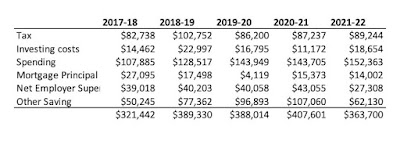

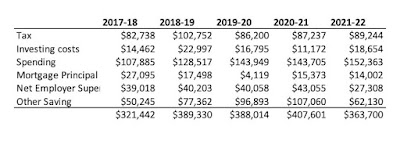

For the last five years I've been putting together reports on our spending over the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many you'll see online, though all our numbers are in Australian Dollars. At the top level we can break down total income (as reported in our tax returns plus superannuation contributions):

The gross income for this year (bottom line) is just an estimate. It looks like falling quite significantly. Tax includes local property tax as well as income tax and tax on superannuation contributions. Investing costs include margin interest. Mortgage interest is included in spending, while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Current saving is then what is left over. This is much bigger than saving out of salaries because gross income includes investment returns reported in our tax returns. The latter number depends on capital gains reported for tax purposes, so is fairly arbitrary. Spending also recommenced its increase this year. Graphically, it looks like this:

We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories:

Our biggest spending category, if we don't count tax, is now childcare and education, which has again risen steeply. As mentioned above, the income and tax numbers are all estimates. Commentary on each category follows:

Employer superannuation contributions: These include employer contributions and salary sacrificed contributions but not concessional contributions we paid to the SMSF this year.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This year it includes tax on our concessional contributions to the SMSF.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income. Foreign tax paid is the same story.

Life and disability insurance: I have been trying to bring this under control and the amount paid has fallen as a result.

Health: Includes health insurance and direct spending. Spending peaked with the birth of our second child and continues to decline.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). We haven't spent much on maintenance this year, so spending is down.

Transport: About 2/3 is spending on our car and 1/3 my spending on Uber, e-scooters, buses etc.

Utilities: This includes spending on online subscriptions etc as well as more conventional utilities. I need to cut back on spending on video games as this category continued to climb strongly.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. Seems crazy that it has almost doubled in five years and become our second biggest spending category.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants. It was low last year because of the pandemic and this year because of a seeming permanent behavior change.

Cash spending: This has collapsed to zero. I mainly use cash to pay Moomin pocket money and he pays me back if we buy stuff online for him. That's how it ended up negative for the year. Moominmama also gets some cash out at supermarkets that is included in that category.

Department stores: All other stores selling goods that aren't supermarkets. No real trend here.

Mail order: This seems to have leveled out in the last three years/

Childcare and education: We are paying for private school for one child, full time daycare for the other, plus music classes, swimming classes...

Travel: This includes flights, hotels etc. It was very high in 2017-18 when we went to Europe and Japan. Last year it was down to zero due to the pandemic and having a small child. This year we went to the nearby coast for a week and this is mostly how much the accommodation, booked at the last minute, cost.

Charity: Not sure why it's down this year.

Other: This is mostly other services. It includes everything from haircuts to professional photography.

This year's increased spending was mainly driven by increased childcare and education costs. I expect these to be about the same next year and then fall for a while in subsequent years - private primary school is cheaper than daycare with the low level of subsidy we get - before beginning to rise again.

.jpg)