On Tuesday the S&P 500 made a strong advance and went beyond the upper trend line of a bearish wedge that bears have been following and hoping for since mid-July. This move is still legitimate in Elliott Wave Theory and is called a throwover. Any further rise though would call the pattern into question or negate it entirely.

As usual recently I have been rather confused about market direction as the NDX has chopped up and down in recent days. My models though also put Wednesday as a critical day - either up or down from here.

Here is a very interesting discussion of whether we have already seen the lows for the four year cycle.

Wednesday, September 27, 2006

Monday, September 25, 2006

Second Thoughts on Retirement Accounts?

As I begin to realize that maybe I can realize my dream of financial independence much faster than I ever thought possible, I am beginning to rethink the role of retirement accounts in my financial plans. Up till recently I have always contributed the minimum to retirement plans with my employers. The other side of the coin is that my main employers have had extreme levels of retirement contributions. In my first academic job in the UK contributing to the retirement plan was voluntary. It was defined benefit and I was only planning on staying a year or two. I thought reducing my debt was more important. The cost-benefit analysis I did at the time showed that the right choice was to opt out. In my next job (in the US) I didn't stay long enough to become eligible for the retirement plan. Then when I moved to Australia, participation was mandatory. Between employer and compulsory employee contributions, 24% of my nominal salary was going into my retirement account. I thought this was enough especially as it is almost impossible to get the money out in the Australian system before age 60. Then after a gap where I claimed to be "self-employed" :) I was back in the US and here we have to contribute a minimum of 1% and the employer 8%. My goal was to rebuild my savings from the 2002 drawdown and then head for the goal of financial independence. Then this year I opened a Roth IRA account when I learned that you can always withdraw the contributions without penalty and use up to $10,000 in earnings towards the first time purchase of a house. My plan was to save towards a potential downpayment using a Roth IRA. This summer, as I began to understand the tremendous profit potential of my trading model I began to rethink my Roth plan. I think I will hardly miss the $4000 annual contributions and the earnings on them. Therefore, I now plan to continue contributing as long as I can and not withdraw my contributions as soon as I hit $10,000 in profit (I am halfway there at the moment).

Now a new idea has struck me. If I maximized my 403(b) contributions to the $15,000 annual limit I could rollover my account into my Roth when I eventually leave my current employer (subject to paying the appropriate taxes). This would be a way of getting much more money into the tax-free Roth environment. I think I may do this as soon as my trading program has reached its full size and if I continue to be profitable money will then be flowing out of the trading program into long term investments (in order to minimize the potential of a catastrophic loss there is a maximum sensible leverage that should be used in a trading program relative to total net worth - in the long term probably 70% of net worth will be directed to long-term investment and 30% to margin for trading). At that stage I will no longer need my salary to expand the size of the trading program and can direct it to a more tax advantaged environment.

The bottom line is that if you are following a Kiyosakian path at first you want to maximize the assets you have to achieve immediate financial independence. But once that goal is achieved, it makes sense to take full advantage of tax sheltered retirement accounts.

Now a new idea has struck me. If I maximized my 403(b) contributions to the $15,000 annual limit I could rollover my account into my Roth when I eventually leave my current employer (subject to paying the appropriate taxes). This would be a way of getting much more money into the tax-free Roth environment. I think I may do this as soon as my trading program has reached its full size and if I continue to be profitable money will then be flowing out of the trading program into long term investments (in order to minimize the potential of a catastrophic loss there is a maximum sensible leverage that should be used in a trading program relative to total net worth - in the long term probably 70% of net worth will be directed to long-term investment and 30% to margin for trading). At that stage I will no longer need my salary to expand the size of the trading program and can direct it to a more tax advantaged environment.

The bottom line is that if you are following a Kiyosakian path at first you want to maximize the assets you have to achieve immediate financial independence. But once that goal is achieved, it makes sense to take full advantage of tax sheltered retirement accounts.

Thursday, September 21, 2006

Mayne Pharma to be Acquired

Mayne Pharma is to be acquired by Hospira. It has been in a trading halt for a couple of days pending a transaction. Yesterday most commentators were still thinking that Mayne would announce an acquisition. But in the last day all the speculation has been about a takeover of Mayne. The takeover price is $A4.10 which results in a $A1972 capital gain for me from a roughly breakeven position at the time of the trading halt. I am still carrying a loss of $A1055 on Symbion the other half of the Mayne Nickless company that demerged last year. It's been a long story since I first invested in Mayne Nickless :) The only question now is whether I should sell or hang on for a possibly higher price. I tend to get impatient during these merger arbitrage situations. This is nice news as the news on the U.S. trading front was not good today for me. The model is still however short but the picture is now a bit unclear.

PS 9:19pm After reading all the info about the proposed takeover I decided that a higher bid was unlikely. The stock opened an hour late at $4.21. I sold at $4.25.

PS 9:19pm After reading all the info about the proposed takeover I decided that a higher bid was unlikely. The stock opened an hour late at $4.21. I sold at $4.25.

Wednesday, September 20, 2006

Update from Croesus Administrators

Croesus Mining's administrators have provided an update on the state of negotiations to either sell Croesus' assets or recapitalize the company. In the latter case, the suspension of trading in Croesus' shares may be lifted. I guess that there is a 50/50 chance that my shares could be worth say 2 Aussie cents each (vs. 27.5 when the trading halt was called) or zero if the assets are sold. The latter would probably mean that there was only sufficient capital to partly pay the creditors (Mitsui Bank and Macquarie Bank are the main ones). Macquarie Bank has been really great through this whole process. Mitsui are the villains. I couldn't link the announcement but it gives a schedule for their meetings with interested parties and for due diligence to be carried out.

PS: 22 September - received a letter today from a fellow shareholder and her lawyers... the lawsuits over the Croesus debacle are beginning to fly. They want $A550 to represent each shareholder without even explaining what their strategy is apart from stating that we should have the same rights as creditors.

PS: 22 September - received a letter today from a fellow shareholder and her lawyers... the lawsuits over the Croesus debacle are beginning to fly. They want $A550 to represent each shareholder without even explaining what their strategy is apart from stating that we should have the same rights as creditors.

Trading Record for the Year So Far

It ain't pretty:

The chart shows the running total of profits from short term trades so far this year. As you can see I got a nice profit early in the year and then blew it all up. Particularly on 29 June. Then I started trading with "the model". I have slightly exceeded the previous maximum level of profits but went through two periods of bad and confused trading against the model. All of this is documented in this blog as it happened. I will need to see a decisive break to a new highwater mark for the year before I will really get convinced that trading this model is practically profitable in the real world. Both pre- and post-model there are some long streaks of mostly winning trades. These tend to engender overconfidence and consequent blowups. Psychology is the hardest part of trading for me.

This might look like irresponsible and reckless risktaking. But losing $4000 in a period of bad trading is a loss of only 1.25% of net worth. This is nothing compared to the reckless risktaking at Amaranth Advisors :). More on Amaranth Advisors.

The chart shows the running total of profits from short term trades so far this year. As you can see I got a nice profit early in the year and then blew it all up. Particularly on 29 June. Then I started trading with "the model". I have slightly exceeded the previous maximum level of profits but went through two periods of bad and confused trading against the model. All of this is documented in this blog as it happened. I will need to see a decisive break to a new highwater mark for the year before I will really get convinced that trading this model is practically profitable in the real world. Both pre- and post-model there are some long streaks of mostly winning trades. These tend to engender overconfidence and consequent blowups. Psychology is the hardest part of trading for me.

This might look like irresponsible and reckless risktaking. But losing $4000 in a period of bad trading is a loss of only 1.25% of net worth. This is nothing compared to the reckless risktaking at Amaranth Advisors :). More on Amaranth Advisors.

Tuesday, September 19, 2006

What's Next for the Market?

This scenario has now played out. The model is switching to short at the close today. The S&P 500 index has now had 3 weeks of sell signals on my old model. Now maybe it is finally time for this much delayed longer term scenario to play out. Near today's highs I bought 20 put contracts in my Roth IRA account. So now I am effectively short 5000 QQQQ shares worth just over $200k. The short-term trend is going to be down from here. The stochastic will have to fall tomorrow unless there is a significant rise in prices. The McClellan Oscillator looks set up for a fall too. This isn't all the evidence to show that the "stars are aligned". So maybe now I will be surprised? :)

Sunday, September 17, 2006

Business and Tax Planning

I am reading the two books on taxes for traders that I ordered. Green's book is not as well written, but his strategies are simpler and less aggressive. Tesser takes things to the next level. There may be some contradictions between their advice but I have only read part of each book so far. I am learning a lot. I am understanding more about what Kiyosaki was hinting about regarding business tax deductions. Deductions taken on a Schedule C for example have no effect on triggering the AMT. Traders have many special tax advantages. So if you think you could qualify as being in the business of trading rather than investing it is well worth reading these books. You don't have to set up a company to get business deductions but it allows you to take some other deductions - particularly deducting health insurance from income and making contributions to retirement plans (and social security). If you have another job or your partner has a job with health insurance this will be less important for traders and investors.

Tesser discusses a program I had never heard of: VEBA - a voluntary employee benefit association. Tesser claims that this program can be used as a retirement program. All the information I can find online though says that it is only for medical expenditures. I think his advice is relying on shutting down the program at some point and distributing the proceeds to the employees. The money in the program is tax deductible and tax deferred. The advantage is that none of the limitations that apply to regular retirement programs regarding contribution limits and age restrictions apply to VEBA. Seems that this is a rather aggressive strategy though he claims that none of the strategies in the book get anywhere near the legal limits.

The IRS has never stated what exactly allows one to qualify as a trader rather than investor but instead lays out some vague criteria in Publication 550. If trading isn't your major income source it seems unlikely you will qualify and instead you will trigger an IRS audit. Trading futures seems to make it easier to claim trader status than trading stocks as futures are prima facie trading instruments. Otherwise you will need to show that you do extensive, frequent, and continuous trading. That can be hard to prove if you have a full time job.

The good news is that I can take things step by step:

1. Planning stage - current: proving profitability of trading strategy - learning about tax law etc.

2. Switching to trading futures - which are taxed at lower rates than stocks.

3. Claiming trader tax status - only possible when income is sufficiently high or I quit my current job.

4. Setting up a management company

5. More advanced strategies for estate planning etc - Tesser recommends partnerships.

Tesser discusses a program I had never heard of: VEBA - a voluntary employee benefit association. Tesser claims that this program can be used as a retirement program. All the information I can find online though says that it is only for medical expenditures. I think his advice is relying on shutting down the program at some point and distributing the proceeds to the employees. The money in the program is tax deductible and tax deferred. The advantage is that none of the limitations that apply to regular retirement programs regarding contribution limits and age restrictions apply to VEBA. Seems that this is a rather aggressive strategy though he claims that none of the strategies in the book get anywhere near the legal limits.

The IRS has never stated what exactly allows one to qualify as a trader rather than investor but instead lays out some vague criteria in Publication 550. If trading isn't your major income source it seems unlikely you will qualify and instead you will trigger an IRS audit. Trading futures seems to make it easier to claim trader status than trading stocks as futures are prima facie trading instruments. Otherwise you will need to show that you do extensive, frequent, and continuous trading. That can be hard to prove if you have a full time job.

The good news is that I can take things step by step:

1. Planning stage - current: proving profitability of trading strategy - learning about tax law etc.

2. Switching to trading futures - which are taxed at lower rates than stocks.

3. Claiming trader tax status - only possible when income is sufficiently high or I quit my current job.

4. Setting up a management company

5. More advanced strategies for estate planning etc - Tesser recommends partnerships.

Saturday, September 16, 2006

That Was a Bad Call

Why do I keep trying to trade against the model? It doesn't make sense. I don't understand why I am doing it. But for some reason it is very hard to stick with what the model says to do. Currently, it is long through Monday's close at least.

Friday, September 15, 2006

Back to the Short Side

Yup. The model is still long but probably Friday will turn out to be the last day of the uptrend in the stochastic. The stochastic can still rise as long as the index remains above 1582 (assuming a high higher than Thursday's 1629 or a low below 1558 do not occur). Friday is also options expiration day. After a strong rally one might expect a sell off on options expiration day as the "max-pain effect" comes into play. Many buyers of call options will have in the money positions. If they sell them to take the profits rather than exercising them the option sellers will then sell the stock they used to hedge their short options positions (delta hedging). This puts a downward pressure on stock prices. Well, just a theory. Futures also expire this time so a lot of stuff is happening - what is called a "quadruple witching". The Elliott Wave formation that began at Monday's low looks complete too. Also my weekly model's forecast for next week would make more sense if prices back off a bit on Friday. So that's my reasoning.

Wednesday, September 13, 2006

Can an Economist be a Trader?

Fin_Indie asked for me discuss how I reconcile being an economics professor and an active trader. I assume he is thinking about the efficient markets hypothesis (EMH) that states that all known information is incorporated in stock prices and prices only move when new information is revealed. This is also often taken to imply that stock prices move according to a pure random walk and changes in prices are unpredictable. Some take this idea further arguing that investors should simply invest in a diversified buy and hold portfolio as there is no way to profit from trading or even deviating from a market weighting of securities.

There are two parts to my response. One is to explain what I think EMH really implies and second to question whether the strong version of EMH holds. As a good economist I don't believe in too many free lunches. Financial markets are highly competitive markets and there should not be easy ways to make above average risk-adjusted returns (taking on more risk is a simple way to get above average returns). Otherwise, participants should simply get a standard return for their provision of investment capital to the market. That is, if that is all they provide. I argue that other inputs provided by investors should also receive returns in this market. These include returns on skill, returns on effort (time spent investing), and returns on special information. Of course if you don't have any of these then don't try to beat the market... It defies imagination that say Warren Buffett's track record is the result of pure chance. Rather, his excess returns reflect returns to these additional inputs. If you think you have these additional inputs you might have an edge, which you can test statistically and then it will allow you to beat the market.

Of course it helps that I am not a professor in the field of finance. I don't even have a PhD in economics (but another field instead). I do have a BA in economics (and the other field) and some graduate classes. I have been published in economics journals, I am a professor in an economics department, and I obviously teach economics. But my background is interdisciplinary and I think makes me much more open to alternative ideas than I might be if I had been indoctrinated in mainstream finance theory in grad school. Most of my research has been empirical and uses time series analysis.

The second part is to argue that while EMH is a good benchmark the strong form of the hypothesis does not hold. Countless anomalies have been documented. The most obvious is that stock prices fluctuate far more than do earnings or interest rates, which are their supposed determinants. A major issue that prevents the market from being perfectly competitive is as I have blogged before most participants in the market do not short-sell and many have mandates to remain fully invested in equities whatever happens. Active traders and hedge funds remain a minority of the participants, despite being very active. Even in among the active traders few are directional traders. Most are arbitrageurs, market-makers etc. Therefore, some forms of technical analysis do work. This is not a "belief" of mine but something I have now tested in the statistically validated trading model I am using. A lot of technical analysis out there makes no sense and a lot of the publicly available TA won't produce excess returns. This is not surprising. But a little digging will produce some useful approaches. Still, most participants have been persuaded that TA is nonsense. That is their problem not mine.

Fin_Indie also asked about my philosophy and inspiration. My basic approach is to trade my account like a global macro hedge fund, with a fairly conservative approach to adjusting the market exposure of my investment portfolio and an aggressive TA approach to trading the trading account. My biggest inspiration on how to trade and invest has been George Soros. But I have drawn elements of what I now do from all over and testing what works and what doesn't. Robert Kiyosaki's books were a big inspiration too.

There are two parts to my response. One is to explain what I think EMH really implies and second to question whether the strong version of EMH holds. As a good economist I don't believe in too many free lunches. Financial markets are highly competitive markets and there should not be easy ways to make above average risk-adjusted returns (taking on more risk is a simple way to get above average returns). Otherwise, participants should simply get a standard return for their provision of investment capital to the market. That is, if that is all they provide. I argue that other inputs provided by investors should also receive returns in this market. These include returns on skill, returns on effort (time spent investing), and returns on special information. Of course if you don't have any of these then don't try to beat the market... It defies imagination that say Warren Buffett's track record is the result of pure chance. Rather, his excess returns reflect returns to these additional inputs. If you think you have these additional inputs you might have an edge, which you can test statistically and then it will allow you to beat the market.

Of course it helps that I am not a professor in the field of finance. I don't even have a PhD in economics (but another field instead). I do have a BA in economics (and the other field) and some graduate classes. I have been published in economics journals, I am a professor in an economics department, and I obviously teach economics. But my background is interdisciplinary and I think makes me much more open to alternative ideas than I might be if I had been indoctrinated in mainstream finance theory in grad school. Most of my research has been empirical and uses time series analysis.

The second part is to argue that while EMH is a good benchmark the strong form of the hypothesis does not hold. Countless anomalies have been documented. The most obvious is that stock prices fluctuate far more than do earnings or interest rates, which are their supposed determinants. A major issue that prevents the market from being perfectly competitive is as I have blogged before most participants in the market do not short-sell and many have mandates to remain fully invested in equities whatever happens. Active traders and hedge funds remain a minority of the participants, despite being very active. Even in among the active traders few are directional traders. Most are arbitrageurs, market-makers etc. Therefore, some forms of technical analysis do work. This is not a "belief" of mine but something I have now tested in the statistically validated trading model I am using. A lot of technical analysis out there makes no sense and a lot of the publicly available TA won't produce excess returns. This is not surprising. But a little digging will produce some useful approaches. Still, most participants have been persuaded that TA is nonsense. That is their problem not mine.

Fin_Indie also asked about my philosophy and inspiration. My basic approach is to trade my account like a global macro hedge fund, with a fairly conservative approach to adjusting the market exposure of my investment portfolio and an aggressive TA approach to trading the trading account. My biggest inspiration on how to trade and invest has been George Soros. But I have drawn elements of what I now do from all over and testing what works and what doesn't. Robert Kiyosaki's books were a big inspiration too.

Aligned with the Trend

The model has now been long for a day and I am again aligned with the model and up on the month a little. This feels better. The uptrend should run through Friday or Monday based on the current forecast. Spent the weekend in Vermont. Sunday went apple picking and other activities. Beautiful weather. Very relaxing.

Friday, September 08, 2006

Planning

A beautiful day here today - trying to appreciate it a little in between the things I have to do. The market has been making me nervous too as I've been confused lately about its direction. It's looking better this afternoon and I don't think I have to bail out (I'm long, though the model is short - go figure). So I can relax a little. The beginning of the Fall Semester is when we start planning for the Spring Semester. I requested to teach classes in the middle of the day most days of the week so I'm free from teaching at market closes and opens. As you can see I am getting addicted to trading :) Most profs try to concentrate all their classes into two days a week. But I have found that pretty tiring. Teaching is like acting or performing in some way. This way I spread my various activities across the week rather than concentrated. Not sure whether I've blogged about my longer term career plans? The downside of academia is immobility and I want to get out of that trap. I also am much less interested in the research part of the job than I was. In fact I enjoy more the management/adminstration aspects now! As long as something useful is getting done by doing them. I am trying to develop trading as a mobile do anywhere source of income that will give me much more flexibility. It won't neccessarily be my main activity. But I would be free to go where I like and do what I want. I am not planning on working in one job or career until I am 65 and then retiring. Why do the same thing your entire life? You only get one life to try out different things. But if I want to stay in the US I first need to get my green card and I am waiting and still waiting. The main driver is on the personal side. My girlfriend is also a potential immigrant and will be limited to visa-compatible jobs employment-wise. Total lottery where those potential jobs may be. The probability that they are close to where my current job is is infinitesimally small. Actually she was just talking about jobs in Sweden again... I won't rule it out, though am not really looking forward to another international move. Probably anyway it would be a 1-2 year position. OTOH I can travel to and live in Sweden with no problems as I have European citizenship.

On another planning front we are finally moving my mother's account from Citibank to two other financial management firms. I had high hopes from Citibank when we opened the account 4 years back and initially we got a decent guy assigned as our "relationship manager". But since then service has gone downhill. Don't think that if you have $1-2 million you will get any better service than a small investor. Many discount brokerage firms would put Citibank to shame. I was reading recently about why wealthy clients dumped managers. The number one reason was poor customer service, not poor investment performance. We just wanted no-hassle peace of mind and as long as we are making a little money we aren't concerned neccessarily about pursuing the highest returns. The last thing I wanted is for my mother to worry about what was happening with her money. One of the new providers is UBS. We will see if they live up to their image of better customer service. The other is a small local firm where she lives. Over time, we will probably place more money with the smaller firm if they are nice to us :) But we can't transfer some of our funds to their custody and don't want to sell them and therefore also need the big bank.

On another planning front we are finally moving my mother's account from Citibank to two other financial management firms. I had high hopes from Citibank when we opened the account 4 years back and initially we got a decent guy assigned as our "relationship manager". But since then service has gone downhill. Don't think that if you have $1-2 million you will get any better service than a small investor. Many discount brokerage firms would put Citibank to shame. I was reading recently about why wealthy clients dumped managers. The number one reason was poor customer service, not poor investment performance. We just wanted no-hassle peace of mind and as long as we are making a little money we aren't concerned neccessarily about pursuing the highest returns. The last thing I wanted is for my mother to worry about what was happening with her money. One of the new providers is UBS. We will see if they live up to their image of better customer service. The other is a small local firm where she lives. Over time, we will probably place more money with the smaller firm if they are nice to us :) But we can't transfer some of our funds to their custody and don't want to sell them and therefore also need the big bank.

Thursday, September 07, 2006

Confused

Yes, I am feeling very confused by the market today, even though so far I guess it is playing out the chart I posted in my last post. Just it went up one more day and then went down and so I ended up losing... Longer term NDX still looks like it is going up, though I still have that sell signal on the weekly SPX I posted about. Probably I should have just gotten out of the market if I was unclear about what was going to happen. Still learning!

Monday, September 04, 2006

New Weekly Model Says: "Get Long"

For the first time today I estimated a model with weekly data. Again, I was stunned by the results - the high correlation between the forecasts and the actual change in the stochastic oscillator in the following week. The R-Squared (a measure of the goodness of fit of the model) between the one step ahead forecasts and the actual data is above 0.9 (very high). This is the sort of number that got my girlfriend to say "whoa!" when I told her about it :) Anyway, to cut to the chase the model predicts the stochastic will increase next week. Therefore, one should be long. I intend to use this model when the daily model is ambiguous as seemed to be at the moment. Well actually my model has clearly been long the last two days but I was stubborn and thinking that the potential turning point on Tuesday after Labor Day would actually lead to a turn to the downside. A day or two down is possible before the market continues to the upside.

Of course all this goes against the fundamentals as I see them. But so be it. The bond market is forecasting recession, but the stockmarket is beginning to change its mind.

Here is a chart that points out the analogous point last November and a guess of the likely price action going forward:

Of course all this goes against the fundamentals as I see them. But so be it. The bond market is forecasting recession, but the stockmarket is beginning to change its mind.

Here is a chart that points out the analogous point last November and a guess of the likely price action going forward:

Sunday, September 03, 2006

Books on Tax for Traders

Just ordered a couple of books about tax for traders. The Tax Guide for Traders by Robert Green and The New Traders Tax Solution by Ted Tesser. This is definitely a topic I need to understand much better before taking my trading business to the next level. I know about several of the issues but am unclear how the following interact: 60/40 treatment of futures, mark-to-market accounting, trader tax status, self-employment tax. Well I know that mark-to-market accounting results in you not being allowed to use 60/40 treatment of futures. But I was reading that you still can claim trader tax status, and somewhere I read you can still avoid the self-employment tax. Need to get this all straight and also understand whether I should set up a business entity such as an LLC or S-Corporation.

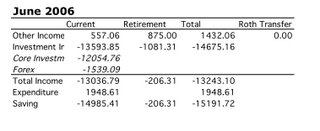

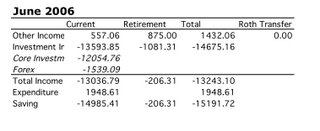

August Report

August was another good month. Net worth increased by $14,000 to $330k, investment return was 3.61%, and total investment income $11380. Expenditure was $2062. I have now increased net worth by $60k year to date. So there is still $40k to go or $10000 per month to reach my goal of increasing net worth by $100k for the year. If I keep up the pace of the last two months I will be able to achieve it. The best investment performers in terms of dollars earned were: QQQQ $4712, Colonial First State Conservative Fund $A2731, and Challenger Infrastructure Fund $A1587. As something like one third of my net worth is in the QQQQ position and more than half in the CFS Conservative Fund those rankings aren't too surprising :).

My return on equity on my trading account was a little more than 15% - slightly more than in July. The goal is therefore to earn trading income of $5400 in September (15% more). My eventual goal is to earn at least as much from trading as from my salary ($6250 per month). So I am not too far from that as things are going now.

My return on equity on my trading account was a little more than 15% - slightly more than in July. The goal is therefore to earn trading income of $5400 in September (15% more). My eventual goal is to earn at least as much from trading as from my salary ($6250 per month). So I am not too far from that as things are going now.

Friday, September 01, 2006

Trading Model Performance for August

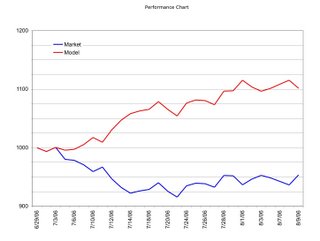

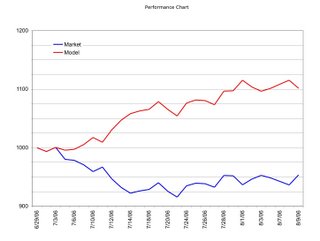

Another month has gone by trading "the model". I have further improved my trading rules and produced a decent performance for both the model and my account in August. The results in percent terms look like this:

NASDAQ 100 Index: 4.66%

Model(Improved Version): 8.36%

Trading Account: 15.26%

This means I captured 182% of the model's performance using about 3 times leverage. Before the improvements were added the model would have only been up about 5% and my performance captured 300% of that lower rate of return. As a result I earned $4700 for the month from trading vs. $3900 in July when the account gained 14.57% on the back of a model performance of 9.57% and a decline in NDX of 4.80%. This chart compares the model performance and the market action to date:

Clearly if you were short in early July and long in mid-August you would capture most of the model's gains.

It is going to take about 3 months from now, therefore, to achieve my goal of regaining all past trading losses on this account. In the meantime I am also saving up cash in my HSBC Online Savings account to open a futures trading account which will be the next adventure. But first I want to prove I consistently trade QQQQ profitably using the model over several months.

NASDAQ 100 Index: 4.66%

Model(Improved Version): 8.36%

Trading Account: 15.26%

This means I captured 182% of the model's performance using about 3 times leverage. Before the improvements were added the model would have only been up about 5% and my performance captured 300% of that lower rate of return. As a result I earned $4700 for the month from trading vs. $3900 in July when the account gained 14.57% on the back of a model performance of 9.57% and a decline in NDX of 4.80%. This chart compares the model performance and the market action to date:

Clearly if you were short in early July and long in mid-August you would capture most of the model's gains.

It is going to take about 3 months from now, therefore, to achieve my goal of regaining all past trading losses on this account. In the meantime I am also saving up cash in my HSBC Online Savings account to open a futures trading account which will be the next adventure. But first I want to prove I consistently trade QQQQ profitably using the model over several months.

At Midday the Rally is Looking Dead

This rally is looking pretty dead here.

Based on the prices earlier this morning my model would have switched to long, and I got close to pulling the plug/switch or whatever metaphor, but now in fact the spike up has extended the recent range and makes the model more likely to remain short at today's close.

Also I mentioned that my indicators were very similar to last November. Another difference is back then the full(5,5,3) stoch went above 80 on a 20 point up day. And the follow through day was another 20 points up and a runaway rally ensued. Here the breakthrough was a 3 point day and the follow through day was something like 9 points.

Of course things might look entirely different by 4pm. Tomorrow morning there is a bunch of very important economic news. This morning's economic news pretty much met expectations and so hasn't moved the market much either way.

Based on the prices earlier this morning my model would have switched to long, and I got close to pulling the plug/switch or whatever metaphor, but now in fact the spike up has extended the recent range and makes the model more likely to remain short at today's close.

Also I mentioned that my indicators were very similar to last November. Another difference is back then the full(5,5,3) stoch went above 80 on a 20 point up day. And the follow through day was another 20 points up and a runaway rally ensued. Here the breakthrough was a 3 point day and the follow through day was something like 9 points.

Of course things might look entirely different by 4pm. Tomorrow morning there is a bunch of very important economic news. This morning's economic news pretty much met expectations and so hasn't moved the market much either way.

Thursday, August 31, 2006

Market Teetering Between a Crash and a Rally

My indicators derived from the stochastic were in exactly the same pattern as they are now twice in 2005. Once in mid to late February and once in early November.

In the first case there was an upturn in the stochs from a high level and a small spike in the stochastics and a small but essentially failed rally. That is what I am betting on here. But in early November the upturn turned into a massive overbought rally.

So distinguishing between the two situations is of utmost importance :)

I'm still short but the market has been rising. In reaction I have dug up a tool I developed to help forecast the most bullish of my indicators. I had been skeptical that this tool was useful. But maybe it is useful in just such a situation. It says to be long at the moment. An alternative is if, for example, your standard position is 3000 shares, to allocate 1000 shares to each of the three indicators. So on a day like today where two indicators are short and one is long you would be theoretically short 2000 shares and long 1000 shares and, therefore, in practice short 1000 shares. I have read people discussing allocating their trading capital across multiple models and indicators. It could make sense. It is an agnostic approach to market direction.

I also found a distinction between February and November 2005. In November the fast %K stochastic was very strong - over 90 on the day that is the best analog for today. In February it was declining and around 80. If today ends up not too much it is going to look more like February and the case for the failed rally hypothesis will be strengthened.

In the first case there was an upturn in the stochs from a high level and a small spike in the stochastics and a small but essentially failed rally. That is what I am betting on here. But in early November the upturn turned into a massive overbought rally.

So distinguishing between the two situations is of utmost importance :)

I'm still short but the market has been rising. In reaction I have dug up a tool I developed to help forecast the most bullish of my indicators. I had been skeptical that this tool was useful. But maybe it is useful in just such a situation. It says to be long at the moment. An alternative is if, for example, your standard position is 3000 shares, to allocate 1000 shares to each of the three indicators. So on a day like today where two indicators are short and one is long you would be theoretically short 2000 shares and long 1000 shares and, therefore, in practice short 1000 shares. I have read people discussing allocating their trading capital across multiple models and indicators. It could make sense. It is an agnostic approach to market direction.

I also found a distinction between February and November 2005. In November the fast %K stochastic was very strong - over 90 on the day that is the best analog for today. In February it was declining and around 80. If today ends up not too much it is going to look more like February and the case for the failed rally hypothesis will be strengthened.

Tuesday, August 29, 2006

Confusing Market Action

Bulls and bears both seem confused at this point. One bear calls for a week of sideways action. This morning the Federal Reserve did a massive permanent open market operation - i.e. buying bonds and putting new money into the money supply. Someone on Silicon Investor who follows the Fed closely said it was the biggest he's seen. Changes in money supply in both Japan and the US often have a strong relation with stock market action. So in retrospect it wasn't surprising then that the market went up. I'm still puzzled about what is the causal driver in these money supply changes - is it market players or the monetary authority? Most commentators seem to assume that it is the Central Bank that drive these actions. However, standard macro theory says it would be investors and traders driving the Central Bank to respond.

In other news my "other model" - what I call the "autoregressive model" (as opposed to the "stochastic model" - both nicely obscure names :)) - the best I had before the latest one - has given a sell signal on the S&P 500 on the weekly chart. The previous signal was a buy for the week of 19 June. Previous to that was a sell in the week of 1 May. So the model is behaving pretty nicely in recent months and I wouldn't ignore it. Previous to that there was a sell for the week of 20 March... but before that a buy for three weeks in April 2005. On the other hand one of the indicators from the "stochastic model" is indicating a buy, but others aren't. So maybe we do just keep going sideways all week.

In other news my "other model" - what I call the "autoregressive model" (as opposed to the "stochastic model" - both nicely obscure names :)) - the best I had before the latest one - has given a sell signal on the S&P 500 on the weekly chart. The previous signal was a buy for the week of 19 June. Previous to that was a sell in the week of 1 May. So the model is behaving pretty nicely in recent months and I wouldn't ignore it. Previous to that there was a sell for the week of 20 March... but before that a buy for three weeks in April 2005. On the other hand one of the indicators from the "stochastic model" is indicating a buy, but others aren't. So maybe we do just keep going sideways all week.

Sunday, August 27, 2006

Bursting Real Estate Bubble and Coming Recession

Seems this weekend there is stuff everywhere on the bursting housing bubble. Too much to post! One of the best is this powerpoint slide show from the National Association of Realtors chief economist. They are still trying to put a bullish spin on things of course. But it is hard to do that anymore. Also more evidence of coming recession. This week the yield curve inverted more. And apart from the state of the housing market there is evidence such as this chart of retail employment.

Saturday, August 26, 2006

Adjusting Investments

It might seem like all I've been doing lately is trading. But I also have been adjusting my long-term investment positions. I am cutting back on a couple and increasing some others in an attempt to make the sizes of the different positions more consistent with the goal of having about 1.5% of net worth in each individual stock, not counting closed end funds which have shown their ability to withstand market corrections. I sold entirely out of IYS. This was originally a "corporate event arbitrage" trade -the fund was going to be wound up and was trading much below the final payout level. But recently we got a letter from Deutsche Bank saying that in order for the bank to pay us we had to agree to a settlement with the Australian Taxation Office. This introduced a risk of complications for foreign investors like me - I am an Australian Citizen but I am resident in the US. So I decided to get out now with a decent profit. I am planning in the coming week to reduce my positions in Telecom NZ and Challenger Infrastructure Fund. I've been waiting for Telecom's dividend book closing which happened on Friday. I just have too much of that stock. The latter looks like it is performing well but reading the annual report, there is a lot I don't understand about its accounting. So following Warren Buffett's maxim I am reducing my position. I have also put a bid in to buy more of Everest Capital after the destapling of this hedge fund management firm from its fund of funds which I am also invested in. Oh, and I also reduced my position in Ansell. There is probably something else I have left out. So actually I have been pretty busy.

PS: Wikipedia has a nice graphic of real UK house prices. The growth rate over the period is 2.4%. I suspect that rate will be lower when a few more years of data accumulate. And leverage doesn't make this look much better if you are paying 1-2% real interest on your loan.

PS: Wikipedia has a nice graphic of real UK house prices. The growth rate over the period is 2.4%. I suspect that rate will be lower when a few more years of data accumulate. And leverage doesn't make this look much better if you are paying 1-2% real interest on your loan.

Thursday, August 24, 2006

Model Update - Progress Towards Goals

At this point it is looking like there will be a buy to cover signal generated at next Tuesday's close. This is about as accurate as weather forecasting so as that date approaches the forecast might be brought forward or pushed out further in time. I continue to be shocked and stunned by the performance of the model and the ease of trading with it. I am getting used to trading the model. In July I got about 1.5 times the model return on my main trading account using roughly 3 times leverage. So far this month I am getting more than 3 times the model return. And, therefore, that performance goal has been realized. The model is on track to match last month's results. It is now up about 18% since 29 June. My taxable trading account is up 40%... The Roth IRA account is up 70% since I opened it earlier this year. I am now more than half way towards my initial goal of making $10,000 in profits in the Roth IRA. I thought that goal might take a few years to achieve. At this rate it could be achieved by the end of this year. I am pretty much also back on track towards this year's goal of increasing total net worth by $100,000. I think multiple near term goals are good - performance targets, profit targets, net worth targets etc. You can always be approaching some goal. Better than a single goal of some huge number you have to reach by "retirement".

P.S. Maybe I should just have bought real estate instead as common wisdom suggests :P The data in the article suggest that the real rate of capital gain on the typical house is 1% per annum. This article assumes 2% and still thinks housing is an inferior investment strategy.

P.S. Maybe I should just have bought real estate instead as common wisdom suggests :P The data in the article suggest that the real rate of capital gain on the typical house is 1% per annum. This article assumes 2% and still thinks housing is an inferior investment strategy.

Labels:

Goals,

Housing Market,

Modeling,

Performance,

Trading

Wednesday, August 23, 2006

Traits that Lead to Success

How many of these traits and habits do you have? I think I have several, though I'm not a very good networker. That's my weakest point.

DIY Recession Probability Calculator

Cool tool for estimating the probability of a recession. The tool is based on an academic paper by a Federal Reserve economist.

Tuesday, August 22, 2006

Expert Systems vs. Expert Opinion

John Mauldin's latest mid-week newsletter is an interesting exploration of the performance of formal quantitative systems that systematize expert knowledge vs. informal expert judgement. Generally, the formal systems perform better. People also tend to be overconfident of their abilities to make better decisions than the formal systems do. Of course this will depend on how good the quantitative model is. Anyone can make a bad model.

Friday, August 18, 2006

Freestyle Management and Black Box Trading

There are actively managed mutual funds and then there are "freestyle managers". A subclass of hedge funds use systematic trading of futures with decisions being generated by "black box systems". One of the biggest is Man Financial. I have been interested in the past in investing with them, but either I didn't have the minimum amount at the time or more recently couldn't apply to their Australian offering as I am not resident in Australia and the US sales representive never responded to my contact... My investment strategy is now a combination of a black box trading system for short-term trades and very freestyle management of longer term investments largely "outsourced" to other investment managers.

Sell Signal

I got another short term sell signal at the close today. It is possible that this is the beginning of the big decline into Fall that I have labeled C. This rally increased the NDX more than 5%.

At the end of the rally I am at a new maximum level of short-term capital gains for the year. The Roth IRA account has made almost $5000 in profits so far since I opened it in February. My general US trading account still has an all time deficit of around $11000 since I started trading in 1998. But now there is only $6000 to go to achieve my first short term goal of breakeven on my two Ameritrade accounts. The next goal is break even on the taxable account. After that I will look at gradually building up trading with the model to the full scale and opening an account to let me trade futures. The latter are more tax effective than short-term stock trading.

At the end of the rally I am at a new maximum level of short-term capital gains for the year. The Roth IRA account has made almost $5000 in profits so far since I opened it in February. My general US trading account still has an all time deficit of around $11000 since I started trading in 1998. But now there is only $6000 to go to achieve my first short term goal of breakeven on my two Ameritrade accounts. The next goal is break even on the taxable account. After that I will look at gradually building up trading with the model to the full scale and opening an account to let me trade futures. The latter are more tax effective than short-term stock trading.

Wednesday, August 16, 2006

Are We Still in the 2000- Bear Market?

I just came across Ian Gordon's website, which has some interesting charts of the Kondratief cycle. He plots the actual stock index (rather than growth rates) alongside the Kondratief cycle and other variables such as interest rates. From looking at his charts it seems to me that there could be two types of "secular bear markets". One is short and sharp like 1929-1932. The other is sideways and protracted like the late 1960s and 1970s etc. The short bears happen at the beginning of the Kondratief Winter - the final stage in the descending wave of the Kondratief cycle. 2000-2002 would then be another of these short bears. People looking for future stockmarket lows below those of 2002 and a protracted sideways bear market would be wrong if this conjecture is correct. Instead a bull market with corrections would be underway for the next 15 years or so. Of course there only appears to be a bear market still underway that started in 2000 if you look at large cap US stock indices and some European indices. Look at small cap US indices or Australian stocks for example and we appear to be in a bull market.

Monday, August 14, 2006

One More Rally?

I am looking for a rally starting either intraday or at the close on Monday on US and most world stock indices. The rally should last a bit longer than a week. I speculate that this will be the final rally before a renewed decline into the Autumn. This is the simplest and most likely scenario for the S&P500:

The levels of these moves are very imprecise - I think the upcoming rally should exceed the recent high at 1293. How far it will go beyond that though is guesswork. Volkmar Hable's latest newsletter concurs with this scenario more or less. He is more vague about what might happen.

PS 4:33pm 14 August

It seems now that the rally got started late on Friday just about where I closed my short position. I went long late this afternoon using call options (September $34) in both my Ameritrade accounts. Kind of dispiriting to see oneself immediately down $400 due to the option spread. Maybe not such a great idea. I did an intraday short trade using 3800 shares at the end but only made $50. That was probably my biggest single financial transaction to date. You can buy a decent house in my town for the value of the closing buy to cover trade, executed at the click of a mouse.

The levels of these moves are very imprecise - I think the upcoming rally should exceed the recent high at 1293. How far it will go beyond that though is guesswork. Volkmar Hable's latest newsletter concurs with this scenario more or less. He is more vague about what might happen.

PS 4:33pm 14 August

It seems now that the rally got started late on Friday just about where I closed my short position. I went long late this afternoon using call options (September $34) in both my Ameritrade accounts. Kind of dispiriting to see oneself immediately down $400 due to the option spread. Maybe not such a great idea. I did an intraday short trade using 3800 shares at the end but only made $50. That was probably my biggest single financial transaction to date. You can buy a decent house in my town for the value of the closing buy to cover trade, executed at the click of a mouse.

Saturday, August 12, 2006

The Paradox of Indexed Investing

Recently I have been reading a lot on the theory of trading and hedge funds and musing about what trends in investment strategies mean for the future of returns on different forms of investment and trading. The following thoughts are hypotheses rather than any worked out kind of theory.

In a world where everyone is an active investor (and investing on the long side only) trying to exploit valuation anomalies perhaps the market index reflects the average of their returns. Therefore, if you hire a manager, the average manager will return to you less than the index return once you pay their fees. The best managers will also migrate to the hedge fund world where they can charge larger fees leaving the average mutual fund manager making less than the index even before fees.

Hedge fund managers can also exploit opportunities on the short side and therefore even after their fees do better than long-only mutual fund managers - at least the better hedge fund managers do.

In comes passive indexed investment. What is the point of paying for an active manager if they earn less than the index say investors? So they put their money in index funds, ETFs, futures etc.

That is about where the investing world was at a few years ago.

The potential paradox is this - all the investors who are putting their money into indexed products are no longer pursuing valuation anomalies except to the extent to which they do this is when losing stocks are dropped from the index and winning stocks added. These market participants are no longer contributing to making the market efficient. This means that the remaining active investors have more opportunities to exploit as some of their competition is removed! The bigger indexing gets the more it will again underperform active management.

In recent years actively managed funds have outperformed the index in the US markets. I blogged before that this was likely because we were no longer in the strongly trending markets of the 1980s and 1990s. This is probably true but could indexation also be a factor?

We could even envisage long term cycles of active and passive management being more and less popular. Any thoughts?

In a world where everyone is an active investor (and investing on the long side only) trying to exploit valuation anomalies perhaps the market index reflects the average of their returns. Therefore, if you hire a manager, the average manager will return to you less than the index return once you pay their fees. The best managers will also migrate to the hedge fund world where they can charge larger fees leaving the average mutual fund manager making less than the index even before fees.

Hedge fund managers can also exploit opportunities on the short side and therefore even after their fees do better than long-only mutual fund managers - at least the better hedge fund managers do.

In comes passive indexed investment. What is the point of paying for an active manager if they earn less than the index say investors? So they put their money in index funds, ETFs, futures etc.

That is about where the investing world was at a few years ago.

The potential paradox is this - all the investors who are putting their money into indexed products are no longer pursuing valuation anomalies except to the extent to which they do this is when losing stocks are dropped from the index and winning stocks added. These market participants are no longer contributing to making the market efficient. This means that the remaining active investors have more opportunities to exploit as some of their competition is removed! The bigger indexing gets the more it will again underperform active management.

In recent years actively managed funds have outperformed the index in the US markets. I blogged before that this was likely because we were no longer in the strongly trending markets of the 1980s and 1990s. This is probably true but could indexation also be a factor?

We could even envisage long term cycles of active and passive management being more and less popular. Any thoughts?

Thursday, August 10, 2006

It's Nice When Losers Become Winners

Today's star is Challenger Infrastructure Fund. I bought into this fund which invests in infrastructure primarily in Britain soon after the IPO. One thing I liked about it was that the Challenger Investment Group and managers had put their own money into the fund. But it didn't do well and at one point I was down $A2000. Maybe it was because of the complicated structure that involved two payments for the shares - one at the IPO and one a year later. But today my investment finally came back into the black. The price is still below the IPO price but I bought more shares at a lower price. Funny thing is that the shares just started trading at a price that reflects the second payment and up it goes...

Trading with Stops

This morning's rally hit my model's stop loss which is set 1.25% from the previous close. I ignored it, which turned out to not be a good move. Most writers on trading state that risk control including use of stops is more important to trading success than finding good trades. For example, notorious hedge fund LTCM had no problem finding good trades, but their risk control was way out. Same with Victor Niederhoffer's fund that blew up a little before then. Less spectacularly you can make profits and then give them away again. Which is what I was doing till recently.

But setting stops is very tricky. If they are too close to the current price they will get hit all the time unnecessarily. Too far away and you lose too much money before the stop is triggered. For the moment I am sticking with 1.25% but adding two rules:

1. If the price comes back to the stop I should re-enter the trade. The 1.25% stop means that only powerful moves will trigger the stop. If those reverse sufficiently to return to the stop then the reversal is probably serious. This rule would have added a little less than 4% to returns in 2003 the one year I have tested fully.

2. If the next day's forecast suggests a trade in the opposite direction to the current trade then you should reverse to the opposite position at the stop. This adds more than 30% of compounded returns in 2003. I know it is hard to believe that - but it is true - it lets you get in on the beginnings of powerful new moves.

This chart shows the model's performance to date relative to the NASDAQ 100 index, assuming $1000 was invested in both at the close of trade on 29 June, and assuming no commissions, no spreads, and no leverage. Given the high rate of return a little leverage could offset the trading costs anyway:

But setting stops is very tricky. If they are too close to the current price they will get hit all the time unnecessarily. Too far away and you lose too much money before the stop is triggered. For the moment I am sticking with 1.25% but adding two rules:

1. If the price comes back to the stop I should re-enter the trade. The 1.25% stop means that only powerful moves will trigger the stop. If those reverse sufficiently to return to the stop then the reversal is probably serious. This rule would have added a little less than 4% to returns in 2003 the one year I have tested fully.

2. If the next day's forecast suggests a trade in the opposite direction to the current trade then you should reverse to the opposite position at the stop. This adds more than 30% of compounded returns in 2003. I know it is hard to believe that - but it is true - it lets you get in on the beginnings of powerful new moves.

This chart shows the model's performance to date relative to the NASDAQ 100 index, assuming $1000 was invested in both at the close of trade on 29 June, and assuming no commissions, no spreads, and no leverage. Given the high rate of return a little leverage could offset the trading costs anyway:

Wednesday, August 09, 2006

Another Fed Day...

This one a lot better than the last for me.... The day after the last one is when I started running "the model". I am currently short and added a little bit to the short after the direction of the market got clearer after the FOMC announcement. It was pretty much exactly as expected. The probability of a rate hike was less than 20% and we had one Fed member dissenting and voting for a hike. The others voted to keep rates on hold. And the statement says that future rate hikes will be data driven. Goldman Sachs had been looking for a rise in rates. Given I was short I wasn't worried about that.... So why is the market down - well the technicals are pointing down, which is why I am short. The only other thing might be that dissenting voice. It is hard to think major market participants would be naive enough to think the Fed would confirm that that was the last rate hike.

I am still short and currently expect to be so at least through Friday unless the stochastic goes below 20 in which case the short would continue into next week. Cisco announces after the close today. It is a major NDX stock so could have some effect on the NDX going forward from here.

I am still short and currently expect to be so at least through Friday unless the stochastic goes below 20 in which case the short would continue into next week. Cisco announces after the close today. It is a major NDX stock so could have some effect on the NDX going forward from here.

Sunday, August 06, 2006

Secret to Planning a Successful "Retirement"

Well I don't believe in retirement as usually construed, but thought this was a good article as he seems to be saying the same thing. Of course there isn't a point in pursuing something as a career that you like but you aren't really talented at. That better stay as a hobby or sideline. And maybe you need to do some job to make money while you develop your alternative career. But the ideal is to do what you like and are good at and look for ways to make money from it.

This has been my path up till now and will continue to be so. Successful academics get into it either because they love teaching or research (latter in my case), or both. The path to a tenured professorship in today's world is one of high risk and uncertainty particularly in the United States and particularly on the research track (and the latter particularly in fields that don't have high research funding). Getting to be a tenured professor shouldn't stop one from switching career and doing something else if one wants to and has the opportunity. Quite a lot of academics in fields that are more prone to application find money making ideas which they then develop in a second career. In economics for example there are also opportunities to move into government etc. Often I read about successful figures in various fields that they started their career getting a PhD or being a professor. But a lot of my fellow academics seem to lose their appetite for risk and in fact become very risk averse (a lot I think are actually risk averse and are traumatised by the path needed to get to tenure). But if you are not going to be a world class star in your field and have a good idea of something else to do, why not do it?

This is the "industry" I am in but similar things will apply in other professions too.

This has been my path up till now and will continue to be so. Successful academics get into it either because they love teaching or research (latter in my case), or both. The path to a tenured professorship in today's world is one of high risk and uncertainty particularly in the United States and particularly on the research track (and the latter particularly in fields that don't have high research funding). Getting to be a tenured professor shouldn't stop one from switching career and doing something else if one wants to and has the opportunity. Quite a lot of academics in fields that are more prone to application find money making ideas which they then develop in a second career. In economics for example there are also opportunities to move into government etc. Often I read about successful figures in various fields that they started their career getting a PhD or being a professor. But a lot of my fellow academics seem to lose their appetite for risk and in fact become very risk averse (a lot I think are actually risk averse and are traumatised by the path needed to get to tenure). But if you are not going to be a world class star in your field and have a good idea of something else to do, why not do it?

This is the "industry" I am in but similar things will apply in other professions too.

Saturday, August 05, 2006

End of Week Report

Today the market rallied initially on an unemployment report and then ended the day lower. The model got stopped out because the NDX rose more than 1.25% intraday. However, I ignored the model as other indicators suggested that was the right course. So far this month my account is up 1.13% though the model is down 1.54% and the market down 0.37%.

Though everyone thinks the Fed will not raise interest rates on Tuesday, I have a suspicion that this time there could just maybe be a surprise (PS: According to Barron's published on Saturday Goldman Sachs have the same suspicion). The Fed almost always raises interest rates too much and induces a recession. Long-bond yields fell today. I have been reading Brian Berry's book on long-wave cycles. The first thing I have read on this that actually makes sense - actually it was Michael Alexander's columns that got me interested. I think we are still essentially in a declining interest rate cycle that started in 1981. After the next recession interest rates will start rising for real along with inflation according to the Kondratieff Cycle Theory. One thing that could help the next cycle be more inflationary is if the Fed triggers a deep recession here and future Fed chairmen dare not be so aggressive. This is just a wild speculation of course. With big bets on bonds, I of course want to see interest rates fall (which pushes up the value of bonds).

At the moment I am still in the real time testing phase of the model. I am only using about a third of the capital that I think would make sense to allocate to the model trading eventually. The eventual plan, if things check out consistently, would be to put about half of my non-retirement capital into it and trade that with about 3 times leverage. The rest of my non-retirement capital would be in unleveraged long-term investments so that the overall leverage is only 2 times, which I believe is a safe level. That is a limiting level. If I felt scared to trade that much I would trade a lesser amount. The ratio of trading to investment capital will also differ in bull and bear markets. The model performs best in bear markets. In bull markets good quality stocks could match it. Problem is finding those stocks!

Though everyone thinks the Fed will not raise interest rates on Tuesday, I have a suspicion that this time there could just maybe be a surprise (PS: According to Barron's published on Saturday Goldman Sachs have the same suspicion). The Fed almost always raises interest rates too much and induces a recession. Long-bond yields fell today. I have been reading Brian Berry's book on long-wave cycles. The first thing I have read on this that actually makes sense - actually it was Michael Alexander's columns that got me interested. I think we are still essentially in a declining interest rate cycle that started in 1981. After the next recession interest rates will start rising for real along with inflation according to the Kondratieff Cycle Theory. One thing that could help the next cycle be more inflationary is if the Fed triggers a deep recession here and future Fed chairmen dare not be so aggressive. This is just a wild speculation of course. With big bets on bonds, I of course want to see interest rates fall (which pushes up the value of bonds).

At the moment I am still in the real time testing phase of the model. I am only using about a third of the capital that I think would make sense to allocate to the model trading eventually. The eventual plan, if things check out consistently, would be to put about half of my non-retirement capital into it and trade that with about 3 times leverage. The rest of my non-retirement capital would be in unleveraged long-term investments so that the overall leverage is only 2 times, which I believe is a safe level. That is a limiting level. If I felt scared to trade that much I would trade a lesser amount. The ratio of trading to investment capital will also differ in bull and bear markets. The model performs best in bear markets. In bull markets good quality stocks could match it. Problem is finding those stocks!

Amusing Article about a Hedge Fund Conference

An amusing article about a hedge fund conference. One guy wants to start a hedge fund and has never traded anything! Even if my trading model works out really well, I wouldn't want to start a hedge fund. Not anytime soon anyway.

Thursday, August 03, 2006

July Report

Net worth increased by $13059 to $316,244. This is still about two thousand below the May high but a nice recovery. My retirement accounts hit a new high. The portfolio rate of return was 3.41% vs. the 0.71% gain for the MSCI. The biggest positive contributers were the rise in the Australian Dollar of about 2 US cents over the month and $4350 in profits from trading QQQQ. The most important negative "contributers" were Ansell and my Australian mutual funds. This month is a good example of my hedging strategy working with gains from currency and trading offsetting investment declines. Performance would be much worse if I wrote off Croesus this month. I plan to adjust the past figures when Croesus is finally presumably delisted assuming its value fell smoothly from the time of the initial trading halt to delisting. On the spending and saving side, my spending seems to be about $1700, which implies around $2700 in saving from salary and retirement contributions. I am surprised spending was so low actually. Maybe I amde a calculation mistake.

Tuesday, August 01, 2006

Further Downside Risk?

The stock futures are off this morning and in recent days the Bank of Japan continues to try to reduce its money supply - a move that has preceded market slumps in recent months. A news releases on personal consumption spending is due at 8:30 EST which should give the market some further information on economic growth and inflation. If the downtrend is confirmed I will likely buy more put options in my Roth IRA account that is currently 90% in a money market account.

Update: 4:58pm

I added 5 QQQQ $39 August Put contracts... I reached a milestone today. Finally, my QQQQ trading over the last several years became profitable. As Investment of course it was lousy. But It helped teach me to trade. Next goal is to regain all trading losses on my US trading account. That's going to probably take a few more months of successful trading to achieve. Currently the model is predicting that the trend will reverse to an uptrend the day after the FOMC announcement next week.

Update: 4:58pm

I added 5 QQQQ $39 August Put contracts... I reached a milestone today. Finally, my QQQQ trading over the last several years became profitable. As Investment of course it was lousy. But It helped teach me to trade. Next goal is to regain all trading losses on my US trading account. That's going to probably take a few more months of successful trading to achieve. Currently the model is predicting that the trend will reverse to an uptrend the day after the FOMC announcement next week.

Upside Risk Reduced

Today the market fell a little, but pretty much went sideways all day. The pop up in the NASDAQ 100 index in the morning extended its trading range and meant that though the stochastic oscillator increased, it didn't increase by much. The risk that the oscillator and the market will actually go up in the near-term is much reduced. Yes, that is the risk that it will rise. If you are short the market like me, you want the market to go down... I get more and more annoyed by the bullish bias in the media that talks about good days when the market goes up and bad ones when it goes down. I think it is discrimination against bears :)

Monday, July 31, 2006

What Type of Trader are You?

Everyone trades to some degree, even when they buy or sell a passively indexed investment. Some traders lose from trading and some gain. Find out which sort of trader you are.

Saturday, July 29, 2006

Going Short

The model is saying to be short on Monday. I have shorted QQQQ before the end of the day ($37.01). Could be early (the price already went to $37.10 and then fell back again), but eventually will be right I think. Based on the chart, this upcoming downmove could be signficant. The model though gives no information on future levels of the index, just the direction.

4:05pm Update:

I was a bit early going short but still up substantially for the day. Updated performance stats since 6/29/06:

Market Gain: -4.75%

Model Gain: 8.80%

Excess Return over Market: 14.22%

Account Gain: 14.90% (about $4000 on this account - not keeping track of gains in the Roth account but it is now up almost 40% on the contribution made earlier this year).

Excess Return over Market: 20.63%

Which is 145% of the model's gain. Using leverage and some intraday trades should result in a gain greater than the model and we are now seeing that. This kind of trading gain for a month is not unusual. What is hard is to not give the money back again. That is the next challenge.

If the index continues to rise on Monday and the full(5,5,3) stochastic goes over 80 (it is now at 75) I will close the short and go long as we will have entered the persistent overbought state. There is a risk of this based on my most forward looking indicator. I am short 2500 QQQQ shares in the trading account and long 5 $39 August puts in the Roth account. A one cent change in QQQQ therefore has a $30 impact on my net worth...

4:05pm Update:

I was a bit early going short but still up substantially for the day. Updated performance stats since 6/29/06:

Market Gain: -4.75%

Model Gain: 8.80%

Excess Return over Market: 14.22%

Account Gain: 14.90% (about $4000 on this account - not keeping track of gains in the Roth account but it is now up almost 40% on the contribution made earlier this year).

Excess Return over Market: 20.63%

Which is 145% of the model's gain. Using leverage and some intraday trades should result in a gain greater than the model and we are now seeing that. This kind of trading gain for a month is not unusual. What is hard is to not give the money back again. That is the next challenge.

If the index continues to rise on Monday and the full(5,5,3) stochastic goes over 80 (it is now at 75) I will close the short and go long as we will have entered the persistent overbought state. There is a risk of this based on my most forward looking indicator. I am short 2500 QQQQ shares in the trading account and long 5 $39 August puts in the Roth account. A one cent change in QQQQ therefore has a $30 impact on my net worth...

Friday, July 28, 2006

Bill Gross' Latest Commentary

More evidence that in Gross' opinion the recent bear market in bonds is over.

Limited Transactions on Online Savings Accounts