Sunday, December 31, 2006

Missing Retirement Contribution

My missing retirement contribution is now showing up on TIAA-CREF's website. But it's been parked in a money market fund despite my instructions in the application forms. Well, I'll move it and change the instructions online for future contributions. Just a reminder to make sure that your instructions are carried out as requested.

TFS Capital Distribution

So far I am very happy with my investment in TFS Capital's Market Neutral Fund. The fund distribution for 2006 has just been announced:

Short term capital gains: 0.0895

Long term capital gains: 0.1272

After my discussion on this blog with one of the portfolio managers I had been a bit concerned that the distribution might impose a big tax burden, which is one of the downsides of actively managed open-ended mutual funds held in taxable accounts. Recent investors have to pay taxes on investment gains from the past which they haven't benefited from income wise. But this distribution is not bad. It is only a 1.6% yield and the short-term long-term CGT composition is close to the 40/60 mix of futures trading. And my gain so far in just over a month of holding the fund is 5.3% (pre-tax)!

Short term capital gains: 0.0895

Long term capital gains: 0.1272

After my discussion on this blog with one of the portfolio managers I had been a bit concerned that the distribution might impose a big tax burden, which is one of the downsides of actively managed open-ended mutual funds held in taxable accounts. Recent investors have to pay taxes on investment gains from the past which they haven't benefited from income wise. But this distribution is not bad. It is only a 1.6% yield and the short-term long-term CGT composition is close to the 40/60 mix of futures trading. And my gain so far in just over a month of holding the fund is 5.3% (pre-tax)!

Initial Assessment for December and 2006

It will take quite a while it seems till I have final figures for December and 2006. One reason is that my supplemental 403b plan isn't showing up on TIAA-CREF's website - I e-mailed them to query this. I guess I should at least get a paper statement for the end of the quarter some time but that will take a long time. As of today I am at a net worth of around $365k which represents a gain of $95k in net worth - 95% of my goal for the year. Total after tax earning including salary, investment gains, retirement contributions totalled around $121k with around $26k of spending. Of that income. $69k came from non-investment sources and net income tax paid and $52k from investments. Changes in exchange rates contributed about $12k of the latter. Net realized short-term capital gains on stocks (not counting mutual fund distributions) were around $8k. Trading the NDX added just $2300 for the year with December adding $60. But at least the losing streak of the last few months has ended. The rate of return on investment (pre-tax) was about 18% and 23% on non-retirement accounts as my retirement accounts have been quite conservatively invested.

As numbers are finalized over the next few weeks I will present a lot of reports on the different factors and how they contributed to the results for the year. The main thing though is I am now at a stage where investment earnings are covering living expenses though there is no guarantee that that will continue. In 2005 my investment return was only 3.4%. On the other hand I continue to learn and improve (as objectively measured by indicators such as my portfolio alpha). Over the last three years my alpha is 10% p.a. relative to the MSCI and 14% relative to the S&P 500. Beta is 0.6-0.7. That means in an average 10% year for the indices I should return between 18-22%. If the indices fall 10% I should return on average more than 12% in theory... But I can have a bad year too unrelated to index performance. Is this enough yet to consider myself "financially free"? Obviously I need to manage my money actively and a bad year could have very significant impact. So I consider myself on the verge of being able to make a living as a trader/investor but still need to accumulate more assets and show a more consistent and better trading performance.

December alone added about $10k to net worth with a 2% investment return and about $2000 of spending. If I could keep that up I would easily meet next year's goals :)

As numbers are finalized over the next few weeks I will present a lot of reports on the different factors and how they contributed to the results for the year. The main thing though is I am now at a stage where investment earnings are covering living expenses though there is no guarantee that that will continue. In 2005 my investment return was only 3.4%. On the other hand I continue to learn and improve (as objectively measured by indicators such as my portfolio alpha). Over the last three years my alpha is 10% p.a. relative to the MSCI and 14% relative to the S&P 500. Beta is 0.6-0.7. That means in an average 10% year for the indices I should return between 18-22%. If the indices fall 10% I should return on average more than 12% in theory... But I can have a bad year too unrelated to index performance. Is this enough yet to consider myself "financially free"? Obviously I need to manage my money actively and a bad year could have very significant impact. So I consider myself on the verge of being able to make a living as a trader/investor but still need to accumulate more assets and show a more consistent and better trading performance.

December alone added about $10k to net worth with a 2% investment return and about $2000 of spending. If I could keep that up I would easily meet next year's goals :)

Friday, December 29, 2006

Hedged Trading

Another new idea. Seem to be a lot of these as I struggle to find a method that fits my psychology well and uses the model signals. Trade 1 NQ and 200 SPY (S&P500 ETF) in opposite directions. So say I am short 1 NQ then buy 200 SPY. This is equivalent to trading a position of $20 times the NDX and the opposite direction $20 times the SPX. Here is a chart of NDX/SPX:

Reasons to use SPY rather than a futures contract as the hedge:

1. I don't have enough money in my futures account to trade 5 NQ and 2 ES which is the correct ratio of futures contracts and I can trade the SPY part in my Ameritrade account.

2. The tax deduction on stocks is greater for a loss than on futures. As the hedge is expected to lose it makes sense to use stocks for this side of the position.

3. The leverage for stocks is lower and an apparent reduction in leverage is psychologically beneficial.

I've done some simulations and over the last year a fully levered (initial margin for NQ of $3750 and 50% margin for stocks) 1 NQ - 200 SPY position behaves pretty much the same as an unlevered 800 QQQQ position. The strongest gaining days are bigger in terms of percentage gain though - the worst losing days are about the same. So I am now experimenting with this idea live. Of course, if the trend is clear I can remove the hedge and even keep the hedge in the same direction and reverse the main position when the trend reverses. Not sure if I will just use the hedge when I am unclear on direction or all the time.

Last night I watched the movie "Pi". Really crazy movie. Anyway, I'm not like that guy though I am looking for patterns in the stockmarket and have studied the Talmud etc in the past :) One example - he didn't actually trade :P

Reasons to use SPY rather than a futures contract as the hedge:

1. I don't have enough money in my futures account to trade 5 NQ and 2 ES which is the correct ratio of futures contracts and I can trade the SPY part in my Ameritrade account.

2. The tax deduction on stocks is greater for a loss than on futures. As the hedge is expected to lose it makes sense to use stocks for this side of the position.

3. The leverage for stocks is lower and an apparent reduction in leverage is psychologically beneficial.

I've done some simulations and over the last year a fully levered (initial margin for NQ of $3750 and 50% margin for stocks) 1 NQ - 200 SPY position behaves pretty much the same as an unlevered 800 QQQQ position. The strongest gaining days are bigger in terms of percentage gain though - the worst losing days are about the same. So I am now experimenting with this idea live. Of course, if the trend is clear I can remove the hedge and even keep the hedge in the same direction and reverse the main position when the trend reverses. Not sure if I will just use the hedge when I am unclear on direction or all the time.

Last night I watched the movie "Pi". Really crazy movie. Anyway, I'm not like that guy though I am looking for patterns in the stockmarket and have studied the Talmud etc in the past :) One example - he didn't actually trade :P

Thursday, December 28, 2006

Buy Signal?

NDX stock futures ran up a lot overnight but are now retreating. NDX needs to be about +5 from the close to trigger a crossing of the moving average and a buy signal. It was +11 at around 6 am but now is back to +4.75. Think I will wait for the new housing number at 10am to make a decision whether to go long.

Wednesday, December 27, 2006

Pair Trade Update

Just checking how the "pair trade" is working out. The concept was fine but if I think of just NCT and IYR in isolation I shorted too much IYR. So far I lost $251 on IYR and gained $259 on NCT. My IYR short position is worth -$8228 and my long NCT $3229. I should have shorted fewer IYR and if I had the trade would be nicely profitable despite the fact that IYR rose. NCT has turned out to be much stronger than the average actual property owning REIT.

NQ Chart

A possible Elliott-Wave interpretation of the market action of the last month (using the NQ futures chart) ... we would be currently in wave 4 of the final downwave of the correction with just wave 5 down to go to complete this month long correction. Then expect a rally to exceed the 2006 highs. Up till wave b of B it had looked like we were in a triangular correction... but soon the breakout from the triangle failed and a larger corrective pattern developed. This happens all the time with E-Wave which is why it is such a hard tool to really use for trading.

Oversold!

I just realized that in fact we are now in "oversold" conditions - the stochastic oscillator is below 20. This hasn't happened for so long I wasn't paying attention. According to the trading rules one ought to be short here not long! I entered a long trade this morning with just one contract. Now will look to exit it.

Monday, December 25, 2006

How Could I Add $105k to Net Worth?

2006's results (to be reported in detail after January 1) were helped by foreign exchange gain and a small ($6-7k) inheritance amount. I doubt foreign exchange will add much this year and it may even take away unless I successfully trade foreign currency. The Australian Dollar is close to 80 US cents and it is hard to imagine it going much higher. The US Dollar could be bottoming. The second part of the inheritance could come this year or not. Legal procedures are extremely slow. I expect it would be about twice the value of the first one but we don't really know. So let's assume all these factors are zero. I also assume that my tax bill in April will be zero - I have been over-withholding and I think it is sufficient to meet the required tax.

I can expect the following - my employer contributes 8% of my salary to my 403b and I am now contributing the maximum allowed contribution. Combined these come in at $1750 per month. If I spend at the same rate as this year, I should still be able to save $1000 a month after tax. Total from "contributions" would, therefore, be $33k for the year. In my previous post I stated a goal of making $19k from trading. That would be a 46% return on those accounts mentioned. This year I only gained $3k from QQQQ/NQ trading. So it seems like a lot. If I can succeed in adhering to my model it isn't though a very high goal. Viewed another way, it is about 1/2 the average US salary and only a step on the way to becoming a succcessful trader. If we assume that I do achieve this then the required return on my investment portfolio is 14%. This also is high, but not impossible. This year the S&P 500 exceeded that. Of course returns could be much lower and my spending much higher. But this is a goal, not a forecast, and the point is that it should be hard but not impossible to achieve.

I can expect the following - my employer contributes 8% of my salary to my 403b and I am now contributing the maximum allowed contribution. Combined these come in at $1750 per month. If I spend at the same rate as this year, I should still be able to save $1000 a month after tax. Total from "contributions" would, therefore, be $33k for the year. In my previous post I stated a goal of making $19k from trading. That would be a 46% return on those accounts mentioned. This year I only gained $3k from QQQQ/NQ trading. So it seems like a lot. If I can succeed in adhering to my model it isn't though a very high goal. Viewed another way, it is about 1/2 the average US salary and only a step on the way to becoming a succcessful trader. If we assume that I do achieve this then the required return on my investment portfolio is 14%. This also is high, but not impossible. This year the S&P 500 exceeded that. Of course returns could be much lower and my spending much higher. But this is a goal, not a forecast, and the point is that it should be hard but not impossible to achieve.

Sunday, December 24, 2006

2007 Net Worth Goal

Though we haven't yet completed 2006 I have added my 2007 net worth goal to the sidebar. $470,000. At this point I look like reaching $365k for 2006 - an addition of $95k to my net worth. $5k short of my goal but far above the amount I wrote I would be happy with. So next year's goal is to add a little more to net worth than this year - $105k. Also at a constant growth rate, $470k is on the growth path to $1 million at the end of 2010. My second goal is to end the year with as much in my three self directed US investment/trading accounts - at Ameritrade and IB as I put into them ( I also have a 403b and an account with TFS Capital - those are doing fine). Currently my net investment has been $60k, but there is only about $41k in the three accounts. I've added that goal to thje sidebar with the amount achieved in parentheses - I'll update it periodically. If I add or withdraw money to the accounts the goal will shift. These two goals are pretty simple I think. A "stretch goal" as people say is pretty obvious - reaching a net worth of half a million dollars :)

Saturday, December 23, 2006

Overnight Trading

I'm struggling to develop a trading strategy which won't involve me staring at the market all day. The idea behind developing the "model"... But seems it is psychologically hard to just follow the model directions and leave a position on all the time until I have a reasonable cushion of profits from trading the model. This doesn't make any sense from the point of view of traditional neoclassical economics, but does make sense from the perspective of behavioral economics. Noting that overnight moves in the stockmarket tend to be much smaller than intraday ones (a well-known economic anomaly) I think I may have an alternative trading strategy:

1. At the close of each day place a trade as directed by the model.

2. In the morning observe the direction of the market from the 8:30am timing of most major U.S. macroeconomic announcements to about 11am.

3. If the market is moving in the direction forecast by the model take profits after a substantial move is made.

4. If the market seems to be going in the opposite direction get out fast.

For example, this morning the market was up slightly before the open but nothing significant. Then came the big fall after the open. Around 9:45am was the ideal time to cover the position. Or just where I decided to go long, a little later. This trade would have made around 13-14 points or $260-280 per contract. The clue that this is doable is that I decided to go long at NQ = 1775. So I'm capable of making the right decision in principle and just need to build that into a strategy.

Making a trade every day also makes it easier to take time out from trading. The psychological difficulty of this strategy is being disciplined to ignore the market for the rest of the day once I've closed the overnight trade. I'll call this strategy "overnight trading" as opposed to "day trading" :)

Of course if the market appears to be in a very strong trend it would make sense to place a stop and let the trade run after observing the morning conditions. This might be easier if I trade say 2 contracts and close one in the morning and let one run if conditions look favorable.

1. At the close of each day place a trade as directed by the model.

2. In the morning observe the direction of the market from the 8:30am timing of most major U.S. macroeconomic announcements to about 11am.

3. If the market is moving in the direction forecast by the model take profits after a substantial move is made.

4. If the market seems to be going in the opposite direction get out fast.

For example, this morning the market was up slightly before the open but nothing significant. Then came the big fall after the open. Around 9:45am was the ideal time to cover the position. Or just where I decided to go long, a little later. This trade would have made around 13-14 points or $260-280 per contract. The clue that this is doable is that I decided to go long at NQ = 1775. So I'm capable of making the right decision in principle and just need to build that into a strategy.

Making a trade every day also makes it easier to take time out from trading. The psychological difficulty of this strategy is being disciplined to ignore the market for the rest of the day once I've closed the overnight trade. I'll call this strategy "overnight trading" as opposed to "day trading" :)

Of course if the market appears to be in a very strong trend it would make sense to place a stop and let the trade run after observing the morning conditions. This might be easier if I trade say 2 contracts and close one in the morning and let one run if conditions look favorable.

Santa Rally?

The market has been going up since July so maybe it is rather late in the day to talk about the "traditional" year-end "Santa Rally" in the stock market. But this period from the day before Christmas till a few days after is also a time of seasonal strength in the market. The model was still short going into this morning, but only marginally so and will probably be long by the end of the day. So I went long at NQ = 1775.00. Still trying to work out if that was the right move. More ominously for bulls is that at this turning point we are now clearly out of the persistently overbought conditions that have prevailed in the last few months. All my indicators are now coinciding and indicating a turn here. This isn't the case in the overbought state. So after this short rally be on the look out for a significant downtrend to develop.

12:14pm

Stopped out at 1771.25. I put the stop at the low of the day so far and it was taken out. If I'd just stuck with the model, which was still short, I would have been up... Not sure, may wait till after Christmas to place another trade.

12:14pm

Stopped out at 1771.25. I put the stop at the low of the day so far and it was taken out. If I'd just stuck with the model, which was still short, I would have been up... Not sure, may wait till after Christmas to place another trade.

Thursday, December 21, 2006

Don't Add to Successful Positions?

Brett Steenbarger writes in his blog to take some profits when a trade works out. This seems to run counter to the idea of letting winners run. Figuring out when to take some profits and when to let the trade run is a very tricky judgement. What I've learnt to my expense in the last couple of days is that when a trade works out well don't add to it even when there looks like plenty of upside left in theory. That's a less extreme version. Rather look to see if you should reverse direction and if so, then think of making a larger trade when you reverse direction. The market opened down yesterday and so dumbly I added to my short position and then the market ran up all day. Turning my winning trade into a losing trade. I covered some and then more this afternoon when the market finally began to reverse down again. Took some losses and left some of the position on the table to see if my original concept will work out.

Wednesday, December 20, 2006

Volatile Weather and Markets and the Demise of Mutual Funds?

This morning there was snow on the ground here in Burlington, VT and there were occasionally snow showers throughout the day. The markets opened steeply lower following a 15% plunge in the Thai stock market and the housing and PPI reports. The US Dollar fell a bit and the markets recovered, with the Dow and S&P 500 ending up on the day. The wave does look corrective on the NDX and the late day sell-off came pretty much where one would expect. The original model forecast was for Wednesday to be the first down day, so I am still expecting a down move tomorrow (which might rescue some of the bad intra-day trades I did today :)).

An interesting article about the potential demise of active mutual funds. Seems that the PF community is on board with the beta part of the story (buy index funds, ETFs, or futures) but doesn't recognize that some managers actually do add value (beta). The question is why pay a manager of a mutual fund or hedge fund to generate both alpha and beta returns when the beta can be bought very cheaply elsewhere. Maybe hedge funds as well will be forced to move to a model where managers are only rewarded for supplying alpha. Contrary to what the author writes, hedge fund managers are in most cases currently rewarded for both alpha and beta.

An interesting article about the potential demise of active mutual funds. Seems that the PF community is on board with the beta part of the story (buy index funds, ETFs, or futures) but doesn't recognize that some managers actually do add value (beta). The question is why pay a manager of a mutual fund or hedge fund to generate both alpha and beta returns when the beta can be bought very cheaply elsewhere. Maybe hedge funds as well will be forced to move to a model where managers are only rewarded for supplying alpha. Contrary to what the author writes, hedge fund managers are in most cases currently rewarded for both alpha and beta.

Tuesday, December 19, 2006

Closing the Australian Beta Trade

As the model has now switched to sell, I closed out the Australian positions I opened to increase my portfolio's beta. The results are as follows:

This is a margin account and so all the money to buy the shares was borrowed and the cost of interest needs to be figured into the profit. All the numbers are in Australian Dollars (1 AUD = 0.78 USD).

Overall I am happy with the result of this experiment :) But the after tax profit is a small fraction of the gross profit. Trading 2 NDX E-Mini (NQ) contracts is a similar size trade in terms of the underlying value of shares traded. Here is an imaginary NQ trade on Interactive Brokers which generates the same pre-tax profit of AUD 900. The results (in USD) would be as follows:

This trade actually provides more beta than the Australian trade I actually did. Fees are dramatically lower and the tax rate is lower too. The after tax profit on the Australian trade was USD 284. By the way, trading a single stock in Aus would only have lowered the combined fees by AUD 40 over what I paid to trade 3 different stocks as for this size trade CommSec charge 0.12% of the trade value (+ an AUD 10 fee for each trade on a margin account).

This is a margin account and so all the money to buy the shares was borrowed and the cost of interest needs to be figured into the profit. All the numbers are in Australian Dollars (1 AUD = 0.78 USD).

Overall I am happy with the result of this experiment :) But the after tax profit is a small fraction of the gross profit. Trading 2 NDX E-Mini (NQ) contracts is a similar size trade in terms of the underlying value of shares traded. Here is an imaginary NQ trade on Interactive Brokers which generates the same pre-tax profit of AUD 900. The results (in USD) would be as follows:

This trade actually provides more beta than the Australian trade I actually did. Fees are dramatically lower and the tax rate is lower too. The after tax profit on the Australian trade was USD 284. By the way, trading a single stock in Aus would only have lowered the combined fees by AUD 40 over what I paid to trade 3 different stocks as for this size trade CommSec charge 0.12% of the trade value (+ an AUD 10 fee for each trade on a margin account).

Early Reversal

Today's action resulted in a new downtrend starting earlier than expected.... though my old acquaintance Ground Zero was already short... the fluctuations in the market seem to be getting shorter in frequency. The breakout from the supposed symmetrical triangle failed as a result - it worked - but now we have fallen back into the triangle zone before making a new high on NDX. I'll close all the long trading positions and then look if I will actually take the short with a limited size.

I spent most of today travelling to Burlington, VT. Amazing how mild it was and how green the landscape sometimes looked on the way up here.... Definitely nothing like a Vermont winter here.

I spent most of today travelling to Burlington, VT. Amazing how mild it was and how green the landscape sometimes looked on the way up here.... Definitely nothing like a Vermont winter here.

Saturday, December 16, 2006

SEC Plans to Increase Net Worth Required to Invest in Hedge Funds

To $2.5million. I don't understand why the U.S. authorities want to keep hedge funds as a club only for the rich, which is the opposite of the trend in other countries. It is especially ridiculous given the increasing number of long-short mutual funds. Anyway, it is much easier to lose your money playing with options, borrowing to buy high-priced houses at the peak of the housing market, and in any number of other ways. Maybe some big hedge funds who won't be affected by the rule want to reduce the competition?

Perfect Storm

This morning's CPI and wage data. Stocks and bonds soared and the US Dollar dropped on the news. Perfect for more my portfolio. But will the massive opening gap hold, or should I sell my stock positions. QQQQ was $44.40 before the news and now is at $44.78 a few minutes later. There is a potential for $45 being an attractor today as it is options expiry day....

12:39pm

The NDX gap pretty much did fill in the end and $44.50 is looking like more of an attractor than $45. I should just trust the model and stay long through Tuesday I guess... The Aussie and 10 year bonds retraced a lot of their surge too.

12:39pm

The NDX gap pretty much did fill in the end and $44.50 is looking like more of an attractor than $45. I should just trust the model and stay long through Tuesday I guess... The Aussie and 10 year bonds retraced a lot of their surge too.

Friday, December 15, 2006

Two More Australian Positions

Just bought 1000 shares of NWS.AX and WDC.AX. The former - the News Corporation - is one of my favorite trading vehicles and it was down at the open today. The latter - Westfield - was on my shopping list yesterday and today was recommended by Clime Capital's CEO Roger Montgomery in his monthly letter to shareholders. Westfield is a huge owner and developer of shopping malls in Australia and the United States. It was founded and still run by the Lowy family. Frank Lowy is one of Australia's billionaires. Both these firms are family companies in a way though publicly traded. Still, I'm not planning an investment here really just a short term trade. Beta of the portfolio is now 1.31 and borrowing 41% of net worth.

The triangle set-up I talked about yesterday worked out and the rally on the NASDAQ does not seem complete yet. The model is signalling that the rally should last through the end of Tuesday at this point. I might be selling a lot of stuff Monday night (Tuesday in Australia) through Tuesday :)

The triangle set-up I talked about yesterday worked out and the rally on the NASDAQ does not seem complete yet. The model is signalling that the rally should last through the end of Tuesday at this point. I might be selling a lot of stuff Monday night (Tuesday in Australia) through Tuesday :)

Thursday, December 14, 2006

Bullish?

After the market managed to close up slightly and stay within the triangle the model is still forecasting upside for the next several days. Actually, a higher close would have made the model bring forward the next downtrend to start sooner. If the NASDAQ manages to break out of the triangle to the upside we could expect a significant rally. So I decided to start increasing my beta further. The plan was to buy 4-5 large cap high beta stocks in Australia. So far I only bought 3000 shares of AMP ($A9.58). If the trend is confirmed I will add more positions. What gives me pause and made me put the question mark in the title is that already the All Ordinaries index's rise so far this evening has resulted in a sell signal using my older "autoregressive model". But that model is rather unreliable and this could simply mean that a strong trend is underway.... Anyway best to be cautious. This move takes my portfolio beta up to 1.17 and total borrowing to 28% of net worth. Another of the stocks I was thinking about buying - Wesfarmers - has, of course, run up sharply since I decided not to buy it today :)

Surprisingly Strong Retail Sales

U.S. retail sales were up 1.1% in November. The consensus forecast was 0.2%. As a result, stocks and the U.S. dollar are up and bonds down. NQ futures are up 7.75 points at the moment (my positions bought yesterday are now in the money). I was actually worried the retail sales number might be low and sold out of a QQQQ position I bought yesterday afternoon just before the number came out and then bought back in just after for a loss of 3 cents per share (I sold the shares for an 11 cent profit - 3 cents is the difference between my buy and sell prices). Yes, I'm still very jittery.

10:28am

Oh well, the market closed the opening gap... and then some. Sometimes the gap closing trade works and sometimes not. I don't have a good theory about this yet. A lot of traders are watching this triangle:

I think it should break upwards, but at this point we are close to testing the downside.

10:28am

Oh well, the market closed the opening gap... and then some. Sometimes the gap closing trade works and sometimes not. I don't have a good theory about this yet. A lot of traders are watching this triangle:

I think it should break upwards, but at this point we are close to testing the downside.

Wednesday, December 13, 2006

FOMC Day

And I gingerly stepped back into the market... So far, just one NQ Mar 07 contract @ 1805.50. If an uptrend takes hold I may add to it. Though it was announced this morning that the US trade deficit narrowed significantly the USD is weak (AUD = 0.7864). Bonds are up slightly and stocks are down. I am a bit apprehensive of getting too bold before the FOMC announcement at 2:15pm. Bernanke is in China, so don't expect any surprises. The most significant thing that could happen I am thinking is if Jeffrey Lacker doesn't dissent from the decision and state that he thinks interest rates should be raised as he has at recent meetings. That could be bullish for stocks (or maybe not - my TA is pointing up in the stockmarket so I suspect it would be read bullishly - rather than a sign that the economy is even weaker). It would certainly be bullish for bonds and bad for the USD.

3:17pm

It's been a catching falling knives kind of day. The model was forecasting a slightly down day (after the level I mentioned yesterday didn't hold). So when the market opened down I thought that was a good time to buy. The market fell much more before the FOMC announcement though... Lacker dissented again. Apparently he is rotating off the FOMC after this meeting. At least the model is forecasting an uptrend now for the near future as I'm underwater on the two contracts I ended up buying (there was a third which I sold for a small gain). Bonds are up and the USD down after the announcement while stocks are up though very volatile.

3:17pm

It's been a catching falling knives kind of day. The model was forecasting a slightly down day (after the level I mentioned yesterday didn't hold). So when the market opened down I thought that was a good time to buy. The market fell much more before the FOMC announcement though... Lacker dissented again. Apparently he is rotating off the FOMC after this meeting. At least the model is forecasting an uptrend now for the near future as I'm underwater on the two contracts I ended up buying (there was a third which I sold for a small gain). Bonds are up and the USD down after the announcement while stocks are up though very volatile.

Tuesday, December 12, 2006

I Know What's Going to Happen...

but don't do anything about it.... same story as last week. The model forecast today as a down day, but my read of the intraday (and daily) charts came to the opposite conclusion. So I was hesitant to do anything. If the market stays up near it's current level (13-14 NDX points) the model forecasts Tuesday as an upday. Basically the market is forecasting a favorable FOMC report tomorrow afternoon. I'm pretty sure I can make money from trading on a full time basis but letting my attention drift can be fatal. And I can't fully focus on it. So that's why I'm not acting. I guess that is better than making more losing trades. And losing money makes me nervous and do dumb things.

This upcoming rally seems likely to be very short-lived though. I think it highly likely we are in an ending diagonal or some other topping action that will last much of this month.

On the foreign exchange front, my guess is that the US Dollar has just completed a fourth wave since October and new wave down is getting underway. This wave if it materializes will take the dollar to the support level that has held in the last couple of decades of 80 or so. Some kind of rally would seem likely from that point even if ultimately the support fails, even though I actually think that unlikely. Prices are already very high in Europe relative to the United States. In the end I believe that relative purchasing power will limit moves in currencies. If this is the case, the US Dollar can only keep on falling relative to the Pound and Euro if there is significantly higher inflation in the US than in Europe.

This upcoming rally seems likely to be very short-lived though. I think it highly likely we are in an ending diagonal or some other topping action that will last much of this month.

On the foreign exchange front, my guess is that the US Dollar has just completed a fourth wave since October and new wave down is getting underway. This wave if it materializes will take the dollar to the support level that has held in the last couple of decades of 80 or so. Some kind of rally would seem likely from that point even if ultimately the support fails, even though I actually think that unlikely. Prices are already very high in Europe relative to the United States. In the end I believe that relative purchasing power will limit moves in currencies. If this is the case, the US Dollar can only keep on falling relative to the Pound and Euro if there is significantly higher inflation in the US than in Europe.

Monday, December 11, 2006

Hyperopia

Interesting academic article which I found from today's New York Times Magazine. I've pondered whether some PF bloggers, particularly those in their 20's are being over-responsible and self-denying. At least based on what they write publicly. I don't regret not saving money during that period of my life and going into debt in order to study, travel, and enjoy life. Nowadays, I am pretty frugal but mainly because I have only gradually increased my material standard of living over time. I am not in any kind of struggle to avoid spending money. I just don't want a lot of "stuff". My saving also isn't directed at some distant "retirement" but rather at achieving "financial freedom" as soon as possible.

Anyway, the point of the article is to test the idea that over time feelings of guilt about not being responsible and overindulging oneself tend to decline, while feelings of regret about missing out on life's pleasures tend to intensify over time. The authors believe that their experimental results support these hypotheses.

Anyway, the point of the article is to test the idea that over time feelings of guilt about not being responsible and overindulging oneself tend to decline, while feelings of regret about missing out on life's pleasures tend to intensify over time. The authors believe that their experimental results support these hypotheses.

Saturday, December 09, 2006

Risk Aversion

Seems I've become very risk averse. That's why I set such a tight stop yesterday morning. But that resulted in me losing money on a day when I had predicted the market direction correctly and should have been making money. I thought about getting short around lunchtime. But was scared the market would run up again. It didn't. The market fell more in the afternoon. I'm still out of the market this morning and am watching the big employment reported. My guess was the market would move up in reaction. So far it has, but I didn't place a trade. Maybe there are times when you should just take a break from trading, like from all things. I'll think about getting into the market again next week (of course I am always 100% invested in a mix of stocks, bonds, funds etc., I am talking about short-term trading. Today is the last class of this semester. I've set my schedule for next semester to make it easier for me to trade. Teaching 4 days a week from 12-2. Plan on heavy market data days to get to campus fairly early and watch the pre-market, market, prepare class etc. Major action in terms of setting a direction in the market tends to be over by 11am I find... setting a stop after that is a lot safer than before 10am which is when my first class is at the moment.

The model trend should remain down over the weekend even if today is something of a rebound day. It is too early to tell if the initial uptrend will hold. Bonds are down and the dollar and stocks are up at this point. As often is the case, it is hard to see what in the report generated the spike in interest rates.

9:17am

Now stocks are down, the dollar is down, and bonds are off a little. Glad I didn't put a long trade on.

12:09pm

Got back from class and NDX is up 20+ points! Now the long trade is looking very good.... glad I'm just not trading :) Bonds are off quite a bit and the US Dollar is rallying strongly.

The model trend should remain down over the weekend even if today is something of a rebound day. It is too early to tell if the initial uptrend will hold. Bonds are down and the dollar and stocks are up at this point. As often is the case, it is hard to see what in the report generated the spike in interest rates.

9:17am

Now stocks are down, the dollar is down, and bonds are off a little. Glad I didn't put a long trade on.

12:09pm

Got back from class and NDX is up 20+ points! Now the long trade is looking very good.... glad I'm just not trading :) Bonds are off quite a bit and the US Dollar is rallying strongly.

Friday, December 08, 2006

Ouch - Stopped Out!

So far it looks like I predicted the direction of the market correctly yesterday. Had a meeting from 9-11 this morning and I set a stop. The stop was set at NQ (December) = 1808 which was the point where the stochastic would rise above 80 and negate the sell signal from the day before. The stop was hit and then the market dived. Lost $140 on the trade - guess it could be worse. But even when I'm right I am losing money which is discouraging. I'll wait for a bounce and re-evaluate whether to go short again.

Thursday, December 07, 2006

Model Switches to Sell

The model switched to sell at today's close. If the NDX had closed above 1802 the model would have remained on buy. This is a rather negative omen for bulls given that the high yesterday (c) did not exceed the previous high around Thanksgiving. As I mentioned, the move down from the top looked like an impulse wave in Elliott Wave terminology. The move up since then (a), (b) , (c) now looks like a corrective wave. So the coming wave down is a wave 3 or wave C.

Saturday, December 02, 2006

November Report

Investment Performance

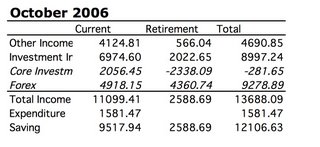

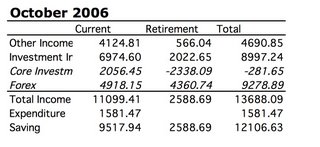

Investment return in US Dollars was 2.67% vs. a 2.88% gain in the MSCI World Index, which I use as my overall benchmark and a 1.90% gain in the S&P 500. The trading accounts lost money again... The contributions of the different investments and trades is as follows:

The returns on all the individual investments are net of foreign exchange movements. The biggest single contribution to US Dollar returns was the foreign currency gains, which appears at the bottom of the table. Powertel made a nice gain this month.

Asset Allocation

At the end of the month the portfolio had a beta of 0.89 (a 1% rise in the market would result in a 0.89% increase in the portfolio). 58% of the portfolio was in stocks, 46% in bonds, 7% in cash, and loans totalled -22%. The remainder was in the hedge fund type and real estate investments, futures value etc.

Net Worth Performance

Net worth rose by $US12,188 to $US354,596 and in Australian Dollars gained $A6809 to $A449,083.

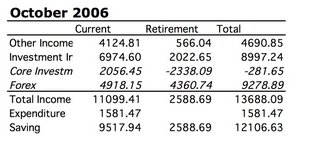

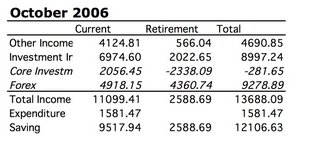

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions. Expenditure was $US1592 - almost exactly the same as last month - only 38% of take home pay ($4125).

Investment return in US Dollars was 2.67% vs. a 2.88% gain in the MSCI World Index, which I use as my overall benchmark and a 1.90% gain in the S&P 500. The trading accounts lost money again... The contributions of the different investments and trades is as follows:

The returns on all the individual investments are net of foreign exchange movements. The biggest single contribution to US Dollar returns was the foreign currency gains, which appears at the bottom of the table. Powertel made a nice gain this month.

Asset Allocation

At the end of the month the portfolio had a beta of 0.89 (a 1% rise in the market would result in a 0.89% increase in the portfolio). 58% of the portfolio was in stocks, 46% in bonds, 7% in cash, and loans totalled -22%. The remainder was in the hedge fund type and real estate investments, futures value etc.

Net Worth Performance

Net worth rose by $US12,188 to $US354,596 and in Australian Dollars gained $A6809 to $A449,083.

Income and Expenditure

Core investment income is total investment gains before taking into account the change in exchange rates. Other income is salary and retirement contributions. Expenditure was $US1592 - almost exactly the same as last month - only 38% of take home pay ($4125).

Wednesday, November 29, 2006

Model Forecasts - Trading Diary

At this point the NDX futures are up 5. If this holds or even if the index were to fall 12 points or so today the model is calling for a change of trend from Thursday. If we fall more than 12 points today then Thursday would open with oversold conditions if the index was unchanged from today's close. So that's the roadmap. Cover short positions today unless there is a huge selloff. Everything will depend on the economic data and Fed Beige Book published today.

Update: 10:47am

I did some NQ daytrading and am now holding the short positions with stops in around the day's highs. One theory is that the high today is the top of the B-Wave (in Elliott Wave Theory) of the correction that started on Friday. The big decline on Monday looks impulsive rather than a complete correction and the wave since then looks like an ABC formation. On the other hand, unless things reverse sharply here and the market ends down (which at the moment looks unlikely unless they totally hate the Fed Beige Book at 2pm) the model is saying to get long at today's close. So wait and see for the moment.

Update: 11:49am

The stops were hit while I was commuting and now I am flat. Though the market is off from the level of the stops (always annoying) I will remain flat till nearer 2pm. Have a meeting coming shortly for the next 1 hour or so. NDX could be making an ending diagonal formation intraday and if so it isn't complete.

Update: 2:34pm

Tha market doesn't hate the beige book, but so far it doesn't seem to like it either. I got long - waiting to see if that is the right stance.

Update: 8:29pm

In retrospect I would have been much better off without the stops.... I always have mixed feelings about stops. Sometimes I wish I had them and other times wish I didn't. I sold out of both long positions (QQQQ and NQ) by the end of the day. Will re-establish in the morning.

Update: 10:47am

I did some NQ daytrading and am now holding the short positions with stops in around the day's highs. One theory is that the high today is the top of the B-Wave (in Elliott Wave Theory) of the correction that started on Friday. The big decline on Monday looks impulsive rather than a complete correction and the wave since then looks like an ABC formation. On the other hand, unless things reverse sharply here and the market ends down (which at the moment looks unlikely unless they totally hate the Fed Beige Book at 2pm) the model is saying to get long at today's close. So wait and see for the moment.

Update: 11:49am

The stops were hit while I was commuting and now I am flat. Though the market is off from the level of the stops (always annoying) I will remain flat till nearer 2pm. Have a meeting coming shortly for the next 1 hour or so. NDX could be making an ending diagonal formation intraday and if so it isn't complete.

Update: 2:34pm

Tha market doesn't hate the beige book, but so far it doesn't seem to like it either. I got long - waiting to see if that is the right stance.

Update: 8:29pm

In retrospect I would have been much better off without the stops.... I always have mixed feelings about stops. Sometimes I wish I had them and other times wish I didn't. I sold out of both long positions (QQQQ and NQ) by the end of the day. Will re-establish in the morning.

Tuesday Update

The market rebounded a little today. Friday remains the likely timing for a more substantial upswing. That is unless we get to oversold conditions (stochastic less than 20) before that. For that to happen we need to get another serious selloff in the next couple of days. The Aussie Dollar rallied against me. My futures position is partially hedging the underlying exposure to the AUD so actually my USD net worth rose still due to this rally in the AUD, but much less than it could have. The "autoregressive model" is now giving a more emphatic sell signal today for the Aussie. Bonds rose too, which is good for me. So all in all today was probably a wash. I did a couple of NDX daytrades the losing one lost a little less than the winning one made so I guess that is OK too :)

Tomorrow we get a bunch more macro news including preliminary GDP, new home sales and the Fed's Beige Book. Today existing home sales were up, but as expected there was a year on year price decline again.

Tomorrow we get a bunch more macro news including preliminary GDP, new home sales and the Fed's Beige Book. Today existing home sales were up, but as expected there was a year on year price decline again.

Tuesday, November 28, 2006

Trading Update

I've been short NDX for a while and losing money. In strongly overbought situations it is hard to use "the model". Each time it seems to show that the overbought situation is ending there has been a quick reversal back to overbought conditions. A nimble trader could have played these intraday "buy the dip" situations we have been having. Today's down move brings me to about breakeven on the month. The model is now clearly short. Expect more downside. Friday though could be the beginning of a new uptrend. It could get going on Thursday already. Overall though my portfolio is up about 2% so far this month and now beating the market. I fully expect to lose money in Australia in the next few days, though.

Monday, November 27, 2006

Forex Update

I've been successful so far trading the Aussie Dollar on the long side - making $US814 so far (this is just futures contracts not gains on my actual Australian investments due to the rise in the AUD) - and now I have switched to the short side. I was long one contract and am now short one contract. So I have gone from almost 100% in Australian Dollars portfolio wide to about 50/50 Aussies and Greenbacks. The reason is because my "autoregressive model" gave a sell signal on the Friday close. I don't know how far the down move will go. It seems reasonable that the sharp fall in the US Dollar last week will correct somewhat even if the USD is headed down further after that. And the Aussie does look relatively weak. I've also relabeled my posts about currency trading as "Forex" instead of "Trading" so that they will be easier to find.

P.S. Noon Monday

I sold another AUD contract, taking my AUD exposure down to 23% and USD up to 67% (the rest is in funds exposed to other currencies).

P.S. Noon Monday

I sold another AUD contract, taking my AUD exposure down to 23% and USD up to 67% (the rest is in funds exposed to other currencies).

Saturday, November 25, 2006

Thanksgiving Conversation

As many other bloggers mention, we often find ourselves having conversations about finances with people we don't usually talk to about finances at occasions like Thanksgiving. And it is always amazing what people don't know. We were talking about looking for other jobs and relocating and someone mentioned: "It's a pity that retirement accounts are set up in America so that it makes it difficult to move jobs". With a bit of prodding it sounds like the guy has a 403(b) defined contribution account with TIAA-CREF just like I do. I told him that it probably isn't a barrier to moving but he should check with his HR people if he is thinking of moving so he knows what to do. I said anyway he could roll it over into an IRA even if he couldn't keep the account or transfer it to his new employer and then he could just start a new account with his new employer. Our host (early 50s, actually with a PhD in economics) then said: "how do you know if you have a defined benefit or defined contribution?" I explained, looks like she has defined benefit with state government and that could be an impediment to moving. If you stay with the state more than 20 years they up the benefit level and she's only been 16 years. That's what she said anyway. Then everyone commented that they hate thinking about this stuff and dealing with money... I didn't investigate why.

The first guy though did know how much was in his 403(b), how much he contributed each month, and had shifted some of the money to more aggressive options in the previous year. The host had an FSA (something I don't do because I think it's too much hassle) and knew all these things came out pre-tax. We also discussed the percentages my employer and I put into my 403(b).

The first guy though did know how much was in his 403(b), how much he contributed each month, and had shifted some of the money to more aggressive options in the previous year. The host had an FSA (something I don't do because I think it's too much hassle) and knew all these things came out pre-tax. We also discussed the percentages my employer and I put into my 403(b).

Tuesday, November 21, 2006

Investment Decisions

I have made the three investment decisions I've been discussing recently:

1. I am investing $7000 in the Hussman Strategic Growth Fund in my Roth IRA.

2. After my discussion with one of the portfolio managers, and reading up on their funds and approach to investing, I have decided to make an initial investment of $5000 (the minimum) in the TFS Market Neutral Fund. Currently, this fund is the top performer in Morningstar's long-short category. The fund's track record is short but over this time it shows strong upward movement, but short-term movements tend to be against the market. This indicates the fund has a low beta and high alpha which are desirable for a market neutral fund. This chart shows the fund's performance relative to the S&P 500:

The fund was particularly strong during the mid-year market meltdown and has beaten the market for the last 12 months and year to date. Other factors that I like are that the managers invest in the fund and also manage hedge funds through the same firm and that they have a particularly interesting compensation structure on a new fund they have launched, which includes an incentive fee, but could result in them receiving no compensation for the year. This suggests they are very confident of beating the market of course. Finally, they focus on quantitative investment and trading strategies.

3. I will max out my 403(b) contributions to my TIAA-CREF account, starting on December 1st.

The reason behind these moves is I don't want to add money to my U.S. trading accounts until they breakeven. I also don't want to devote more money to short-term trading until I can prove I can make profits consistently.

The Hussman and TFS Funds essentially give you a hedge fund without high hedge fund fees, high minimum investments, high net worth requirements, or low liquidity. These and other such funds are well worth considering as an alternative to traditional long-only mutual funds. I already invest in two hedge fund vehicles in Australia - one a fund of funds, and one a closed end fund that is similar to these two funds.

The two new funds add to my existing core investments. These are intended to be investments that do not need adjustment over the stock or business cycle. Eventually, I'd like to have around 50% of net worth in investments of this type I think.

1. I am investing $7000 in the Hussman Strategic Growth Fund in my Roth IRA.

2. After my discussion with one of the portfolio managers, and reading up on their funds and approach to investing, I have decided to make an initial investment of $5000 (the minimum) in the TFS Market Neutral Fund. Currently, this fund is the top performer in Morningstar's long-short category. The fund's track record is short but over this time it shows strong upward movement, but short-term movements tend to be against the market. This indicates the fund has a low beta and high alpha which are desirable for a market neutral fund. This chart shows the fund's performance relative to the S&P 500:

The fund was particularly strong during the mid-year market meltdown and has beaten the market for the last 12 months and year to date. Other factors that I like are that the managers invest in the fund and also manage hedge funds through the same firm and that they have a particularly interesting compensation structure on a new fund they have launched, which includes an incentive fee, but could result in them receiving no compensation for the year. This suggests they are very confident of beating the market of course. Finally, they focus on quantitative investment and trading strategies.

3. I will max out my 403(b) contributions to my TIAA-CREF account, starting on December 1st.

The reason behind these moves is I don't want to add money to my U.S. trading accounts until they breakeven. I also don't want to devote more money to short-term trading until I can prove I can make profits consistently.

The Hussman and TFS Funds essentially give you a hedge fund without high hedge fund fees, high minimum investments, high net worth requirements, or low liquidity. These and other such funds are well worth considering as an alternative to traditional long-only mutual funds. I already invest in two hedge fund vehicles in Australia - one a fund of funds, and one a closed end fund that is similar to these two funds.

The two new funds add to my existing core investments. These are intended to be investments that do not need adjustment over the stock or business cycle. Eventually, I'd like to have around 50% of net worth in investments of this type I think.

Sunday, November 19, 2006

Benefits Fair

I went to my employer's annual benefits fair on Friday. The fair is on the first day of the open enrollment period that runs till December 1st. Like a trade convention/fair on two floors, with tables for all the vendors. Full of people talking with the vendors' representatives and eating the free snacks. The only one I was really interested in was the TIAA-CREF rep. I asked him about supplemental retirement accounts (we are required to contribute 1% of salary and receive an 8% employer contribution - to contribute more than 1% you need to apply for a supplementary account). He was out of forms and told me to go visit HR's office. Back at my own office I downloaded the form from HR's website. Turns out that you can start a supplemental account and change your contribution every month! No need to wait for "open enrollment". I still need to make a final decision on this, but now I know I can reverse this any time and stop making additional contributions it feels a bit easier. I figure that going from a 1% employee contribution to the maximum allowed contribution ($1250 per month) will reduce each half-monthly take home pay check by only $380. That's not too bad.

Tuesday, November 14, 2006

Letter from the Australian Tax Office

Today, I received a letter from the Australian Tax Office regarding my past holding of IYS. This investment sold by Deutsche Bank is in the process of being wound up, though I have already sold. The ATO has disallowed some deductions and other features of the scheme , which apparently it regarded as being too aggressive in reducing tax. So they want to know what I reported on my 2001-2 tax Australian tax return regarding this investment (I moved to the US in July 2002). Luckily, I have all my old tax returns here and the spreadsheets I used in preparing them, so it took hardly any time to dig out the information. Now I know why I save all this stuff :) After mid-2002 I reported all income, deductions, and capital gains and losses on this investment to the US IRS. I hope I don't owe too much tax if any in Australia for that year.

Sunday, November 12, 2006

Inheritance

Claire is blogging again about money from family. I'm the first commenter on this post.

After reading some of the other comments on Claire's post I think there are some things that I should or could add. Somebody mentioned telling their parents what to spend. I certainly don't do that, except as I said in the post to tell my mother she is rich and can and should spend more money. I only advise on choosing other financial advisers and then work with them to make decisions on investments. My father asked my advice too while he was alive but never gave me any clue about how much money there was in total.

In the posts there is a strong emphasis on the merits of being self-made and self-reliant. I agree that these are very desirable. If I have children (I'm 41 now, but my father was 48 when I was born :)) it is probably something I am going to have to think about regarding them too. I know of cases where people who inherited money young were demotivated. The good cases seem mostly to share the trait that the children worked in the family business alongside the parents and eventually took it over. In my case I had no idea there was as much money as there is till I was 37 years old when my father died. We grew up very much at the lower end of the middle class. My father came from a formerly wealthy family - the main thing we inherited though then was attitudes to investment, risk, debt etc. I sometimes say he was nouveau pauvre - the newly poor and the exact opposite of the nouveau riche - the newly rich. His mother died in 1970 and legal battles among family took up many years after that. What he inherited was art and antiques. His father's family were in the art/antique dealing business. What he received was mainly inventory from his father's business. His father died in 1922 when my father was just 5-6 years old.

Over time he sold most of it. The final sale in 1996 was the biggest. These art works realised far more than the valuation. He was shocked how much he received. At the time he just told me it was much more than the valuation.

The point of this story is that people don't want their parents to sacrifice to leave them money. I fully agree with this. Our case is different in that the core of the wealth was handed down from the previous generation (the little we have salvaged actually - maybe this makes us more upper class than middle class however ludicrous that notion is), though my father saved plenty during his life time too. I think my mother should spend the income on what she has inherited. But she's not.

After reading some of the other comments on Claire's post I think there are some things that I should or could add. Somebody mentioned telling their parents what to spend. I certainly don't do that, except as I said in the post to tell my mother she is rich and can and should spend more money. I only advise on choosing other financial advisers and then work with them to make decisions on investments. My father asked my advice too while he was alive but never gave me any clue about how much money there was in total.

In the posts there is a strong emphasis on the merits of being self-made and self-reliant. I agree that these are very desirable. If I have children (I'm 41 now, but my father was 48 when I was born :)) it is probably something I am going to have to think about regarding them too. I know of cases where people who inherited money young were demotivated. The good cases seem mostly to share the trait that the children worked in the family business alongside the parents and eventually took it over. In my case I had no idea there was as much money as there is till I was 37 years old when my father died. We grew up very much at the lower end of the middle class. My father came from a formerly wealthy family - the main thing we inherited though then was attitudes to investment, risk, debt etc. I sometimes say he was nouveau pauvre - the newly poor and the exact opposite of the nouveau riche - the newly rich. His mother died in 1970 and legal battles among family took up many years after that. What he inherited was art and antiques. His father's family were in the art/antique dealing business. What he received was mainly inventory from his father's business. His father died in 1922 when my father was just 5-6 years old.

Over time he sold most of it. The final sale in 1996 was the biggest. These art works realised far more than the valuation. He was shocked how much he received. At the time he just told me it was much more than the valuation.

The point of this story is that people don't want their parents to sacrifice to leave them money. I fully agree with this. Our case is different in that the core of the wealth was handed down from the previous generation (the little we have salvaged actually - maybe this makes us more upper class than middle class however ludicrous that notion is), though my father saved plenty during his life time too. I think my mother should spend the income on what she has inherited. But she's not.

A Pair Trade?

Pair trades are one of the strategies commonly used by hedge funds. The idea is to buy a stock that is expected to perform well and short another stock in the same industry which is expected to underperform. A similar idea is to buy a portfolio of stocks that the investor expects to perform well and short index futures or ETFs etc. to remove the general market risk from the portfolio. The latter is the Hussman Strategic Growth Fund's strategy in perceived poor market conditions. I have been thinking for a while of shorting an ETF that attempts to replicate the Dow Jones REITs index - IYR. Many REITs have very high P/E ratios and high price to book ratios. Even if there were no decline in the property market it seems possible that their share prices should correct towards more historical price earnings and price book ratios. The rapid rise of IYR's share price is rather scary though for shorts.

On Friday I was reading about the upcoming IPO of hedge fund manager Fortress Investment Group. I noticed that they manage one NYSE listed REIT - Newcastle. This REIT invests in mortgages rather than actual property - largely commercial mortages. Its dividend yield is very high, its P/E is low and management is buying shares. What I don't understand is how it is managing to significantly increase earnings and dividends when it pays out 90% plus of earnings. Of course it seems strange to buy shares in a REIT when I expect a downturn in the property market.... I also have shares in my 403(b) in the TIAA Real Estate Fund. It invests directly in property and the value of the fund is based directly on the appraised value of the properties it owns. The share price cannot deviate from the fund's book value.

A solution to my reluctance to short IYR and concern about how NCT could increase earnings is to buy NCT and short IYR. It seems to me that IYR is overvalued relative to NCT. I am thinking to buy just 100 shares of NCT initially (less than 1% of net worth), but to short 100 shares of IYR (a little more than 2% of net worth). The additional short exposure to IYR will be partially hedging my TIAA Real Estate and Hudson City Bank Corp investments. For a complete hedge I'd need to short around 200 shares of IYR.

I am gradually moving short-term trading from my Ameritrade account to my Interactive Brokers account due to the tax advantages of futures trading and cheaper commissions at IB. So I am gradually turning my Ameritrade account into an investment account. I want to keep $25k of equity in the account in order to allow me to daytrade if I want to. So I want to have around $50k in investments in this account eventually (50% margin ratio). So far I have a little less than $8k (BRK/B and HCBK).

On Friday I was reading about the upcoming IPO of hedge fund manager Fortress Investment Group. I noticed that they manage one NYSE listed REIT - Newcastle. This REIT invests in mortgages rather than actual property - largely commercial mortages. Its dividend yield is very high, its P/E is low and management is buying shares. What I don't understand is how it is managing to significantly increase earnings and dividends when it pays out 90% plus of earnings. Of course it seems strange to buy shares in a REIT when I expect a downturn in the property market.... I also have shares in my 403(b) in the TIAA Real Estate Fund. It invests directly in property and the value of the fund is based directly on the appraised value of the properties it owns. The share price cannot deviate from the fund's book value.

A solution to my reluctance to short IYR and concern about how NCT could increase earnings is to buy NCT and short IYR. It seems to me that IYR is overvalued relative to NCT. I am thinking to buy just 100 shares of NCT initially (less than 1% of net worth), but to short 100 shares of IYR (a little more than 2% of net worth). The additional short exposure to IYR will be partially hedging my TIAA Real Estate and Hudson City Bank Corp investments. For a complete hedge I'd need to short around 200 shares of IYR.

I am gradually moving short-term trading from my Ameritrade account to my Interactive Brokers account due to the tax advantages of futures trading and cheaper commissions at IB. So I am gradually turning my Ameritrade account into an investment account. I want to keep $25k of equity in the account in order to allow me to daytrade if I want to. So I want to have around $50k in investments in this account eventually (50% margin ratio). So far I have a little less than $8k (BRK/B and HCBK).

Saturday, November 11, 2006

Currency Hedging and Exposure: Part III

Finally, I get to actual practical hedging strategies. But, first, I'll explain something about forex futures contracts. These are the contract sizes of the smallest futures contracts available in a few different currencies:

Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

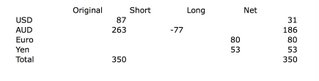

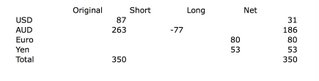

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.

Euro E-Mini E62,500

Australian Dollars $A100,000

Yen E-Mini Y6.25 million

$A100k is the minimum trade size. You can't trade only $A50k, for example.

To gain exposure to $A100,000, for example, you put down a margin of $US1000 and the value of your deposit then varies based on the underlying contract value. So if the Australian Dollar rises by 1 US cent your deposit becomes $US2000. If it moves the other way you have zero and must put up more margin (you actually need to do this as soon as the margin deposit falls below $US1000) or sell the contract. You can also short sell a contract to get negative exposure to the same amount. Short selling a contract means creating a new contract - the same as short-selling an option. But unlike selling an option you don't receive money up front for the contract - money flows into your account only if the value of the underlying asset falls. All these contracts are relative to the US Dollar. Shorting a contract converts an exposure to that currency into a USD exposure.

My net worth is $US350,000.$US87,000 or 25% is in US accounts - My 403(b) ($33k), Roth IRA ($8k), Ameritrade trading account ($26k), Interactive Brokers account ($10k), HSBC Online Savings Account ($9k), Checking Account etc. My Australian accounts have $US267k or $A349k.

Therefore, if I buy 1 AUD contract I convert $US77k of my USD exposure into Australian Dollars. I now have only $US10k of exposure to the US Dollar left. If I want to eliminate my Australian Dollar exposure I could short-sell 3 to 4 AUD contracts. Short selling 3 leaves me with $A49k exposure to the AUD. If I short-sell 4 contracts then my net US Dollar exposure is $US395k (4*77k+87k) and a net negative Australian Dollar exposure.

The preceding paragraph is one possible hedging strategy. If I am bullish on the USD I would short 3 AUD contracts and if I am bullish on the AUD I would buy one AUD contract. This will swing my exposure from almost all US Dollars to almost all Australian Dollars.

But, as I discussed in my previous post, that isn't a very diversified approach. To get a diversified currency exposure I could short sell 2 AUD contracts and buy 1 Euro and 2 Yen contracts. The resulting exposure is (here I resort to a spreadsheet!):

The net USD exposure is reduced because I converted $US154k of Australian Dollars into US Dollars but then bought $US186k of Euro and Yen. This results in an effective USD loan of $US32k (you don't actually borrow the money it is implicit in the contracts you are entering into). Borrowing money in a currency is just like shorting that currency. Because, my account is still relatively small, I can't avoid the lumpiness of the resulting exposure. Here is another example portfolio which is more bullish on the AUD (but still ends up shorting it!):

I short one AUD contract and buy 1 Yen and 1 Euro. It's possible to get net short in some of the currencies, but I think that is speculating rather than hedging and diversifying and not something I want to do. At least at the moment.

Right now I am long one AUD contract. My USD exposure is, therefore, 3% and my AUD exposure 97%. This hyperbullish stance on the Aussie probably doesn't make a lot of sense.

Friday, November 10, 2006

Currency Exposure and Hedging: Part II

Diversifcation makes sense in currency trading in the same way it makes sense in stock trading and investing. For example, in the last couple of days I thought the US Dollar would fall. Turned out I was right but the Australian Dollar also turned out to be weak. So just buying Australian Dollars did not turn out to be the way to profit from the move in the USD. In retrospect the Euro would have been the best choice. One couldn't have known that upfront but being diversified away from the US Dollar - holding say AUD, Euro, and Yen would have been a better strategy than just buying the Aussie. Don't put all your eggs in one basket.

Currency Exposure and Hedging: Part I

Most investors don't think about currency exposure and leave their portfolio in the currency of their home country. When they invest in foreign assets they may consider their currency exposure and either try to take advantage of changes in the value of the foreign currency relative to their own currency or hedge it away. For small investors this usually means buying a fund that hedges the foreign currency exposure back into the domestic currency. But currency exposure is a choice even if it is a default choice. If you don't do anything about it you do not have a neutral exposure but probably a big exposure to your home currency. Now, if you are for example a US investor it may make sense to have a portfolio denominated in US Dollars as when you get to actually spend some of the money you will be spending in US Dollars if you are still living in the United States. Diversifying runs the risk that if the US Dollar gains value against foreign currencies over time your portfolio will lose value in US Dollar terms. But if the US Dollar loses relative value over time diversifying would result in gains.

For an international investor like myself with 75% of my net worth in Australian accounts and 25% in US accounts, who isn't sure what country he or she will be living in in the future, currency strategy becomes much more important. From a low in 2001 of less than 50 U.S. Cents the Aussie rose to around 80 cents in 2004-5 and is now trading around 77 U.S. Cents. As most of my assets were still in Australia when I moved to the US in 2002 I gained tremendously from the rise in the Australian currency. Since moving to the US I have sent considerable savings back to Australia when the AUD was at a level that I perceived as attractive.

I don't know if the Aussie Dollar will keep rising. It is no longer undervalued like it was at the beginning of the decade and 80 U.S. Cents has provided resistance during the last decade. On the other hand, I don't see any compelling reasons to cause it to fall. So now we are in more of a trading environment.

As my net worth has grown the absolute dollar value of changes in the exchange rate have of course increased. My Australian Dollar exposure is $A341k. Therefore, a 1 cent move up or down in the Aussie changes my net worth in USD terms by $US3410. That's very nice when the Aussie is rising but not good news when it is falling. The changes in my net worth measured in Australian Dollars are much less of course.