Regal Partners just merged with VGI to create a new larger alternative fund manager that will be known by the former name. The company still trades under the VGI.AX ticker but is expected to switch to RPL.AX. It seems undervalued to me at a PE of 6 and so I bought some shares. Especially, as that is based on VGI's inferior track record to date.

Monday, June 06, 2022

New Investment: Regal Partners

Thursday, June 02, 2022

May 2022 Report

World markets stabilized with the MSCI World Index (USD gross) rising by 0.19% and the S&P 500 by 0.18%. On the other hand, the ASX 200 fell 2.43%. All these are total returns including dividends. The Australian Dollar rose from USD 0.7114 to USD 0.7177 increasing Australian Dollar returns and reducing USD returns. Our luck ended this month, and we lost 3.10% in Australian Dollar terms or 2.24% in US Dollar terms. The target portfolio lost 1.05% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 0.21% in US Dollar terms. So, we under-performed all benchmarks.

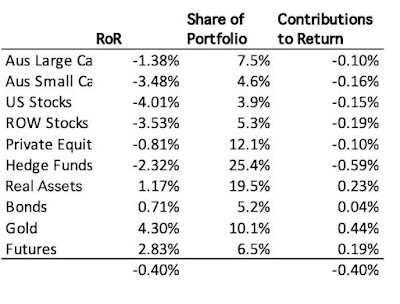

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Hedge funds were the worst drag on performance followed by gold. Only futures and real assets had positive returns.

Things that worked well this month:

- TIAA Real Estate (AUD 4k), Australian Dollar Futures (4k), and URF (also 4k) were the best performers.

What really didn't work:

- Tribeca Global Resources (- AUD 25k), gold (-19k), and Pershing Square Holdings (-18k) were the three worst performers...

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We are performing 1% per annum worse than the average hedge fund levered 1.67 times.

We moved a little bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think. On the other hand, around 47% of net worth (not including our house) are now in retirement accounts. Liquid investments are 57% of net worth and illiquid non-retirement investments are 13% of net worth. Because of leverage, the total is 117%.

We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month. It was a busy month.

- I bought 1,000 shares of 3i (III.L) after its share price fell in sympathy with US retailers like Target and Costco. I figured that the problems those faced probably weren't that similar to those faced by Action – 3i's European discount retailer. 3i also posted very good results recently.

- I sold all our shares in URF at 27 cents a share.

- I made additional investments in APSEC and the Australian Unity Diversified Property Fund.

- We made a small investment in a start-up via Unpopular Ventures syndicate.

- There were a lot of small trades involved with forex, tax loss harvesting, moving positions between accounts etc...

Wednesday, May 18, 2022

Invested in Another Startup

Unpopular Ventures offered a syndicated investment in the seed round of a start-up based in Europe. I can't give any details of the investment. Based on their projections, which I think look pretty unrealistic, it would be a fantastic investment but they have been growing very rapidly so far, have a lot of experience, and the valuation doesn't seem too crazy.

The investment is basically in a separate fund, where the general partners get 20% carry. They suggested investing USD 2,500 (minimum was USD 1,000) and I did that, following Meb's advice to invest a little in lots of different start-ups. I'm used to investing 1-2% or as little as 1/4% of the portfolio in an investment and this is more like 1/16%. On the one hand, I don't want to make too many different investments because of information overload. On the other hand, I can't do anything about this investment unless there is an exit or opportunity to invest more, so I don't really need to pay much attention to its performance.

Friday, May 13, 2022

Got Out of URF

After reading the most recent quarterly report I decided to get out of URF. I'm not optimistic that even if the shareholders vote against the sale deal we will eventually realize more for the investment and there is a big risk it is approved and we get less than the current market price. I exited yesterday and today at 27 cents per share for a net loss on the investment of AUD 2,300, which isn't too bad, I guess. Obivously, there are a lot of people thinking differently to me who want to buy in.

Sunday, May 08, 2022

So Far So Good

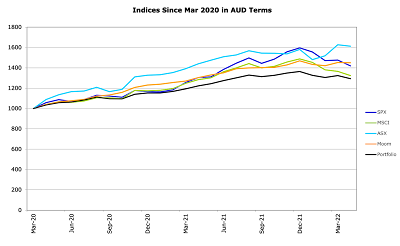

The graph tracks the performance of our portfolio (Moom, orange) since the March 2020 low versus various benchmarks. All of these are in Australian Dollar terms. So, for example, we multiply the S&P 500 index by the Australian Dollar - USD exchange rate and track that.

Our portfolio is now a little ahead of the S&P 500 and quite a bit ahead of the MSCI but has had a smoother ride than both. The ASX 200 is ahead of us, but has also been more volatile.The target portfolio (Portfolio, black) also has lower volatility but we have beaten it by fund selection and trading.

No guarantee that this performance continues, but our goal is to achieve market like returns with lower volatility. Also, it isn't as pretty in US Dollar terms. Our strategy is designed to give low volatility in Australian Dollar terms.

Saturday, May 07, 2022

April 2022 Report

World markets fell sharply with the MSCI World Index (USD gross) falling by 7.97%, the S&P 500 falling 8.72%, and the ASX 200 falling 0.85%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7494 to USD 0.7114 increasing Australian Dollar returns and reducing USD returns. We lost only 0.16% in Australian Dollar terms but lost 5.23% in US Dollar terms. The target portfolio lost by 2.34% in Australian Dollar terms and the HFRI hedge fund index is lost 0.93% in US Dollar terms. So, we out-performed all benchmarks apart from the HFRI index. I felt like I was losing a lot of money, but in Australian Dollar terms it wasn't that bad.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

In a reversal of last month real assets, gold, and futures gained money, while other asset classes lost. Real assets were negatively affected by the URF debacle. Rest of the world stocks were negatively affected by the China Fund. Gold rose in Australian Dollar terms, though the USD price fell. US stocks performed worst and detracted from performance most, while gold performed best and contributed most to performance.

Things that worked well this month:- Gold gained AUD 21k, Winton Global Alpha 10k, Tribeca Global Resources (TGF.AX) 11k, and Aspect Diversified Futures 8k.

What really didn't work:

- Pershing Square Holdings (-22k), Australian Dollar Futures (-17k), and Hearts and Minds (HM1.AX, -11k) all lost more than AUD 10k.

Our SMSF continues to perform quite well compared to our employer superannuation funds:

They're all indexed to 1000 in April 2021.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We are basically performing a bit worse than the average hedge fund levered 1.67 times. Hedge funds have been doing well recently.

I adjusted the leverage on the URF.AX investment to roughly 3:1 in our gross asset allocation as there still seems some possibility that the wind-up deal will be voted down by the shareholders.

We moved a little bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month. It was a busy month.

- I invested in the Unpopular Ventures rolling fund on the AngelList platform. The initial investment is USD 10k and then the same amount each quarter for eight quarters.

- Our listed investments trusts are now all in a CommSec account within

the SMSF, which means I get accurate tax reporting and can subscribe to

dividend reinvestment, which I did.

- I sold 10k shares in Pengana Private Equity (PE1.AX). These were shares in my name that I held to get accurate tax reporting, which I don't need any more. I sold at AUD 1.69 and the price is now AUD 1.49. So, that was a good move.

- I sold AUD 30k for USD and bought one more AUD futures contract, increasing AUD exposure by about 100k, which was a mistake.

- I withdrew AUD 25k from Domacom Investments after two crowdfunding campaigns just vaporized.

- But I started accumulating units in another property at

Domacom. It is a market garden property near the planned Badgery's Creek

Airport. 60 Devonshire Road, Rossmore.

- I bought 12.5k WAM Leaders shares (WLE.AX).

- I invested AUD 10k in the Winton Global Alpha Fund, which has been doing well recently, for a change as I predicted. Seems futures work well in inflationary environments but not in low inflation environments. I based this opinion on this research.

- I invested AUD 10k in the Australian Unity Diversified Property Fund.

- I bought AUD 7k shares in Pendal as a merger arbitrage play.

- I invested in a new painting at Masterworks: "No Hopeless". I felt this might be over-valued but took the plunge anyway.

Monday, April 25, 2022

Two New Investments

I invested in another painting at Masterworks, No Hopeless by Yoshitomo Nara:

This takes my investment back up to 12 paintings again, given that Doppelbild by Albert Oehlen was sold and should pay out soon. I was a bit nervous this was overvalued but after a bit of research took the plunge anyway and invested USD 10k.

I also started buying units in a property on Domacom: 60 Devonshire Road, Rossmore, which is a market garden near the planned Badgery's Creek Airport. After the initial investors paid up big fees for the establishment of the investment, it trades below par but at the last valuation saw an uptick in value. I am thinking now it makes more sense to buy in the secondary market on Domacom instead of joining "campaigns" that seem to go nowhere.

So far, I only invested AUD 920, but have a bid open waiting for sellers.

Wednesday, April 06, 2022

Unpopular Ventures

- It has good historic returns.

- Meb is an investor, which I see as a good sign.

- It not only invests in the US but also in other countries, and in particular, developing countries and regions like India and Latin America. These regions are not as competitive for venture capital as the US market and so it should be able to get into investments at better valuations in theory. I guess exits might not be as highly valued either... but diversification is good.

Until now, we only had venture capital investments in Australia through Aura Ventures funds and the listed Wilson Asset Management Alternative Assets Fund (WMA.AX).

Tuesday, April 05, 2022

New Trade: Pendal

I bought a position in Pendal (PDL.AX). Yesterday, they announced that they got a takeover offer from Perpetual (PPT.AX) for the equivalent of AUD 6.23 per share. The price isn't a constant as it is about 2/3 in terms of Perpetual shares. The stock was trading around AUD 5.25 after being higher yesterday, but PPT was trading up on yesterday. Analysts say the stock is undervalued and a strong buy after falling a lot in the last year, prior to the bid. So, I didn't see lot of downside in this.

In other news, URF.AX is now up to AUD 0.24, 10% above the AUD 0.22 that investors are supposed to eventually receive. I can't sell as my shares are in transit from Interactive Brokers to Commonwealth Securities. They have now left Interactive Brokers, but haven't shown up yet at CommSec...

Monday, April 04, 2022

Domacom Appoints New Chairman and CEO

I can see scope for improving the fractional investing product. I find the financial information provided on existing investments to be unclear and non-transparent. The level of explanation really needs to be stepped up to make secondary investors willing to participate and increase market liquidity in my opinion. I have only invested in one secondary investment, which is now exiting. I signed up to several "campaigns" but there is glacial progress on raising funds for them. I just discovered that two of them seem to have given up and released the pledged cash back to investors.

Hopefully, these things will improve going forward. Maybe I should send the new chairman (who is my honorary colleague) a letter with my thoughts :)

Saturday, April 02, 2022

March 2022

World markets rebounded with the MSCI World Index (USD gross) rising by 2.22%, the S&P 500 by 3.71%, and the ASX 200 rising by 7.10%. All these are total returns including dividends. The Australian Dollar rose from USD 0.7248 to USD 0.7494 reducing Australian Dollar returns and increasing USD returns. We gained 1.89% in Australian Dollar terms or 5.35% in US Dollar terms. The target portfolio rose by 0.75% in Australian Dollar terms and the HFRI hedge fund index is expected to rise 1.11% in US Dollar terms. So, we under-performed the ASX200, but outperformed all the other benchmarks.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Real assets, gold, and rest of the world stocks lost money, while other asset classes gained. Real assets were negatively affected by the URF debacle. Rest of the world stocks were negatively affected by the China Fund. Gold fell in Australian Dollar terms, though the USD price rose. Futures performed best, and hedge funds contributed most to performance.

Things that worked well this month:- The three top performers were all hedge funds: Tribeca Global Resources (TGF.AX) gained AUD 35k, Regal Funds (RF1.AX) AUD 30k, and Pershing Squre Holdings (PSH.L) AUD 27k. These were followed by the Winton Global Alpha Fund with an AUD 14k gain.

What really didn't work:

-

URF.AX lost AUD 22k when the fund announced they were selling their portfolio at a discount. Gold was second worst with an AUD 19k loss.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We are basically performing like the average hedge fund levered 1.64 times.I adjusted the leverage on the URF.AX investment down to 1:1 in our gross asset allocation as it is supposedly no longer exposed to movement of the actual real estate portfolio. On the other hand, since the end of the month, the share price has bounced back above the 22 cents which shareholders are supposed to receive as a distribution later this year while the convertible bonds are trading at an 18% discount to face value. This suggests that the market doesn't think that the stated deal is final. After all, URF shareholders need to vote on it.

This changed our asset allocation a lot. Real assets are now the most underweight asset class and hedge funds the most overweight. We moved nearer to the target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- I sold AUD 125k in exchange for US dollars.

- I sold 2,000 shares of PMGOLD.AX equivalent to 20 ounces of gold.

- I sold 1,000 shares of Fortescue Metals (FMG.AX).

- I sold 10,000 shares of URF.AX. Only 5% of our position.

- I sold 7,039 shares of RF1.AX.

- We are exercising the rights distributed by Pengana Private Equity (PE1.AX).

- I am preparing to invest in a venture capital fund on the AngelList platform. I was trying to invest through our SMSF but that ran into problems...

Thursday, March 31, 2022

Related-Party Asset

"A partnership can elect to be taxed as a Limited Liability Company (LLC) in USA or a partnership under the tax law due to the elections that the LLCs make with the US Internal Revenue Office. It is common for such partnerships (US) to be taxed as a company.

To support compliance with SISA/SISR for investments in Limited partnerships we note the following potential scenarios and information for audit purposes:

- Where the entity is taxed as an LLC, this supports that the LP should be treated as a company where the members of the Fund are not members of the LP and the investment therefore is considered as an investment in an unrelated entity. This is usually able to be ascertained from the financial report of the LP.

- Where the entity is taxed as an LP, and the members of the fund are not members of the LP, and the investment is in within a limited capital account arrangement. This is usually able to be ascertained from the financial report and the application agreements.

- Where the entity is taxed as an LP, and the members of the fund are members of the LP.

If the investment falls into scenario 2 and 3 then the investment would classified as an in-house asset which would mean it needs to be below 5% of the SMSF’s total assets."

It seems that this falls under scenario 3. I just sent AngelList an email to check. The problem is that the minimum investment required, let alone subsequent hoped for appreciation, would take us over the 5% limit. So, it seems it is not really true that you can invest in anything you like through an SMSF. It seems silly to me to treat a fund where I am only investing through the SMSF along with 1500 other investors as a "related-party asset". Probably, I will need to invest in this fund using my own name and pay higher tax than I would through the SMSF.

Tuesday, March 29, 2022

Still Trying to Transfer Shares

So, I have been trying to transfer our holdings of listed investment trusts from our SMSF's Interactive Brokers account to a new account I set up with Commonwealth Securities. I first sent the required form to Commonwealth Securities 6 weeks ago. After nothing happened for three weeks I emailed them again. They then sent me the next day a text message telling me to phone. They told me that I needed to change some details on the form. I sent a new form in. Again nothing. Yesterday, I again emailed them. Today, they again texted me and I phoned them. They said that Interactive Brokers were not accepting the transfer and I should initiate it at that broker instead. I have just done that. All online of course, no paper forms required. Let's see if it works. I don't want to have to sell and rebuy the shares again as there is a AUD 34k capital gain plus two sets of commissions and slippage.

But this service from CommSec where they just forget about the request for 3 weeks until they are reminded again is really not good!

P.S. 6Apr22

Success! The shares have arrived at CommSec.

Monday, March 28, 2022

Another Sale and a Failed Auction

Following the recent record gain on a townhouse, a freestanding house sold in our development last Thursday but the price hasn't been disclosed yet. On Saturday, there was an auction of another townhouse. I went to the auction and there were no bidders. The condition of the property wasn't that great.

P.S. 29 March

The townhouse has been listed at "offers above $829k".

URF Selling Property Portfolio

The U.S. Masters Residential Property Fund (URF.AX) announced they are selling their property portfolio at a discount. As a result, they will pay out URFPA holders at the AUD 100 face value of the units, but ordinary equity owners of URF.AX will only get 22 cents per unit.

I didn't manage to get out in the initial auction and the price is now at 20 cents. I am down AUD 25k for this month and a AUD 15k loss overall at this point. This is my 5th worst trade or investment ever at this point.

However, this is a 10% return from here and so I guess I will hold for the moment. That will turn it into the 10th or 11th worst investment.

This was always a speculative investment and so I didn't invest too much in it. It represented 1.36% of net worth not including our house prior to this announcement. However, there are still some lessons to be learned:

1. When they recently said that they were likely going to sell the portfolio at a discount I should have sold then.

2. I should have invested in the URFPA units all along. I was put off investing in them because of their complicated structure/conditions. But they were safer than URF.AX and had a lot of potential upside.

3. There's often a good reason why the market seems to undervalue an investment. Turns out it didn't undervalue it enough, though!

4. Still, the 5th and 10th best investments have made roughly 10 times what this has lost at the moment.

In other bad news, Domacom settled the dispute for only AUD 2.5 million. That will only last them 6 months...

Saturday, March 12, 2022

New Record Gain for our Development

This townhouse sold for AUD 835k:

That is a 101% gain on its original 2008 sale price, the largest gain to date in our development. This is also more than the AUD 740k we paid for our house. I added all the townhouse sales to my valuation model and it comes up with a value of AUD 1.307 million for our house for 2022. Of course, this is based just on this single sale for 2022. But there is another auction coming up later this month, which will provide another datapoint. I use a single value for our house for a year at a time. This new value also pushes us over another big round number networth wise, which I once thought we wouldn't reach till the end of 2024.

Wednesday, March 02, 2022

February 2022 Report

World markets fell but the Australian market rose with the MSCI World Index (USD gross) falling by 2.55%, the S&P 500 by 2.99%, and the ASX 200 rising by 1.66%. All these are total returns including dividends. The Australian Dollar rose from USD 0.7063 to USD 0.7248 reducing Australian Dollar returns and increasing USD returns. We lost 1.10% in Australian Dollar terms but gained 1.49% in US Dollar terms. The target portfolio fell 2.38% in Australian Dollar terms and the HFRI hedge fund index is expected to fall 1.09% in US Dollar terms. So, we under-performed the ASX200, outperformed the other benchmarks.

It was a bit calmer month despite war breaking out in Ukraine at the end of the month. We continued to work on setting up a second brokerage account for the SMSF and transferring our holdings of listed investment trusts into it.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

All the equity categories lost money, while all the others gained. Gold both performed best and added the most to returns. US stocks was the worst performer while hedge funds detracted most from performance.

- Gold gained AUD 26k. WAM Alternatives (WMA.AX) and URF.AX were the next two best performers, gaining AUD 10k and AUD 6k, respectively.

- Hearts and Minds (HM1.AX) and Cadence Opportunities (CDO.AX) were the two worst performers, losing AUD 13k and AUD 11k, respectively.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 but not so much against the other two benchmarks, which are measured in USD terms.

Our asset allocation did not change much. Private equity is still the most underweight asset class and real assets the most overweight. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- As the gold price rose, the share of gold in gross assets went over 10% and following policy I sold 500 shares of PMGOLD.AX to bring it back to 10%.

- I sold 1,000 shares of Fortescue Metals (FMG,AX). Should have sold more...

- I opened a new position in WAM Leaders (WLE.AX), buying 20,000 shares so far.

- I bought 6k shares in Pengana Private Equity (PE1.AX) when the price was low.

- I sold 3k shares of Regal Funds (RF1.AX) to fund this.

- I heard that our investment in Doyle's farm through Domacom will be wound up and sold. The majority of holders voted to do this. This is my only active investment through Domacom, so a bit disappointing. Hopefully, we won't lose too much considering selling costs and that we have had very little upside so far in this investment. The management company, Domacom (DCL.AX), also doesn't look like relisting on the ASX any time soon.

- On the other hand, Masterworks sold their second painting, which turns out to be one I hold.

Thursday, February 24, 2022

Good and Bad News: Masterworks Sells Doppelbild by Oehlen and Domacom Goes to Court with AustAgri

It's one of the paintings I invested in. The price uplift is 43%. They are claiming a 33% IRR after fees. My original investment was in early January 2021. US investors will receive payment in their "Masterworks Wallet". Don't know how foreign investors will be paid yet. I still have shares in 11 paintings I have invested in.

To counter this good news, Domacom (DCL.AX) announced today that AustAgri haven't onboarded Cedar Meats to the Domacom platform. Domacom is, therefore, demanding the AUD 8.5 million break fee, but AustAgri is disputing that they owe anything and it is going to court. This deal always sounded strange. If they have the funding to acquire Cedar Meats from other sources why would they need to pay fees to Domacom? I expect that Domacom will remain suspended from the ASX. I am pretty sceptical of recovering any of this investment at this point.

Friday, February 18, 2022

Annual Report 2021: Contributions of Individual Investments

I think all investment valuations for 2021 are now in. So, as I promised here is the profit or loss on each individual investment. We didn't hold all of these at the same time. Currently we have about 37 investments.* This doesn't account for investment costs, the most important of which is interest, or other investment returns like interest on bank accounts, of which there is very little.

Of course, this doesn't control for the size of each investment. Generally, the losing investments were smaller, with the exception of Hearts and Minds. Still even that investment was not as bug as the two top investments in terms of performances or the really large investments in the two superannuation funds. This means our capital allocation made sense and helped generate strong returns this year.* Counting all 12 paintings at Masterworks as a single investment, for example.

Tuesday, February 15, 2022

New Investment: WAM Leaders

I bought some shares of WAM Leaders (WLE.AX) in our SMSF. The position is only 0.16% of the total portfolio so far but I will likely add to it. This is because the allocation model says that we need more Australian large cap shares. Previously, I held Argo (ARG.AX) but that is trading at more of a premium and seems that this performs better. Here is a comparison of WAM Leaders with an ASX200 ETF (A200.AX):

On top of this, WLE has a higher dividend yield...

Thursday, February 03, 2022

January 2022 Report

Stock markets fell, with the MSCI World Index (USD gross) falling by 4.89%, the S&P 500 by 5.17%, and the ASX 200 by 5.80%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7266 to USD 0.7063 reducing Australian Dollar losses and increasing USD losses. We lost 2.28% in Australian Dollar terms or 4.94% in US Dollar terms. The target portfolio is expected to lose 2.53% in Australian Dollar terms and the HFRI hedge fund index is expected to fall 2.16% in US Dollar terms. So, we out-performed the ASX200, the S&P 500, and the target portfolio, and underperformed the other two benchmarks. Of course, we are trying to optimize AUD returns. This means USD returns will be a lot more volatile. The currency neutral return for the month – where we just look at the gains on each investment in its own currency and ignore appreciation or depreciation of assets due to exchange rate changes was 2.82%. This tends to be close to the Australian Dollar return because we hold a lot of foreign investments in Australian Dollar denominated funds.

It was a busy month with a lot of trading. Quite a bit of this was for tax loss harvesting, selling in one of our names and buying in the other.

The record-breaking run of winning months in Australian Dollar (and currency neutral) terms finally ended. We hadn't had a losing month since March 2020. This was a 21 months run. We had several monthly US Dollar losses in that time.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Futures performed best. Gold made the largest contribution, but that was only because we hold it in an Australian ETF (PMGOLD.AX). The price of gold in Australian Dollars was boosted by the fall in the exchange rate. Aus small cap and US stocks were the worst performers while hedge funds detracted most from performance.

- Gold gained AUD 11k. Other gainers included Winton Global Alpha (AUD 7k), Aspect Futures (AUD 5k), Cadence Capital (CDM.AX), Fortescue Metals (FMG.AX), Pengana Private Equity (PE1.AX)...

- Hearts and Minds (HM1.AX) lost AUD 37k, while Pershing Square Holdings (PSH.L), Regal

Funds (RF1.AX), and Unisuper each lost AUD 24-25k constituting the majority of our total loss. This is the downside to

benefiting from the upside in the latter two. I'm beginning to question

whether HM1 is a good investment and am thinking of reducing our

position. In theory, it is attractive to invest in fund managers "best ideas", but when those are all overvalued growth stocks, there is a problem.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the other two benchmarks, which are measured in USD terms.

Our asset allocation got a little closer to our long-run asset allocation. Private equity is the most underweight asset class and real assets the most overweight. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- I sold and bought Pengana Private Equity (PE1.AX) shares, which were trading a lot above NAV and then near NAV. I ended up increasing the position by around 6k shares.

- I bought 3k Hearts and Minds (HM1.AX) shares, which was a mistake so far.

- I sold 1,000 Fortescue Metals (FMG.AX) shares, to trim my position a bit. Then I bought back at a lower price.

- I bought a net 11k Regal Funds (RF1.AX) shares.

- I sold 2k Ruffer shares (RICA.L) to get liquidity.

- I net added around 1k of Cadence Opportunities (CDO.AX).

- I net added about 0.5k (WAM Strategic Value) WAR.AX shares.

- I closed our position in MCP Income Opportunities (MOT.AX).

- I did a couple of small futures trades.

- I started opening a second brokerage account for the SMSF with CommSec. The idea is to hold our listed trusts (RF1.AX, PE1.AX, URF.AX) in this account in order to get proper tax statements from the share registries. The tax data that Interactive Brokers provides for these is incorrect but I discovered that they are now sharing it with the ATO who challenged Moominmama's tax return from a couple of years back... So ATO believes the incorrect data...

Update on TIAA Real Estate Fund

Back in May, I predicted that the TIAA Real Estate Fund would perform well and shifted almost all my US retirement account into it. Well, it has done exactly that:

Since May it has gained 14.4%, while the Social Choice fund gained only 1.3%! I wish all my predictions were this good and I hadn't left anything in the Social Choice fund. The question now is when to start switching back again.

How Has Our SMSF Done So Far?

We have been fully invested in the SMSF for 9 months now. It's more volatile than PSSAP – Moominmama's employer super fund and about as volatile as Unisuper – my employer super fund. It has higher mean returns than both of them so far: 1.32% per month vs. 0.30% for Unisuper and 0.81% for PSSAP. Unisuper's return has really been brought down by a more than 5% loss in January. By contrast, the SMSF lost 1.18% (preliminary) and PSSAP 1.52%. If I regress the SMSF returns on the Unisuper returns I get a beta of 0.34 and alpha of 16% p.a. Of course, these are really early days and I don't expect that to hold up. I will want to see a longer track record before considering rolling over any of our employer superannuation into the SMSF.

Monday, January 24, 2022

How is Our Portfolio Holding Up in the Downturn?

Looks like this will be our first down month since March 2020. At this point, we are roughly down 1.75% in AUD terms and 2.95% in USD terms for the month. By comparison, the ASX 200 is down 3.62%, the MSCI down 5.52% and the S&P 500 down 7.2%. So, we are capturing about half the downside, which is roughly what I expect. We're only 1.5% below the ASX200 total returns over the last 10 years here (207.5% vs. 209%) and beat it at all horizons through five years...

Gold is the strongest performer in dollar terms so far this month. Regal Funds and Hearts and Minds are neck and neck for worst performer in dollar terms. US stocks are the

worst asset class (-7.22%) and futures the best (2.68%).

Monday, January 17, 2022

Australian Unity Merger Terminated

Saturday, January 08, 2022

Annual Report 2021

The biggest development this year at Moomin Valley is that we set up the SMSF. We also finished investing the money we inherited in late 2018. I also reviewed all our existing investments to decide which to drop. Investment returns were again very strong. We exceeded the net worth projection in last year's report, which at the time I thought was crazy. In my academic career, I didn't feel very productive. Mainly I worked on completing research projects started in previous years, though there was one project that started right at the end of last year that we have already submitted for publication. I was frustrated with online teaching in the first half of the year and then with the second lockdown in Canberra in the second half of the year. Luckily, we could send our younger child to daycare throughout the lockdown this time. The estimated value of our house rose sharply in line with market trends and we closed some of the lag to the general housing market that we have experienced since buying here. At the end of the year, we went for our first trip outside our local region since the pandemic started, to South Durras, NSW:

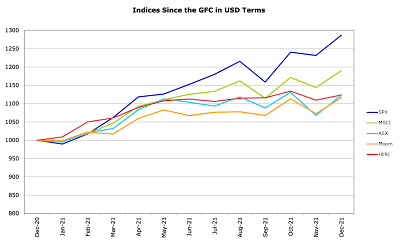

In Australian Dollar terms we gained 18.8% for the year and in USD terms we gained 11.7% because of the decline in the Australian Dollar over the year. The MSCI gained 19.0% in USD terms and the ASX 200 only 19.5% in AUD terms. The HFRI hedge fund index gained 12.4% in USD terms. Our target portfolio gained 17.4% in AUD terms. So, we only beat the target portfolio benchmark this year. This is expected in a strong bull market.

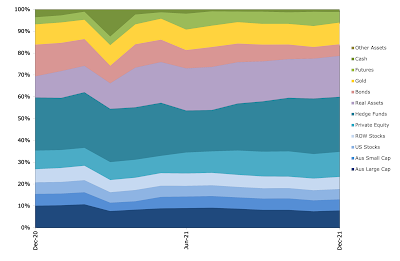

The main changes in allocation over the year were that we continued to reduce our bonds allocation while increasing real assets and private equity mostly:

The blip in the early part of the year is when we transferred funds from Colonial First State to the SMSF. The CFS funds were all converted to cash.

Accounts

Here are our annual accounts in Australian Dollars:

Percentage changes are for the total numbers. There are lots of quirks in the way I compute the accounts, which have gradually evolved over time. There is an explanation at the end of this post.

We earned $166k after tax in salary, business related refunds, medical payment refunds, tax refunds etc. This was up 17% on 2020 because Moominmama went back to work. We earned (pre-tax including unrealized capital gains) $485k on non-retirement account investments. A small amount of the gains were due to the fall in the Australian Dollar (forex). We gained $278k on retirement accounts with $37k in employer retirement contributions (more details below). The big difference to last year, is that instead of the value of our house falling, I estimate it rose by $246k. As a result, investment income totalled $1.008 million and total income $1.211 million.

$19k of the current pre-tax investment income was tax credits – we don't actually get that money so we need to deduct it to get to the change in net worth. We transferred $374k into retirement accounts (ultimately the SMSF) from existing savings.

The change in current net worth, was therefore $1234k. Looking at just saving from non-investment income, we dissaved $344k. So, before the transfer to retirement accounts we saved about $31k (19%) from salaries etc.

We made $37k in pre-tax contributions to retirement accounts (after the 15% contribution tax) and made an estimated $278k in pre-tax returns. $20k in "tax credits" is an adjustment needed to get from the number I calculate as a pre-tax return to the after tax number. Taxes on returns are just estimated because apart from the SMSF all we get to see are the after tax returns. I do this exercise to make retirement and non-retirement returns comparable. Net worth of retirement accounts increased by $668k.

How Does This Compare to My Projection for This Year?

Last year my baseline projection for 2021 was for a very high 19% rate of return, a 6% increase in spending, and flat other income, leading to an $800k increase in net worth to around $5.7 million. This just seemed like too much to me so I also made a "more sensible projection" of an increase of $400k to around $5.3 million. Investment returns matched the baseline projections very closely. The additional gain in net worth is mainly due to the estimated increase in the value of our house. Using the same methodology, the baseline projection for 2022 is for a 16% rate of return, no increase in the value of our home, flat other income, and 6% growth in spending. This results in net worth increasing by $800k to around $6.7 million. Again, anything could happen.

Notes to the Accounts

Current account includes everything that is not related to retirement accounts and housing account income and spending. Then the other two are fairly self-explanatory. However, property taxes etc. are included in the current account. Since we notionally converted the mortgage to an investment loan, mortgage interest is counted in current investment costs. So, the only item in the housing account now is increases or decreases in the value of our house. This simplified the accounts a lot but I still keep a lot of cells in the spreadsheet that might again be used in the future.

Tuesday, January 04, 2022

December 2021 Report

Stock markets performed very strongly, with the MSCI World Index rising by 4.03%, the S&P 500 by 4.48%, and the ASX 200 by 3.15%. All these are total returns including dividends. The Australian Dollar rose from USD 0.7122 to USD 0.7261 reducing Australian Dollar returns and increasing USD returns. We gained 2.14% in Australian Dollar terms or 4.14% in US Dollar terms. The target portfolio is expected to gain 1.13% in Australian Dollar terms and the HFRI hedge fund index is expected to rise 1.90% in US Dollar terms. So, we out-performed three of the benchmarks but underperformed the S&P 500 and the ASX 200. Though I track performance against the S&P 500, it isn't really a benchmark, as I can't imagine investing all my assets in it. This month's numbers are very preliminary though. The returns for two of the top performing investments are just estimates based on historical internal rates of return. These venture capital funds only update valuations every six months and report the results more than a month after the quarter end.

The record-breaking run of winning months in Australian Dollar (and currency neutral) terms continued. We haven't had a losing month since March 2020. This is a 21 months run so far. We have had several monthly US Dollar losses in that time.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Private equity had the best performance and contributed the most to the account. This includes estimated returns of venture capital funds that won't report the year end value till some time in February and so is very preliminary. US and rest of the world stocks had negative returns. This was because of the negative performance of the Hearts and Minds Fund (HM1.AX), which lost 7% for the month and had a 3.7% portfolio weight.

- Venture capital funds Aura VF1 and VF2 are predicted to perform well. In reality VF2 might not be upvalued at all and VF1 revalued by more than predicted because of a strong funding round for Shippit, which is the largest holding in the fund. Pengana Private Equity (PE1.AX) gained AUD 15k, Tribeca Global Resources (TGF.AX) AUD 12k, Cadence Opportunities (CDO.AX) 10k, Fortescue (FMG.AX) 9k, and Pershing Square Holdings (PSH.L), 9k also.

- As mentioned above, Hearts and Minds was by far the worst performer, losing AUD 14k.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 index. We are a little bit better than the median hedge fund levered 1.6 times.

We moved a little bit towards our desired long-run asset allocation. We reduced the shares of futures and hedge funds in the portfolio and increased the shares of everything else. Private equity is the most underweight asset class and real assets the most overweight. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- I bought a second Australian Dollar futures contract to hedge our foreign currency exposed positions.

- I reduced our leverage quite a lot from 23% of gross assets (not counting our house) to 18%. This includes the mortgage on our house. The main reason was to reduce our most expensive debt – a margin loan from Commonwealth Securities. I also replaced a pile of AUD cash with the second futures contract and reduced our US Dollar margin loan from Interactive Brokers by selling AUD 66k. I sold the remaining 200 shares of the Ready Capital baby bond (RCB) to complete this delevering.

- I invested in my twelfth painting at Masterworks. A David Hockney painting shown above. I just liked it. As usual, I invested USD 10k.

- I sold 25k shares of Pengana Private Equity (PE1.AX) as the share price rose above NAV.

- I sold 38k of Regal Funds (RF1.AX) shares I recently bought when the NAV hit AUD 4.02. NAV is now AUD 3.83. Still we made a profit of about AUD 3k on this trade.

- I bought 1,000 shares of the China Fund (CHN) after they paid out a dividend that reduced the dollar value of my holding by almost as much.

Monday, December 06, 2021

Australian Unity Merger Deferred

Australian Office Fund (AOF.AX) announces that the merger meeting is delayed till at least February because some large shareholders gave negative feedback on the proposal. That's strange because I thought the merger unfairly benefited AOF shareholders! Anyway, we will have to wait and see what changes are made or if the whole thing is cancelled in the end.

Thursday, December 02, 2021

November 2021 Report

The MSCI World Index fell by 2.38%, the S&P 500 by 0.69%, and the ASX 200 by 0.37%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7518 to USD 0.7122 boosting Australian Dollar returns and making USD returns very negative. We gained 1.52% in Australian Dollar terms or lost 3.83% in US Dollar terms. The target portfolio gained 2.15% in Australian Dollar terms and the HFRI hedge fund index is expected to fall 0.99% in US Dollar terms. So, we under-performed the target portfolio benchmark, the two international indices, and the HFRI but outperformed the Australian index.

The record-breaking run of winning months in Australian Dollar (and

currency neutral) terms continued. We haven't had a losing month since

March

2020. This is a 20 months run so far. We have had several US Dollar

losses in that time. This month was the 6th and worst decline. This

graph shows returns since 2018 in Australian Dollar terms:

As designed we are getting less volatility on average than the MSCI index in Australian Dollar terms. This month it was up though the index was down in US Dollar terms. If you are wondering why the scale is so wide on this graph, this is the reason:

US Dollar returns are much more volatile. For Australians, holding foreign assets reduces volatility in Australian Dollar terms as the Australian Dollar tends to move with stock prices, raising the Australian Dollar value of foreign assets when stock markets decline. For Americans, holding foreign assets increases volatility... You really would need to short the US Dollar to get similar results in US Dollar terms.Here is a report on the performance of investments by asset class (currency neutral returns):

Gold had the best performance and contributed the most to the account followed by large cap Australian stocks.

- Gold was the star performer. Gold started the month very strongly but then collapsed after Jay Powell

was appointed for another term as Federal Reserve chair. But it then ended the month a lot ahead. We gained AUD 31k. In fact the US Dollar price of gold fell slightly but the fall in the Australian Dollar provided all the gains as we hold our gold as PMGOLD.AX. Runners up were Fortescue (FMG.AX) at AUD 12k and Regal Funds (RF1.AX) AUD 10k. The Fortescue position is relatively small. It gained 15%.

- Cadence Capital (CDM.AX) lost AUD 10k and Cadence Opportunities (CDO.AX) lost AUD 5k after opening above the IPO price. Despite CDO's great historic performance, the firm raised much less money than they hoped at the IPO.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 index. We are a little bit worse than the median hedge fund levered 1.6 times.

We moved a little bit away from our desired long-run asset allocation. Private equity is the most underweight asset class and real assets the most overweight. Our actual allocation currently looks like this:

Roughly two thirds of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month:

- I closed the small positions we had in Pengana Capital (PCG.AX) following the distribution in specie from PE1.AX and sold 10k shares of PE1 I recently bought when the stock price was below NAV.

- I bought back 4k shares of RICA.L that I sold to participate in the RF1.AX rights issue.

- I bought 36k Regal Funds (RF1.AX) shares when they announced a jump in NAV to the share price on the hope of the premium to NAV coming back. I don't plan to hold this for the long term. I've already sold 17k of them.

- Cadence Opportunities IPO-ed (CDO.AX). I moved the shares into Moominmama's Interactive Brokers account and planned to sell stuff there to pay down some of my CommSec margin loan. I try to keep a balance of contributions in her IB account to match money we deposited there from the mortgage redraw.

- Planning for that move, I sold 12k MOT.AX shares, an Australian private credit fund.

- But then WCM Global Long-Short (WLS.AX) announced that they have redone their accounts and now the post-tax NAV is the same as the pre-tax NAV, which is also higher. I thought it was a good opportunity to increase our holding in that fund to around a 2% position and bought 44k shares, which used up the cash in the account...

- But I did sell all our holdings of Scorpio Tankers (SBBA) and most of our Ready Capital (RCB) baby bonds in her account and bought AUD 65k helping increase our holdings of Australian Dollars and reducing US Dollars.

- I also sold our position (4k shares) in Argo Investments (ARG.AX), which was suggested by the investment review.

- In order to hedge some remaining foreign currency exposure and get back closer to a 50/50 Australian Dollar/Foreign Currency exposure balance, I bought one Australian Dollar futures contract.