I was wondering whether we were getting worse off over time at my employer and so plotted my real and nominal pre-tax salary for the time I have been in my current position. Halfway along there was a blip where I was department head and got paid more. In real terms I am now about $2000 below where I started in 2011. The union is asking for a 15% increase in the latest bargaining round. After tax that is a about an 11% increase (because of progressive tax rates).

Wednesday, October 26, 2022

Real Salary

Saturday, October 22, 2022

More Factoids from the 2019-2020 Australian Income and Wealth Survey

3.2% of households are in both the top income and top net worth deciles. That means their net worth is above $2.258 million and their annual income is above $235k.

Friday, October 21, 2022

2019-20 Australian Income and Wealth Distribution

I didn't notice when the Australian Bureau of Statistics released the 2019-20 data on Australian household income and wealth distribution. I previously reported on the 2015-16 and 2017-18 data.

Mean gross household income was $121k per year in 2019-20 (all $ are Australian Dollars). The median was $93k. These are not adjusted for household size. ABS provides data adjusted for household size in terms of the income a single person would need to achieve the economic well-being of the average household. To adjust these to the required income of a household with 2 adults and 2 children requires multiplying by 2.1. I seriously doubt that adding a child only increases costs by 0.3 of the first adult!

Mean gross household income in the ACT was $150k and the median $124k.

To be in the top 10% of households requires a gross income of at least $235k. To get information on the breakdown inside the top 10% you have to use their data on the number of households within each of different bands of weekly income. 4.7% of households have an annual income above $312k and another 3% between $260k and $312k. Our gross income was $264k (taxable income), so we just fall within this group and, therefore, in the top 7.7%.

Mean household net worth was $1.04 million and the median was $579k. To be in the top 10% you needed a net worth of $2.26 million. We were at $4.44 million at the end of June 2020. To be in the top 3.9% you needed a net worth of $4 million. So I estimate we were at the edge of the top 3.3%. I guess it makes sense given my age that we higher in the wealth distribution than in the income distribution.

1.2% of households had a net worth above $7 million and 0.6% above $10 million.

There is a lot more data on breakdown of assets etc. which I might report on another time.

To be in the US top 1% by net worth required USD 11 million ($17.75 million) in the same period. A top 1% US household income is around USD 600k and above.

Tuesday, October 18, 2022

Regal Investment Fund Implements Resource Royalties Strategy

Regal Investment Fund (RF1.AX) is continuing to diversify their portfolio. Recently, they added a water strategy through Kilter Rural. Now they are adding a resource royalties strategy through the Gresham Resource Royalties Fund. While the water strategy is only 2% of the fund, the resource royalties strategy will be 17% of the fund initially. I am categorizing both of these in the real assets class. From the announcement:

"A resource royalty is a right to receive payment usuallyreflecting the value of a percentage of revenue derived from the production from a mining, oil and gas or renewable project. A commodity stream is an agreement conferring a right to purchase all or a portion of the production produced from a mining, oil and gas or renewable project at a pre-set price. Royalties and commodity streams are often used interchangeably. Royalties and commodity streams are typically acquired for an upfront payment. They can provide investors with the upside potential of increased commodity prices, increased production and extended mineral reserves (and sometimes new discoveries) with no or limited exposure to variable operating costs and future capital calls to fund exploration or other capital costs."

Friday, October 14, 2022

Performance of Average Investors

Latest version of the famous J.P. Morgan graph:

They estimate the returns for "average investors" from mutual fund flows. My return for this period was 6.12% (USD return). It's good that I am way ahead of the average investor but not good that I am behind a 60/40 portfolio (with no fees).

For a while now, I have been tracking these 20 year returns. Here is a graph with rolling 20 year USD returns for my portfolio and some key indices:

Each datapoint is the return for the 20 years up to that month. I started investing in 1996 and so the first observation is for September 2016. While I used to be worse than the median hedge fund, in the last couple of years my 20 year track record is a little bit better than the hedge fund index. I like to think it is more important to perform well the more money you have to invest :) In other words, dollar-weighted returns are more important than time-weighted returns.Monday, October 10, 2022

Gargantua by George Condo Sold

Saturday, October 08, 2022

September 2022 Report

In September the stock markets again fell sharply and the US Dollar rose. The MSCI World Index (USD gross) lost 9.53%, the S&P 500 9.21% in USD terms, and the ASX 200 6.14% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6855 to USD 0.6399 and even fell against the Pound. We lost 1.74% in Australian Dollar terms or 8.28% in US Dollar terms. The target portfolio lost 1.28% in Australian Dollar terms and the HFRI hedge fund index lost 2.27% in US Dollar terms. So, we out-performed the stock market indices but not these alternative benchmarks.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have added in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return.Only gold had a positive return and that was only because of the fall in the Australian Dollar - we hold our gold mostly in the ASX listed PMGOLD ETF. The Australian Dollar was the biggest positive contributor to performance measured in Australian Dollars and hedge funds were the biggest detractor, though Rest of World Stocks had the worst rate of return.

Things that worked well this month:

- After gold (AUD 13k), Regal Funds (RF1.AX) gained 10k, Winton Global Alpha 9k, and Aura VF2 8k.

What really didn't work:

- Tribeca Global Resources lost AUD 28k, followed by Australian Dollar Futures lost 21k, and Unisuper at-17k.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index nor the MSCI. Compared to the ASX200, our rate of return has been almost the same, but our volatility has been almost 5% lower. We are performing almost 4% per annum worse than the average hedge fund levered 1.76 times. Hedge funds have been doing well in recent years.

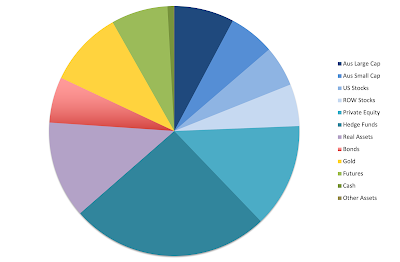

We moved towards our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I sold my holding of 10k Pendal shares (PDL.AX). Perpetual, which is taking over Pendal seems to continue to sink in price since the merger was announced.

- I participated in the Regal Investment Partners (RPL.AX) rights issue.

- I did some trading of Regal Funds (RF1.AX). It is tending to fluctuate around the NAV.

- I shifted another AUD 25k from Aspect Diversified Futures Wholesale to First Sentier Developing Companies on the Colonial First State platform and then sold and withdrew the rest of our holding to reduce debt.

- I sold 20k Cadence (CDM.AX) shares to increase cash in our SMSF brokerage account.

- I did a quick Australian Dollar Futures trade, which didn't work out well.

Monday, October 03, 2022

Moominmama Actually Had Negative Tax for 2021-22

Not sure why the calculation I posted here showed positive tax, but both the ATO and my own calculation show that Moominmama's tax assessment was -$127 for 2021-22. That's kind of like the holy grail or something :)

Heading for a Fall in Net Worth

This is why I have been concerned about saving money recently:

I'm currently forecasting that this year comprehensive after-tax income (including superannuation and unrealized capital gains/losses) will be less than spending. This would be the first decline in end of year net worth (not counting our house) since the financial crisis.

Friday, September 30, 2022

Classic Case of Bad Market Timing

At the beginning of the 2020-21 financial year the Macquarie Winton Global Alpha Fund (managed futures) had AUD 1.27 billion in assets. It only returned AUD 1 million that year and had been performing weakly for a while. In the 2020-21 financial year there were net redemptions of AUD 829 million. Then in 2021-22 it made AUD 80 million. There were still net redemptions of AUD 194 million this year and the fund is down to AUD 324 million in assets.

More Saving

This blog hasn't really been about saving money in terms of spending less. But facing a year with negative returns and maybe even a fall in net worth in the end, I have focused on cutting expenditure and costs. By switching our car insurance from a comprehensive policy to a third party property damage policy I saved about AUD 400 a year. A reduction from about AUD 675 to AUD 175. The insurance company only values our car at AUD 2,300 and the excess is AUD 695. So, it just didn't make sense to me to insure the car itself. On the new policy we can still get a payout if our car is damaged in an accident by an uninsured driver.

Recently we also called a plumber to look at all the faulty taps in the house. They can't repair taps with ceramic disks and so I decided to just replace all the 7 sets of taps in the house. The plumber told me that I can save money by going buying the taps myself and then getting them to install them. Saving is about $500. So, today we went to a bathroom/plumbing store and selected and ordered taps.

I wonder what Ramit would think about all this?

Wednesday, September 21, 2022

Not Renewing Wholesale Investor Status

I got a message from Interactive Brokers that I needed to renew my wholesale investor status as two years had passed since I submitted an accountant's certificate. They currently only allow retail investors to borrow a maximum of AUD 50k in margin loans. The accountant agreed to do it again and I sent her all the relevant material to prove my net worth was more than AUD 2.5 million that took me 2-3 hours to put together. I came up with a number of AUD 3.7 million – the test is done on an individual not family basis – and so thought it would be easy. But now she has come back and said she can't include any superannuation in the number! So she estimates my net worth for the purpose of the test is AUD 2.4 million. She suggested I get a professional valuation of my house to prove the higher number I suggested for it (AUD 1.25 million).

It doesn't make any sense to me that an SMSF would be excluded but home equity included.

Anyway, I looked carefully at my Interactive Brokers account. Currently, I could borrow a maximum of AUD 96k. The saving in interest per year for the amount above 50k compared to CommSec is about AUD 5k. But I am unlikely to borrow that much, as I don't want to get a margin call if things go pear-shaped. So, I've decided not to do the property valuation, because it might come in lower and I still wouldn't qualify. I will wait till when I actually want to borrow more or make a new venture capital investment in Australia and I am closer to qualifying.

Of course, it is much easier to qualify as an accredited investor under US rules. Moominmama qualified in order to participate in AngelList even though her net worth including super is definitely under AUD 2.5 million.

Tuesday, September 13, 2022

Childcare and Education Spending

Spending on childcare and education is by far our largest spending category now and has gone up steeply. We are now at AUD 47k for the last 12 months, which is 30% of spending. So, I was wondering where all that money was going:

Turns out that we are spending twice as much on daycare for the 3 year old as on private school for the 6 year old. We get little childcare subsidy. We also spent $4k on deposits for the two children to start at a new private school in 2024. We shouldn't have that expenditure again and the government wants to increase childcare subsidies. So, perhaps this is peak expenditure on this category in real terms until they are both in high school? School fees first fall and then increase again with age.

Tuesday, September 06, 2022

Lowered my Mortgage Rate

I read in the Australian Financial Review that having an offset facility usually means that the mortgage interest rate that you are paying is higher and that this gap is biggest at the Commonwealth Bank, where we have our mortgage and offset account. The article said that the gap could be as big as 1.91%! I don't remember this being explained to me when we got our mortgage and offset account though I did discuss with the salesperson whether we should get an offset account.

I have wondered why our mortgage rate was so high and tried to move our mortgage to HSBC to get a lower rate. They just continually ran me around and nothing ever happened. So, I gave up on that.

So, I phoned the bank and he told me that I should phone regularly to "review my discounts", which I have never done. Basically, there is a seniority discount - the longer you are with the bank the more the discount. So the standard rate for the offset account is actually 6.3%. I was paying 5.4%. He increased the discount from 0.9% to 2.29%, lowering my mortgage rate to 4.01%. If I switched to the no frills product cited in the AFR he could only give me a 0.2% discount off the 5.53% standard rate.

I estimate the gain in net worth at the end of the mortgage, assuming we don't pay off the mortgage any faster, is AUD 271k at 6% inflation and AUD 188k at 3% future inflation. The saved interest is in the ballpark of AUD 90k. It feels weird to earn that much for about an hour's work.

Sunday, September 04, 2022

August 2022 Report

August was a mixed month. The MSCI World Index (USD gross) lost by 3.64% and the S&P 500 lost 4.08% in USD terms, but the ASX 200 gained 1.43% in AUD terms. All these are total returns including dividends. The Australian Dollar fell from USD 0.6968 to USD 0.6855 but it rose against the Pound from one Pound buying AUD 1.7430 to AUD 1.6958. We gained 0.25% in Australian Dollar terms but lost 1.38% in US Dollar terms. The target portfolio lost 0.71% in Australian Dollar terms and the HFRI hedge fund index rose 0.50% in US Dollar terms. So, we out-performed three benchmarks and under-performed two.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have added in the contributions of leverage and other costs and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance followed by futures, which had the strongest return. US stocks were the worst performer followed by gold and rest of the world stocks.

Things that worked well this month:

- Pershing Square Holdings was the best performer (AUD 11k) followed by Aspect Diversified Futures (10k) and Winton Global Alpha (8k).

What really didn't work:

- Australian Dollar Futures lost AUD 7k.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. The final three rows report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index nor the MSCI. Compared to the ASX200, our rate of return has only been 0.6% lower, but our volatility has been 5% lower. We are performing 2% per annum worse than the average hedge fund levered 1.7 times.

We moved a bit away from our target allocation. Our actual allocation currently looks like this:

About 70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I bought AUD 75k of units in the Aspect Diversified Futures Fund (Class A). This cash came from the redemption of Pershing Square Tontine Holdings.

- I sold AUD 25k of the First Choice Wholesale version of this fund and bought units of First Sentier Developing Companies instead.

- I switched about USD 17k from the TIAA Real Estate Fund to the TIAA Social Choice Fund (a balanced fund).

- I traded 10k shares of Regal Funds (RF1.AX) a couple of times.

- I invested USD 2.5k in a start-up offered by the Unpopular Ventures syndicate.

- I sold 12.5k shares of WAM Leaders (WLE.AX) to fund venture capital investments.

- I sold 3k shares of Ruffer Investment Company (RICA.L) for the same purpose.

- We received the payout from the sale of Lured.

Monday, August 29, 2022

Transfer to HSBC Australia Didn't Work

I transferred USD 1,000 from Interactive Brokers to the HSBC Everyday Global Account. I was surprised to find that they converted it to Australian Dollars. I am confused about whether I did something wrong or not. I posted a question about it in the mobile chat and the app said it was still learning and didn't understand and a consultant would get back to me.

P.S. 30Aug22

So, the consultant explained that first you have to add the US Dollar "product" to your account before you can transfer US Dollars to your account. I now applied and was approved.

Even if I get this working properly this is a slow method of converting currency. First I need to transfer money to IB, then wait before I am allowed to withdraw it again, then wait while the transfer to HSBC happens, then do another transfer. Of course, we could simply have lots of US Dollars lying around at HSBC just in case, but there is an interest cost to doing that... So all this might be too much hassle.

For September's investment in Unpopular Ventures, I'm planning to sell some shares at IB and then transfer US Dollars to HSBC and see how it goes.

P.P.S. 30Aug22

So now I know when you get the 2% cashback on debit card purchases. You need to deposit at least $2,000 a month into the account. That is a tremendous rate of return compared to passing that spending money through our offset account - about 5 times the rate of return. So, I am going to get Moominmama's salary deposited to this account in future. I'm not sure about opening one myself as I have a lot lower rate of spending on a debit/credit card.

Sunday, August 28, 2022

History of Franking Credits

This year's tax returns include large amounts of franking credits connected to Australian dividends. I almost managed to wipe out Moominmama's tax bill with them. The franking credits are added to income and then deducted from the tax bill. As the corporate tax rate for large companies is 30%, if you are in the 34.5% marginal tax bracket (including the Medicare Levy) like she is, it would seem that franked dividends will slightly increase your tax bill. Say you got a $1,000 dividend including the franking credit. Your tax on the dividend as a whole is $345 and you deduct the $300 franking credit from that, paying $45 in tax on the dividend. The magic of franking credits is that if you have investment deductions like margin interest, you will end up with surplus credits. Let's say you have $500 in margin interest in this example. Then your tax on the net $500 in income is $172.50. After deducting the franking credit from this, you have $127.50 in tax credits, which you can apply against the tax on your salary etc.

Foreign source income tax offsets work in a similar way. These are tax paid to foreign governments on dividends etc. Finally, there are also Early Stage Venture Capital Limited Partnership tax offsets. If you invest in an ESVCLP you can get a credit worth up to 10% of your investment. This totally offsets tax on other income even without any deductions!

Over time, the amount of franking credits and foreign source income tax offsets we have received has increased, as you would expect, though this year's credits are off the scale:

This doesn't include any tax credits received by our SMSF or any other superannuation fund for that matter.

Saturday, August 27, 2022

Moominmama's 2021-22 Taxes

I also did Moominmama's taxes for this financial year. The post about last year's taxes is here. Here is a summary of her tax return for this year:

Her salary was up steeply this year, as last year large superannuation contributions were deducted from it. This year, we redirected those to our new SMSF. Australian dividends were up dramatically as I tried to get more investments in her name. Gross income fell by 15% though because of reduced capital gains.

Total deductions rose by 66%, mainly because of the $20k in contributions to the SMSF. As a result, net income fell 32% mainly I think because of the reduced capital gains this year.

Gross tax applies the tax bracket rates to taxable income. Most of this nominal tax was eliminated by the 208% increase in franking credits. As a result, she should be assessed for only $1.4k in tax. As this is much less than the tax withheld from her salary, I expect she will get a refund of around $4k.

Moominpapa's 2021-22 Taxes

This year, I've prepared our tax returns earlier than usual as I have already received all the required information. Here is a summary of my taxes. Last year's taxes are here. To make things clearer, I reclassify a few items compared to the actual tax form. Of course, everything is in Australian Dollars.

On the income side, Australian dividends and franked distributions from managed funds are again up strongly. My salary still dominates my income sources but only increased by 3%.

A big chunk of foreign source income is from the distribution from Aspect Diversified Futures Fund. As a result, I am moving that holding into the SMSF. Net capital gain is zero due mainly to some strategic sales ton generate losses. I am carrying forward $99k in capital losses, which is double what was brought forward from last year.

In total, gross income grew 8%.

Deductions fell 47% because last year they included the loss on Virgin Australia bonds. Most deductions are interest including the $14k in other deductions.

Net income rose as a result by 26%.

Gross tax is computed by applying the rates in the tax table to the net income. In Australia, you don't enter the tax due in your tax return, but I like to compute it so that I know how big or small my refund will be.

Franking credits (from Australian dividends), foreign tax paid, and the

Early Stage Venture Capital (ESVCLP) offset (none this year as there were no capital calls from Aura) are all deducted from gross

tax to arrive at the tax assessment.

Estimated assessed tax rose 47%.

I estimate that I will pay 28% of net income in tax. Tax was withheld on my salary at an average rate of 31%. I already paid $6,546 in tax installments and so estimate that I need to pay an additional $2,829 in tax.

Wednesday, August 17, 2022

Reduced Our Health Insurance Premium

Inspired by Jessica Irvine's article on health insurance in the Sydney Morning Herald (I get her weekly newsletter), I phoned BUPA a couple of times and reduced our monthly health insurance premium from AUD 596 to about AUD 530. I switched the hospital coverage from gold (which we wanted when Moominmama was pregnant) to silver advanced (which is probably still too much coverage) and the extras from Budget Extras to Freedom 50. I think we should probably just drop the extras but Moominmama seems to think we'll use it. I'll monitor after a year or two and see if we are getting our money's worth. I estimate that the extra tax we would have to pay if we didn't have private health insurance is about AUD 370 a month. Moominmama likes private health insurance (and private schools etc.) whereas I don't get the point, really.

Saturday, August 13, 2022

HSBC Everyday Global Account

Back at the beginning of 2021 I opened an HSBC account for Moominmama because Plus 500 refused to send money to an account in our joint names. Moominmama has just been using it for shopping getting 2% cashback some months. I just realised that it can hold foreign currencies. So, instead of using OFX to convert and transfer money to the US to invest in Unpopular Ventures and Masterworks I could convert the money at Interactive Brokers at the best exchange rate, transfer it to HSBC and then transfer it to the recipient from there for an AUD 30 fee. OFX have about a 1.4% exchange rate cost plus an AUD 15 fee for small orders. And one day when there are distributions from Unpopular Ventures we could transfer the money back to HSBC without converting it.

Superannuation Performance Update

I just calculated the return on my TIAA-CREF 403b in Australian Dollar terms to compare to our Australian superannuation funds. While the SMSF has done a lot better than Unisuper and PSS(AP) since inception, TIAA has really shone. This is mainly due to our investment in the TIAA Real Estate Fund and partly due to the fall in the Australian Dollar. Now, I am wondering whether to switch out of that fund.

Pre-tax returns for the 2021-22 financial year were: SMSF 2.6%, Unisuper -5.0%, PSS(AP) -2.9%, TIAA-CREF 28.5%. I am very generous in estimating the tax paid by Unisuper and PSS(AP). This boosts estimated pre-tax returns on the way up a little but detracts a bit on the way down.

Saturday, August 06, 2022

June 2022 Report

With the final private asset valuations complete, I am ready to present the June accounts. I needn't have waited, as the share price of Aura VF1 only rose by one cent and Aura VF2's share price was constant.

World markets fell sharply with the MSCI World Index (USD gross) falling by 8.39% and the S&P 500 by 8.25%. The ASX 200 fell 7.72%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7177 to USD 0.6900 increasing Australian Dollar returns and reducing USD returns. We lost 5.82% in Australian Dollar terms or 9.46% in US Dollar terms. The target portfolio lost 2.42% in Australian Dollar terms and the HFRI hedge fund index lost 3.08% in US Dollar terms. So, we under-performed all benchmarks apart from the ASX.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Hedge funds were the worst drag on performance followed by leverage. Only gold and the Australian Dollar contributed positive returns. The total benefit of the fall in the Australian Dollar was greater as many foreign assets are denominated in Australian Dollars. This includes gold which we invest in through an Australian ETF PMGOLD.AX.Things that worked well this month:

- Gold was the top performer (AUD 13k) followed by the China Fund (CHN) (9k), Winton Global Alpha (5k), and Aspect Diversified Futures (4k).

What really didn't work:

- Tribeca Global Resources (TGF.AX) lost an incredible AUD 86k :(. Regal Funds followed with -36k and PSSAP rounded out the bottom three with -18k.

We moved a bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I bought 5,000 shares of Regal Partners (RPL.AX). So far, this looks like a mistake.

- I bought 20,000 shares of Pengana Private Equity (PE1.AX).

- I bought 2,000 shares of Regal Funds (RF1.AX).

- I sold 2,000 shares of PMGOLD.AX, a gold ETF. I'm beginning to feel over-stretched. This move reduced our leverage a bit and reduced our most expensive debt (CommSec margin loan). It also pushed our gold allocation back to 10% of gross assets.

- I sold a net 988 shares of WAR. I moved the rest of the position from one account to another to avoid a margin call.

Wednesday, August 03, 2022

July 2022 Report

July was a reversal of June. The S&P500 gained more than it lost in the previous month and gold fell more than it rose in the previous month. Investors seem to think that the Federal Reserve will raise interest rates by less than originally expected. The MSCI World Index (USD gross) rose by 7.02%, the S&P 500 by 9.22%, and the ASX 200 by 5.77%. All these are total returns including dividends. The Australian Dollar rose from USD 0.6900 to USD 0.6968 increasing Australian Dollar returns and reducing USD returns. We gained 4.11% in Australian Dollar terms or 5.13% in US Dollar terms. The target portfolio gained 3.75% in Australian Dollar terms and the HFRI hedge fund index was up only 1.65% in US Dollar terms. So, we out-performed the latter two benchmarks but under-performed the stock indices. The AUD return for the month is more than what would be expected historically given the ASX 200 performance for the month.

Here is a report on the performance of investments by asset class:

The asset class returns are in currency neutral returns as the rate of return on gross assets. I have for the first time added in the contributions of leverage and the Australian Dollar to the AUD net worth return.

Hedge funds were the biggest contributor to performance while Australian small cap had the best return. Gold was the worst performer and a significant detractor. Rest of the World stocks had a relatively poor performance because of our weighting to the China Fund.

Things that worked well this month:

- Regal Funds was the best performer (AUD 25k) followed by Pershing Square Holdings (18k), Tribeca Global Resources (18k), and another seven investments that gained more than AUD 10k.

What really didn't work:

- Gold was the worst performer (-24k) followed by the China Fund (-9k) and Winton Global Alpha (-5k). Only six investments lost money while 29 gained.

The investment performance statistics for the last five years are:

The first three rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. This month, I have added another three rows to report the performance of the three indices themselves. We show the desired asymmetric capture and positive alpha against the ASX200 but not against the hedge fund index and not really against the MSCI. Compared to the ASX200 our rate of return has only been 0.6% lower but our volatility has been 5% lower.

We are performing 2% per annum worse than the average hedge fund levered 1.7 times. I'm not sure why this alpha has deteriorated sharply recently. July 2017, which was dropped from the estimation this month, was a good month for hedge funds but both June and July 2017 were particularly good months for us in USD terms as the Australian Dollar rose sharply.

We moved a bit away from our target allocation. This was mainly because of the redemption of Pershing Square Tontine Holdings that reduced our private equity allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think.

We receive employer contributions to superannuation every two weeks. We are now contributing USD 10k each quarter to Unpopular Ventures Rolling Fund and less frequently there will be capital calls from Aura Venture Fund II. In addition we made the following investment moves this month:

- I sold 4,000 shares of WAM Leaders to get some cash.

- I made an AUD 20k concessional superannuation contribution for Moominmama.

- We combined these to start an account at Colonial First State for the SMSF investing in Aspect Diversified Futures with an initial AUD 25k (the minimum investment for Class A shares).

- As mentioned above, PSTH returned the cash to shareholders. There is a placeholder position still in our account which might turn into SPAR warrants at some point.

- I bought a net AUD 75k, mainly with the US Dollars from PSTH.

- I invested around AUD 10k in 64 Devonshire Road, Rossmore, NSW.

- I bought 1,250 PMGOLD shares (12.5 ounces of gold).

- I bought 3,000 more shares in Pendal (PDL.AX), when it was announced that merger talks were back on.

Friday, July 29, 2022

How I Made AUD 2,900 Instantly

A couple of days ago, I went on the Domacom platform just to see if anything was new. I found an offer to sell about 10,000 units in a semi-rural property near Sydney for AUD 1.0156 placed on 30th May. But the property was revalued on 18th July by around 30%!. Almost instantly I bought the units. One downside is that I already own about AUD 10k of units in the neighboring property. Of course, I can't realize this profit, so it is just on paper. The market is very illiquid, which is why I managed to get this bargain in the first place. Both properties have a vote next March on whether to sell the properties and wind up the funds or whether to continue to hold. Recently, my first investment at Domacom held a vote and sold for a big profit.

To get the funds, I had to cancel my pledge to a campaign to buy rural property. My money has been tied up in the campaign for a year while they have made almost no progress on raising money. I think that in future I won't make pledges to campaigns and only engage in the secondary market. The additional advantage of that is that I avoid paying big fees for the purchase of the property and the often huge upfront cut (c. 10%) taken by the promoters of the campaign. It would be much better if they were paid by performance fees instead...

Career Update

A year on, the career plan needs updating. I agreed with the School Director to take long service leave in 2022 and delay my leadership position to 2023-24. Instead, another person would take that leadership role for one year. Two months into the year, the director became a head of school at another university. The person temporarily filling the leadership position took over as interim director and a third person filled the leadership role. When I raised the issue recently, the person in the leadership role said they knew nothing of the plan to put me into the position in 2023-24 and it would depend on the new permanent school director who will be starting in January 2023. I don't think that the new director would be enthusiastic about me in that role.

Yesterday, I met with my immediate Department Head. He said that he thinks the leadership position is now off the table and doesn't think there will be pressure for me to take that kind of role now... He also wants me to again teach one of the courses I dropped.* The advantage, of course, is that teaching this course won't require any preparation. This new course has taken more preparation that anything I've taught before, I think. I am still working on that as the course began this week, but the end of prep is near... I'm not happy about teaching more again... Anyway, I told him that I would want to teach both courses in the same semester rather than spreading them out over the year. I find switching between teaching and research to be hard and end up wasting a lot of time doing that.

I also told him that I had thought about going to part-time status instead. Yesterday, I sent an email to HR asking about that. But I think that depending partly on investment income is a bit scary given the current economic and market uncertainty. On the other hand, the question is whether I will ever feel like I have enough money to retire....

I'll probably end up teaching the old course again together with the new one this time next year.

* He is teaching it this year (he also taught it before). Next year, he wants to revive another course that we have both taught before....

Thursday, July 21, 2022

Sam Dogen Interview

Sam Dogen of Financial Samurai has first video interview. Finally, you can get to see him, even if you still don't know his real name 😀

Monday, July 18, 2022

A Tale of Two Bloggers

Enough Wealth has a new post comparing our two NetWorthShare net worth curves titled a Tale of Two Bloggers. He took out the step changes due to inheritance in both our histories. But the two curves are in different currencies - mine in USD and his in AUD despite us both living in Australia. I wanted my track record to be comparable to the majority of other members who are US based. The volatility of my net worth is much lower in AUD than in USD. This is by design. The Australian Dollar tends to fall during "risk-off" periods reducing losses in AUD terms and increasing them in USD terms.

So, I thought I'd post a comparison of my net worth curve in both AUD and USD terms:

These go back way before the record on NetWorthShare. Back to September 1990, the month I started my PhD in the US... In addition to bigger moves during bear markets, the US series has a number of flat periods compared to the AUD series - around 2015, 2018-19 and in 2021. Overall, the AUD curve ascends more smoothly. We can also reminisce about that time after the GFC when the Australian Dollar was worth more than the US Dollar!

Saturday, July 16, 2022

Division 293 Humblebrag

It looks like I will have to pay Division 293 superannuation contributions tax for the first time. This is an extra 15% tax on superannuation contributions that you have to pay if your income including concessional super contributions is above AUD 250k. My preliminary estimate of my taxable income is already above AUD 250k. So, for sure the total including around 30k of super contributions will be even if the final income number is a little lower. This is probably going to mean an extra AUD 4,500 of tax.

I'm also currently estimating I'll owe more than AUD 13k in extra tax after paying AUD 6k in tax installments. Last year I got a tax refund because of the Virgin Australia debacle. Bond losses can be deducted immediately from your income unlike losses on shares. The tax installments were because the previous year's tax return...

I'm reluctant to stuff more money into super as non-concessional contributions to reduce tax in case we'll need it. For example, to buy a bigger or better located house. If I continue to work, we can't withdraw the money from my account till I'm 65 in 8 years time. And much longer in Moominmama's case. That liquidity costs in taxes.

In the last couple of years we made large non-concessional contributions. I also have illiquid investments in venture capital and art. Our liquid investments are 46% of gross assets not including our house. I doubt I can get a bigger mortgage given my age and Moominmama's low wage income.

Tuesday, July 12, 2022

Some Good Financial News

Masterworks sold Lured by Cecily Brown for USD 1 million. The initial offer price was USD 605k. We are supposed to get the money within a month. I think this is the third painting they have sold, two of which were ones I invested in.

Domacom reported to the ASX that their private placement was over-subscribed! They hope to be reintstated in the ASX soon.

Sunday, July 10, 2022

Portfolio Planning

I won't post June accounts for quite a while. There

doesn't seem much point until we have all valuations for private assets

for the end of the financial year and that won't happen till some time

in August probably.

I did a bit of a portfolio planning exercise again with some moves planned. I tweaked the portfolio allocation a little as a result to meet the various constraints. Target allocation to Australian large cap is down from 8% to 7%, hedge fund allocation down from 25% to 24% and bonds and futures both up from 5% to 6%. Other allocations remain unchanged (real assets 15%, private equity 15%, international shares 11%, gold 10%, and cash 1%). Back in 2017, our Australian large cap allocation was 35-36%!

In theory, the new allocation does increase the historical portfolio Sharpe ratio.

So here is the current allocation where I break down by asset class and type of holding:

You are going to need to click on this to see any detail. The names at the bottom are most of the relevant investments in that category. Employer super includes my US retirement account as well. I originally developed this spreadsheet when we were planning the SMSF. Then the future allocation tries to move more towards the long run allocation while taking into account the amount of money in each pot and what the employer super is invested in etc.

It also reflects that we are probably going to get the cash back from our investment in PSTH, which is then reinvested in the SMSF. I want to move my holding of Aspect Diversified Futures into the SMSF I will sell and buy again rather than actually move it as I plan to buy a class with lower fees. With the proceeds from selling Aspect we invest in Australian small cap and international shares. We then use the proceeds from PSTH to buy Aspect in the super fund. Plus a $20k concessional contribution for Moominmama I just made. Otherwise, the allocation says we need to increase holdings of real assets outside of super a lot. I don't know what those investments would be...

Saturday, July 02, 2022

Spending 2021-22

For the last five years I've been putting together reports on our spending over the Australian financial year, which runs from 1 July to 30 June. This makes it easy to do a break down of gross income including taxes that's comparable to many you'll see online, though all our numbers are in Australian Dollars. At the top level we can break down total income (as reported in our tax returns plus superannuation contributions):

The gross income for this year (bottom line) is just an estimate. It looks like falling quite significantly. Tax includes local property tax as well as income tax and tax on superannuation contributions. Investing costs include margin interest. Mortgage interest is included in spending, while mortgage principal payments are considered as saving. Spending also includes the insurance premia paid through our superannuation. Current saving is then what is left over. This is much bigger than saving out of salaries because gross income includes investment returns reported in our tax returns. The latter number depends on capital gains reported for tax purposes, so is fairly arbitrary. Spending also recommenced its increase this year. Graphically, it looks like this:We break down spending into quite detailed categories. Some of these are then aggregated up into broader categories:

Our biggest spending category, if we don't count tax, is now childcare and education, which has again risen steeply. As mentioned above, the income and tax numbers are all estimates. Commentary on each category follows:

Employer superannuation contributions: These include employer contributions and salary sacrificed contributions but not concessional contributions we paid to the SMSF this year.

Superannuation contributions tax: The 15% tax on concessional superannuation contributions. This year it includes tax on our concessional contributions to the SMSF.

Franking credits: Income reported on our tax returns includes franking credits (tax paid by companies we invest in). We need to deduct this money which we don't receive as cash but is included in gross income. Foreign tax paid is the same story.

Life and disability insurance: I have been trying to bring this under control and the amount paid has fallen as a result.

Health: Includes health insurance and direct spending. Spending peaked with the birth of our second child and continues to decline.

Housing: Includes mortgage interest, maintenance, and body corporate fees (condo association). We haven't spent much on maintenance this year, so spending is down.

Transport: About 2/3 is spending on our car and 1/3 my spending on Uber, e-scooters, buses etc.

Utilities: This includes spending on online subscriptions etc as well as more conventional utilities. I need to cut back on spending on video games as this category continued to climb strongly.

Supermarkets: Includes convenience stores, liquor stores etc as well as supermarkets. Seems crazy that it has almost doubled in five years and become our second biggest spending category.

Restaurants: This was low in 2017-18 because we spent a lot of cash at restaurants. It was low last year because of the pandemic and this year because of a seeming permanent behavior change.

Cash spending: This has collapsed to zero. I mainly use cash to pay Moomin pocket money and he pays me back if we buy stuff online for him. That's how it ended up negative for the year. Moominmama also gets some cash out at supermarkets that is included in that category.

Department stores: All other stores selling goods that aren't supermarkets. No real trend here.

Mail order: This seems to have leveled out in the last three years/

Childcare and education: We are paying for private school for one child, full time daycare for the other, plus music classes, swimming classes...

Travel: This includes flights, hotels etc. It was very high in 2017-18 when we went to Europe and Japan. Last year it was down to zero due to the pandemic and having a small child. This year we went to the nearby coast for a week and this is mostly how much the accommodation, booked at the last minute, cost.

Charity: Not sure why it's down this year.

Other: This is mostly other services. It includes everything from haircuts to professional photography.

This year's increased spending was mainly driven by increased childcare and education costs. I expect these to be about the same next year and then fall for a while in subsequent years - private primary school is cheaper than daycare with the low level of subsidy we get - before beginning to rise again.

Monday, June 06, 2022

New Investment: Regal Partners

Regal Partners just merged with VGI to create a new larger alternative fund manager that will be known by the former name. The company still trades under the VGI.AX ticker but is expected to switch to RPL.AX. It seems undervalued to me at a PE of 6 and so I bought some shares. Especially, as that is based on VGI's inferior track record to date.

Thursday, June 02, 2022

May 2022 Report

World markets stabilized with the MSCI World Index (USD gross) rising by 0.19% and the S&P 500 by 0.18%. On the other hand, the ASX 200 fell 2.43%. All these are total returns including dividends. The Australian Dollar rose from USD 0.7114 to USD 0.7177 increasing Australian Dollar returns and reducing USD returns. Our luck ended this month, and we lost 3.10% in Australian Dollar terms or 2.24% in US Dollar terms. The target portfolio lost 1.05% in Australian Dollar terms and the HFRI hedge fund index is expected to gain 0.21% in US Dollar terms. So, we under-performed all benchmarks.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

Hedge funds were the worst drag on performance followed by gold. Only futures and real assets had positive returns.

Things that worked well this month:

- TIAA Real Estate (AUD 4k), Australian Dollar Futures (4k), and URF (also 4k) were the best performers.

What really didn't work:

- Tribeca Global Resources (- AUD 25k), gold (-19k), and Pershing Square Holdings (-18k) were the three worst performers...

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We are performing 1% per annum worse than the average hedge fund levered 1.67 times.

We moved a little bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. A lot of these are listed investments or investments with daily, monthly, or quarterly liquidity, so our portfolio is not as illiquid as you might think. On the other hand, around 47% of net worth (not including our house) are now in retirement accounts. Liquid investments are 57% of net worth and illiquid non-retirement investments are 13% of net worth. Because of leverage, the total is 117%.

We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month. It was a busy month.

- I bought 1,000 shares of 3i (III.L) after its share price fell in sympathy with US retailers like Target and Costco. I figured that the problems those faced probably weren't that similar to those faced by Action – 3i's European discount retailer. 3i also posted very good results recently.

- I sold all our shares in URF at 27 cents a share.

- I made additional investments in APSEC and the Australian Unity Diversified Property Fund.

- We made a small investment in a start-up via Unpopular Ventures syndicate.

- There were a lot of small trades involved with forex, tax loss harvesting, moving positions between accounts etc...

Wednesday, May 18, 2022

Invested in Another Startup

Unpopular Ventures offered a syndicated investment in the seed round of a start-up based in Europe. I can't give any details of the investment. Based on their projections, which I think look pretty unrealistic, it would be a fantastic investment but they have been growing very rapidly so far, have a lot of experience, and the valuation doesn't seem too crazy.

The investment is basically in a separate fund, where the general partners get 20% carry. They suggested investing USD 2,500 (minimum was USD 1,000) and I did that, following Meb's advice to invest a little in lots of different start-ups. I'm used to investing 1-2% or as little as 1/4% of the portfolio in an investment and this is more like 1/16%. On the one hand, I don't want to make too many different investments because of information overload. On the other hand, I can't do anything about this investment unless there is an exit or opportunity to invest more, so I don't really need to pay much attention to its performance.

Friday, May 13, 2022

Got Out of URF

After reading the most recent quarterly report I decided to get out of URF. I'm not optimistic that even if the shareholders vote against the sale deal we will eventually realize more for the investment and there is a big risk it is approved and we get less than the current market price. I exited yesterday and today at 27 cents per share for a net loss on the investment of AUD 2,300, which isn't too bad, I guess. Obivously, there are a lot of people thinking differently to me who want to buy in.

Sunday, May 08, 2022

So Far So Good

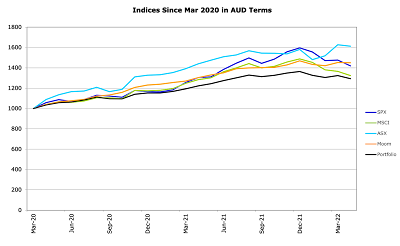

The graph tracks the performance of our portfolio (Moom, orange) since the March 2020 low versus various benchmarks. All of these are in Australian Dollar terms. So, for example, we multiply the S&P 500 index by the Australian Dollar - USD exchange rate and track that.

Our portfolio is now a little ahead of the S&P 500 and quite a bit ahead of the MSCI but has had a smoother ride than both. The ASX 200 is ahead of us, but has also been more volatile.The target portfolio (Portfolio, black) also has lower volatility but we have beaten it by fund selection and trading.

No guarantee that this performance continues, but our goal is to achieve market like returns with lower volatility. Also, it isn't as pretty in US Dollar terms. Our strategy is designed to give low volatility in Australian Dollar terms.

Saturday, May 07, 2022

April 2022 Report

World markets fell sharply with the MSCI World Index (USD gross) falling by 7.97%, the S&P 500 falling 8.72%, and the ASX 200 falling 0.85%. All these are total returns including dividends. The Australian Dollar fell from USD 0.7494 to USD 0.7114 increasing Australian Dollar returns and reducing USD returns. We lost only 0.16% in Australian Dollar terms but lost 5.23% in US Dollar terms. The target portfolio lost by 2.34% in Australian Dollar terms and the HFRI hedge fund index is lost 0.93% in US Dollar terms. So, we out-performed all benchmarks apart from the HFRI index. I felt like I was losing a lot of money, but in Australian Dollar terms it wasn't that bad.

Here is a report on the performance of investments by asset class (currency neutral returns in terms of gross assets):

In a reversal of last month real assets, gold, and futures gained money, while other asset classes lost. Real assets were negatively affected by the URF debacle. Rest of the world stocks were negatively affected by the China Fund. Gold rose in Australian Dollar terms, though the USD price fell. US stocks performed worst and detracted from performance most, while gold performed best and contributed most to performance.

Things that worked well this month:- Gold gained AUD 21k, Winton Global Alpha 10k, Tribeca Global Resources (TGF.AX) 11k, and Aspect Diversified Futures 8k.

What really didn't work:

- Pershing Square Holdings (-22k), Australian Dollar Futures (-17k), and Hearts and Minds (HM1.AX, -11k) all lost more than AUD 10k.

Our SMSF continues to perform quite well compared to our employer superannuation funds:

They're all indexed to 1000 in April 2021.

The investment performance statistics for the last five years are:

The first two rows are our unadjusted performance numbers in US and Australian Dollar terms. The following four lines compare performance against each of the three indices over the last 60 months. We show the desired asymmetric capture and positive alpha against the ASX200 and the MSCI but not against the hedge fund index. We are basically performing a bit worse than the average hedge fund levered 1.67 times. Hedge funds have been doing well recently.

I adjusted the leverage on the URF.AX investment to roughly 3:1 in our gross asset allocation as there still seems some possibility that the wind-up deal will be voted down by the shareholders.

We moved a little bit nearer to our target allocation. Our actual allocation currently looks like this:

70% of our portfolio is in what are often considered to be alternative assets: real estate, art, hedge funds, private equity, gold, and futures. We receive employer contributions to superannuation every two weeks. In addition we made the following investment moves this month. It was a busy month.

- I invested in the Unpopular Ventures rolling fund on the AngelList platform. The initial investment is USD 10k and then the same amount each quarter for eight quarters.

- Our listed investments trusts are now all in a CommSec account within

the SMSF, which means I get accurate tax reporting and can subscribe to

dividend reinvestment, which I did.

- I sold 10k shares in Pengana Private Equity (PE1.AX). These were shares in my name that I held to get accurate tax reporting, which I don't need any more. I sold at AUD 1.69 and the price is now AUD 1.49. So, that was a good move.

- I sold AUD 30k for USD and bought one more AUD futures contract, increasing AUD exposure by about 100k, which was a mistake.

- I withdrew AUD 25k from Domacom Investments after two crowdfunding campaigns just vaporized.

- But I started accumulating units in another property at

Domacom. It is a market garden property near the planned Badgery's Creek

Airport. 60 Devonshire Road, Rossmore.

- I bought 12.5k WAM Leaders shares (WLE.AX).

- I invested AUD 10k in the Winton Global Alpha Fund, which has been doing well recently, for a change as I predicted. Seems futures work well in inflationary environments but not in low inflation environments. I based this opinion on this research.

- I invested AUD 10k in the Australian Unity Diversified Property Fund.

- I bought AUD 7k shares in Pendal as a merger arbitrage play.

- I invested in a new painting at Masterworks: "No Hopeless". I felt this might be over-valued but took the plunge anyway.

.jpg)