (forecast)

Australian 60/40 benchmark: 0.36%.

We gained 1.22% in Australian Dollar terms or 3.62% in US Dollar terms. So, we beat all the Australian Dollar benchmarks and the HFRI index but not the MSCI or S&P 500 indices.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets and so are larger than the Australian Dollar returns on net assets mentioned above. Returns for most asset classes were positive. Futures had the highest rate of return and made the largest contribution to returns while gold had the lowest return and private equity detracted the most from returns.

Things that worked well this month:

- The top 3 investments this month were: Bitcoin (AUD 49k), Pershing Square Holdings (PSH.L, 13k), and Tribeca Global Resources (TGF.AX, 9k).

What really didn't work:

- Nothing was particularly bad this month.

Here are the investment performance statistics for the last five years:

The top three lines give our performance in USD and AUD terms, while the last three lines give results for three indices. Compared to the ASX200 we have a lower average return but also lower volatility, resulting in a higher Sharpe ratio of 0.92 vs. 0.64. But as we optimize for Australian Dollar performance, our USD statistics are much worse and worse than either the MSCI world index or the HFRI hedge fund index. We do beat the HFRI in terms of return, but at the expense of much higher volatility. We have a positive alpha relative to the ASX200 of 3.61% with a beta of only 0.45.

We are fairly close to our target allocation. We are most underweight private equity and Australian large cap stocks and overweight real assets and hedge funds. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. This was a bit quieter month than April. We made the following additional moves this month:

- I sold all 1,000 shares of PBDC and all 350 shares of the Bendigo Bank hybrid security. I expected to keep these longer, but new opportunities came up. Made AUD 356 on the Bendigo trade or about 1% in a month and USD 725 or about 2% on PBDC so it was better than holding cash.

- I bought 65k shares of Defi Technologies (DEFI.CA). I ended up buying 35k on the Canadian CBOE exchange and 30k on the US OTC market, as there was a public holiday in Canada. Brokerage is lower for buying in Canada.

- I bought another 5k shares of Platinum Capital (PMC.AX).

- I bought 3k shares of Regal Partners (RPL.AX).

- I bought another 100 shares of FBTC and six bitcoin futures trades, all of which made money (total of USD 1,645).

- I invested USD 7.5k in three new investments syndicated by Unpopular Ventures. This may seem like very small investments but I have now invested USD 32.5k in their syndicated investments. I am treating this like gradually buying into a fund that holds these different investments. These are in addition to our rolling fund investments. It's just random chance that three investments that met my criteria were offered in a single month. My last syndicated investment was in September 2023.

Sold 500 Shares of 3i

3i has been an excellent investment to date, so I plan on holding the remaining shares till something fundamental changes. The IRR has been 21.8% and has been a 23-bagger. I haven't multiplied my investment 23 times though, as for the longest period I had only 600 shares. My original investment in 2008 was a purchase of 200 shares and at the low point I had only 100 shares. I reached 5,000 shares only in 2022. Still it is the highest notional multiple on any of my investments ever. The second best of those I currently hold is Platinum Capital at about 10x.

Tuesday, June 04, 2024

Regal Partners Acquires Merricks Capital

Regal Partners announced that it is acquiring Merricks Capital, a private credit manager. The performance of their main fund is quite remarkable:

The rate of return is high and there was only one down month. It reminds me of Bernie Madoff's fund. I am not saying there is anything wrong here, but this kind of performance shouldn't be possible according to efficient market theory! The fund is way outside the envelope of the other assets on this risk-reward graph:

We are investors in Regal Partners (13k shares).

Pershing Square Sells Stake in Management Company

Pershing Square has sold a 10% stake in its management company for USD 1.05 billion. Last year, Pershing Square Holdings, its listed hedge fund that makes up most of its assets under management (we have 5k shares in it), made around USD 400 million in management and performance fees. Even if we assume that most compensation of employees is through dividends and share appreciation rather than salaries, that makes the P/E of the management company around 25, which is very high for an asset management company, especially one depending on variable performance fees. Regal Partners - an Australian listed hedge fund manager that I am invested in (13k shares) - has a forward P/E of about 15. Rather, Pershing Square's high P/E is predicated on raising a new USD 25 billion listed fund in the US. At 2%, this would produce management fees of USD 500 million per year! The fees of the existing Pershing Square fund listed in London will be reduced by part of the management fees on the new fund, so the $500 million isn't purely accretive. Previously Ackman said that they planned to raise USD 10 billion for the new fund.